Form 8594 Foreign Seller In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

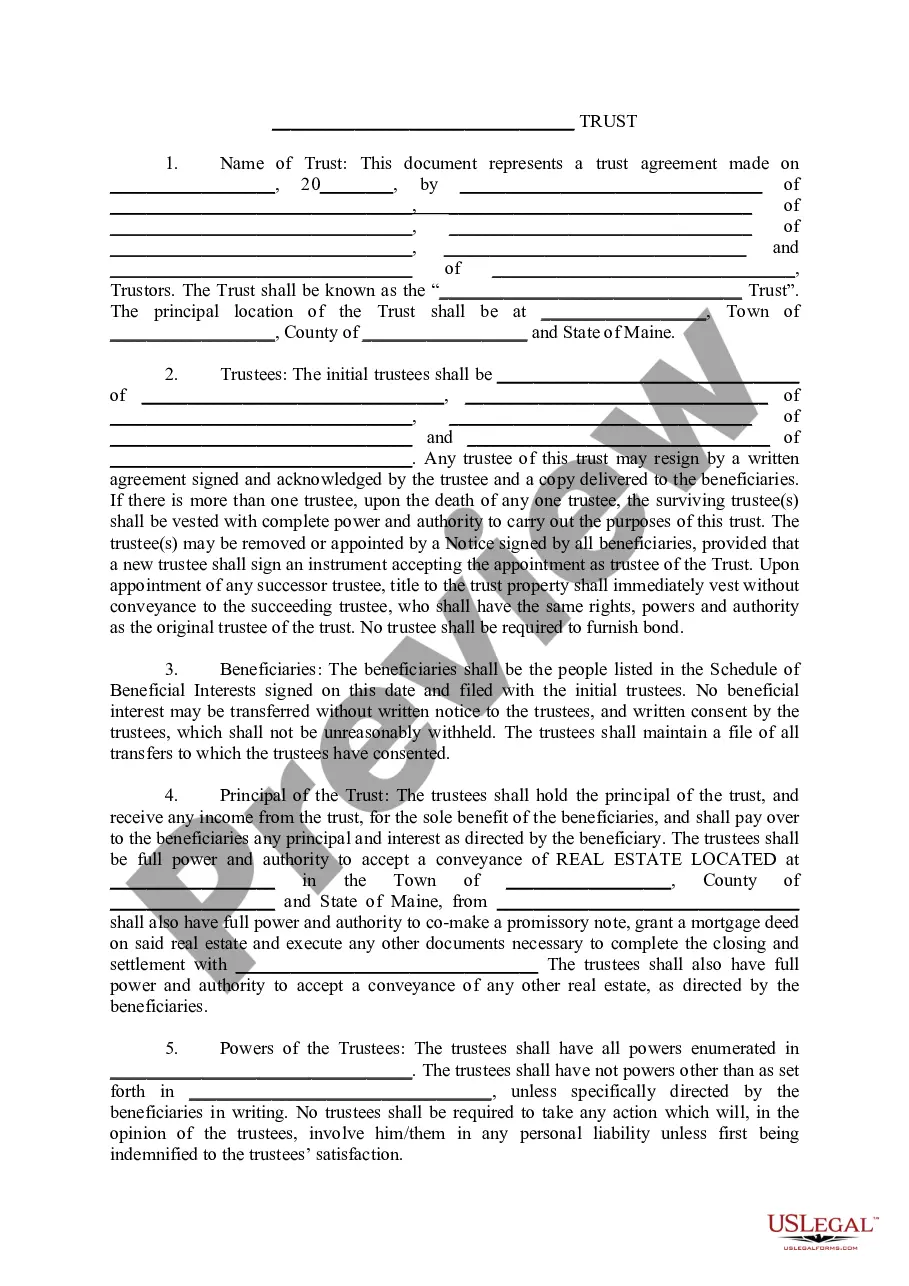

Form 8594, utilized for foreign sellers in Phoenix, is a critical document in asset purchase agreements. This form facilitates the reporting of the sale of assets when a business is purchased, outlining the allocation of the purchase price among various asset categories. Key features of this form include sections detailing the assets being sold, liabilities assumed by the buyer, and any excluded assets. Users should fill out the form accurately, providing percentages for the allocation and ensuring that all parties involved agree to the terms outlined. Common use cases include transactions involving business mergers or acquisitions where assets are transferred from a foreign seller to a buyer. Attorneys, partners, owners, associates, paralegals, and legal assistants involved in these transactions must carefully review and edit the form to ensure compliance with local laws and proper representation of both parties' interests. The clarity in structuring the assets and liabilities provides a straightforward reference throughout the transaction process, aiding in legal reviews and negotiations.

Free preview