Sale Of Business Asset With Personal Use In Hillsborough

Category:

State:

Multi-State

County:

Hillsborough

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

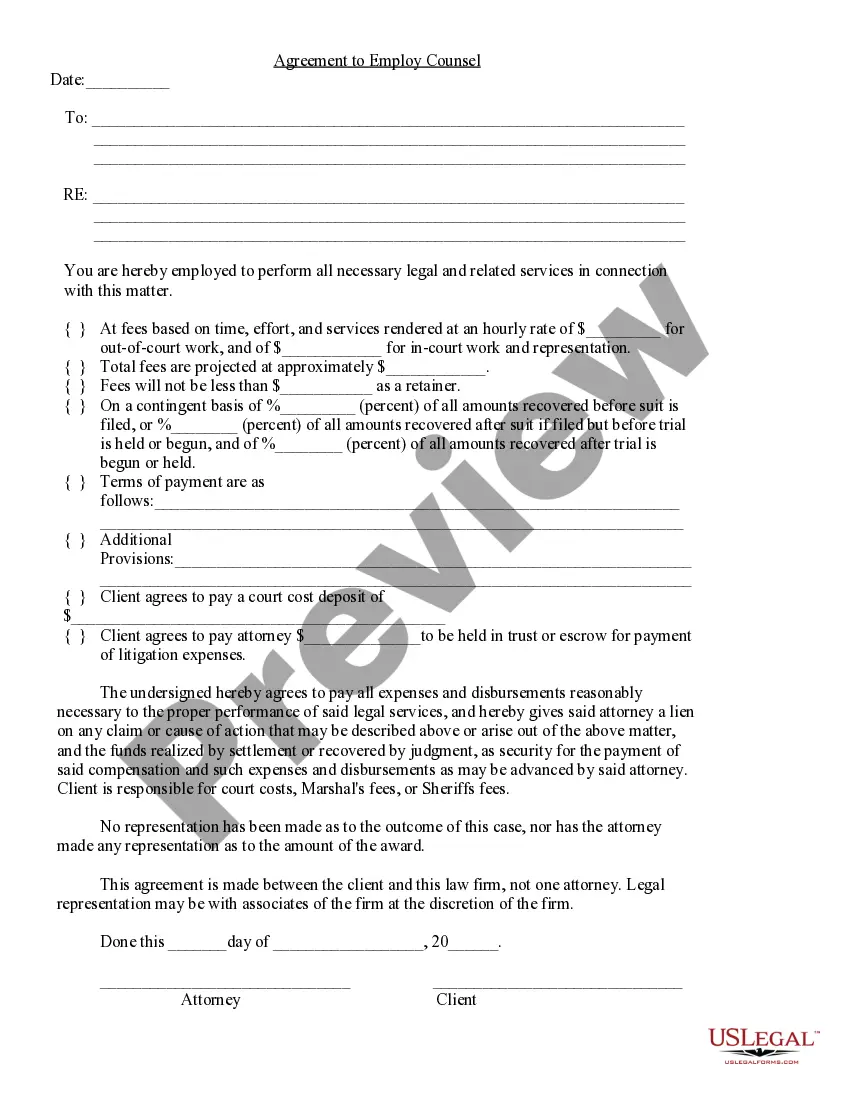

The Sale of Business Asset with Personal Use in Hillsborough form is crucial for documenting the transfer of assets between a Seller and Buyer. This Agreement covers details such as the identification of the Seller and Buyer, the assets being sold, and the liabilities assumed by the Buyer. Key features include the definition and listing of assets, the purchase price breakdown, payment structure, and conditions for closing. It also includes sections on seller and buyer representations, warranties, and covenants essential for protecting both parties throughout the transaction. The form allows for exclusions of certain assets and sets forth indemnification clauses to safeguard against future claims. It is beneficial for attorneys, partners, owners, associates, paralegals, and legal assistants who handle business transactions, ensuring a clear understanding of rights and obligations involved in the sale. Filling out the form requires attention to detail, particularly in customizing sections to reflect the unique circumstances of the transaction. Legal professionals can guide users in completing and modifying the document to ensure compliance with local laws and effective protection of their interests.

Free preview