Sale Business Asset With Customer In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

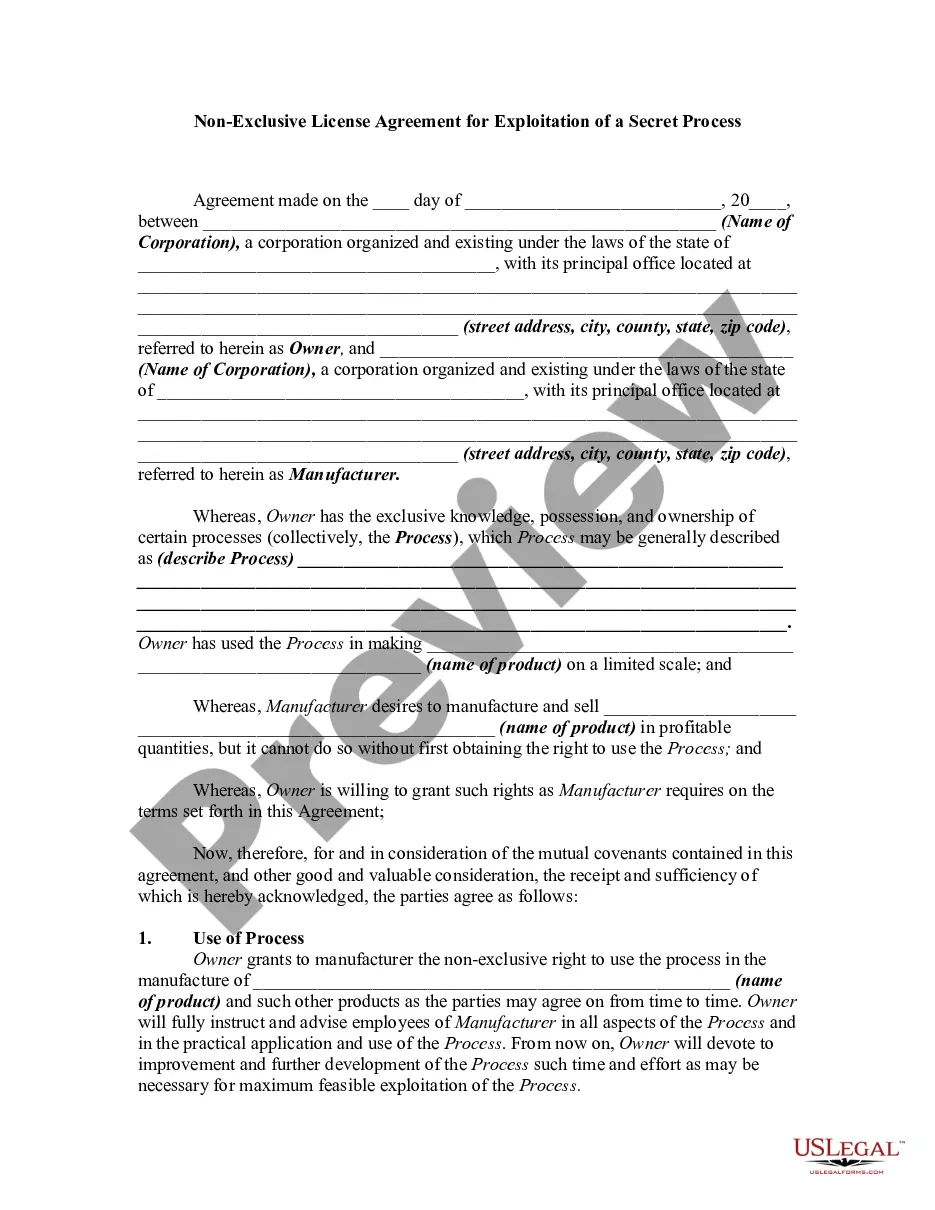

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

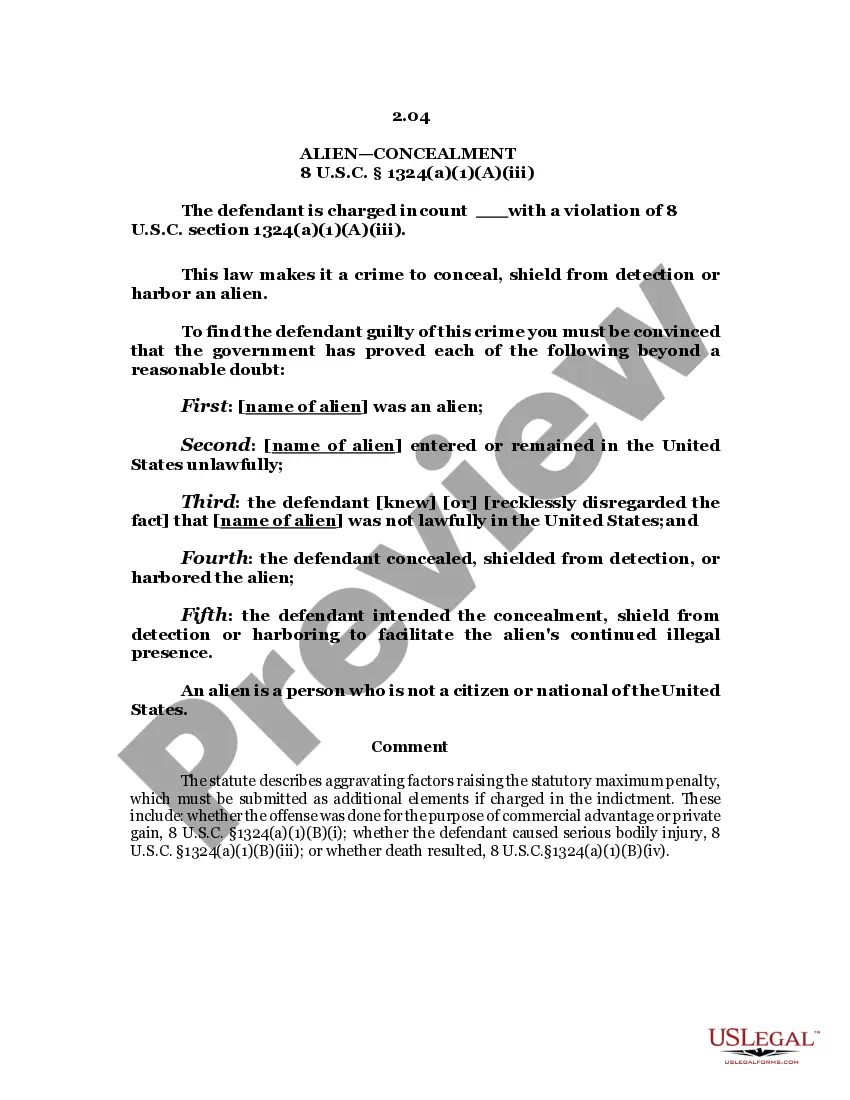

When selling a business asset (in this case, a computer), in Turbotax, do I need to BOTH: 1. Catherine Travis is starting a new business.She has several assets that she wants to use in her business that she has been using personally. This form includes the business name and location, a description of assets, cost and acquisition dates, and an opinion of value for business personal property. A taxable asset purchase allows the buyer to "step up," or increase, the tax basis of the acquired assets to reflect the purchase price. Determining an asset's basis is important, as basis guides the amount of depreciation taken each year and the gain or loss recognized upon sale of the asset. And when you enter information in account sales revenue, you will see field "Asset Retirement", Tick this field and click enter. Review our Frequently Asked Questions below. If you need additional assistance, please contact us. Travis County will offer a second round of small business grants through the TCTX Thrive 2.0 Small Business Program to eligible waitlisted businesses.