Form 8594 And Assumed Liabilities In Hillsborough

Description

Form popularity

FAQ

A $10,000 penalty may be imposed for failure to file Form 8854 when required. IRS is sending notices to expatriates who have not complied with the Form 8854 requirements, including the imposition of the $10,000 penalty where appropriate.

A failure-to-file penalty is 5% of the unpaid tax obligation for each month your return is late. This penalty can't exceed 25% of your total unpaid taxes, and will max out after five months.

In simple terms you can say that acquisition is an act of one company taking over or acquiring another company's controlling interest. This can be done either by buying assets of that company or buying shares or stocks of the company.

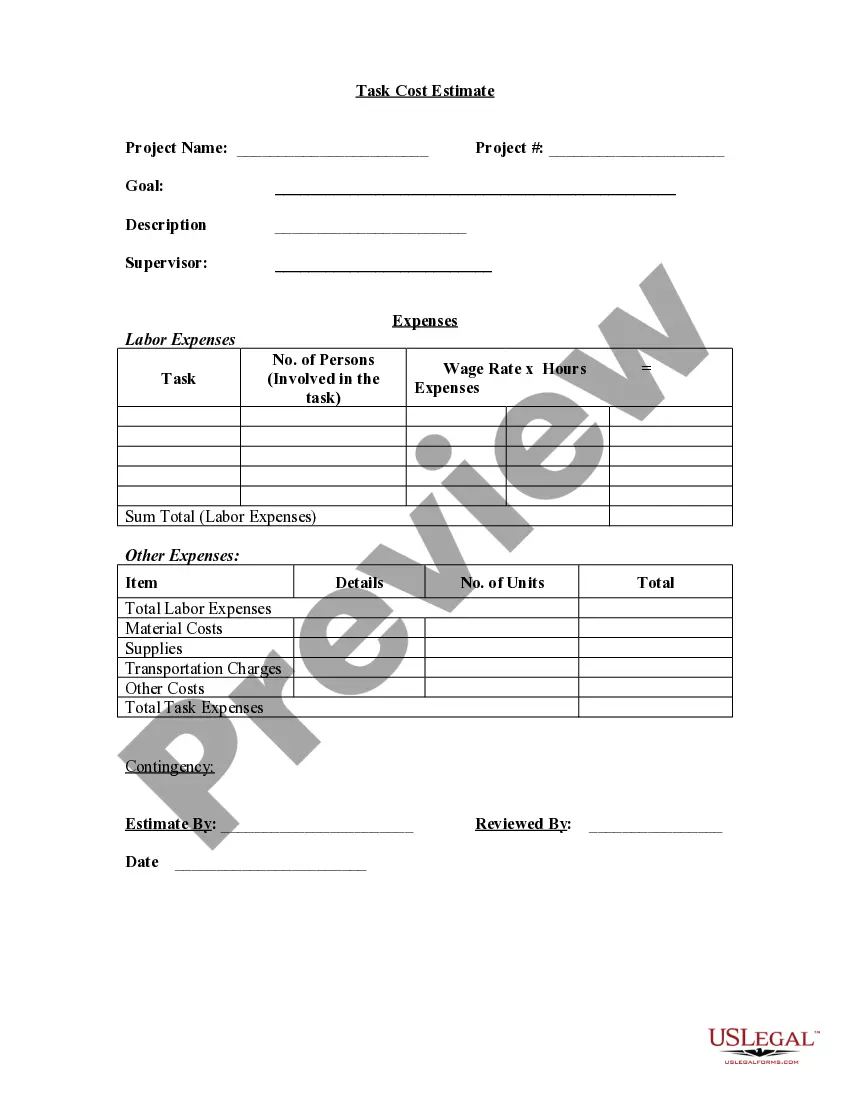

How to fill out the Declaration of Assets and Liabilities Form? Gather all necessary documents related to your finances. Fill in details regarding movable and immovable assets. Document any outstanding liabilities and dues. Provide personal information accurately. Review the form for accuracy before submission.

Depreciation recapture occurs when you sell business property for a gain after taking depreciation deductions. This tax rule requires you to report part of your gain as ordinary income to “recapture” some of the benefit you previously received from the deductions.

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets.

If the amount allocated to any asset is increased or decreased after the year in which the sale occurs, the seller and/or purchaser (whoever is affected) must complete Parts I and III of Form 8594 and attach the form to the income tax return for the year in which the increase or decrease is taken into account.

The following tax forms are typically used when selling a business: Form 8594, Asset Acquisition Statement. Form 4797, Sales of Business Property.

The distinction between whether a transaction is on account of business or on account of capital is important because business income gets included in income at 100% whereas capital gains are only included in income at 50%.

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.