Sales Of Assets Business Advantages And Disadvantages In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

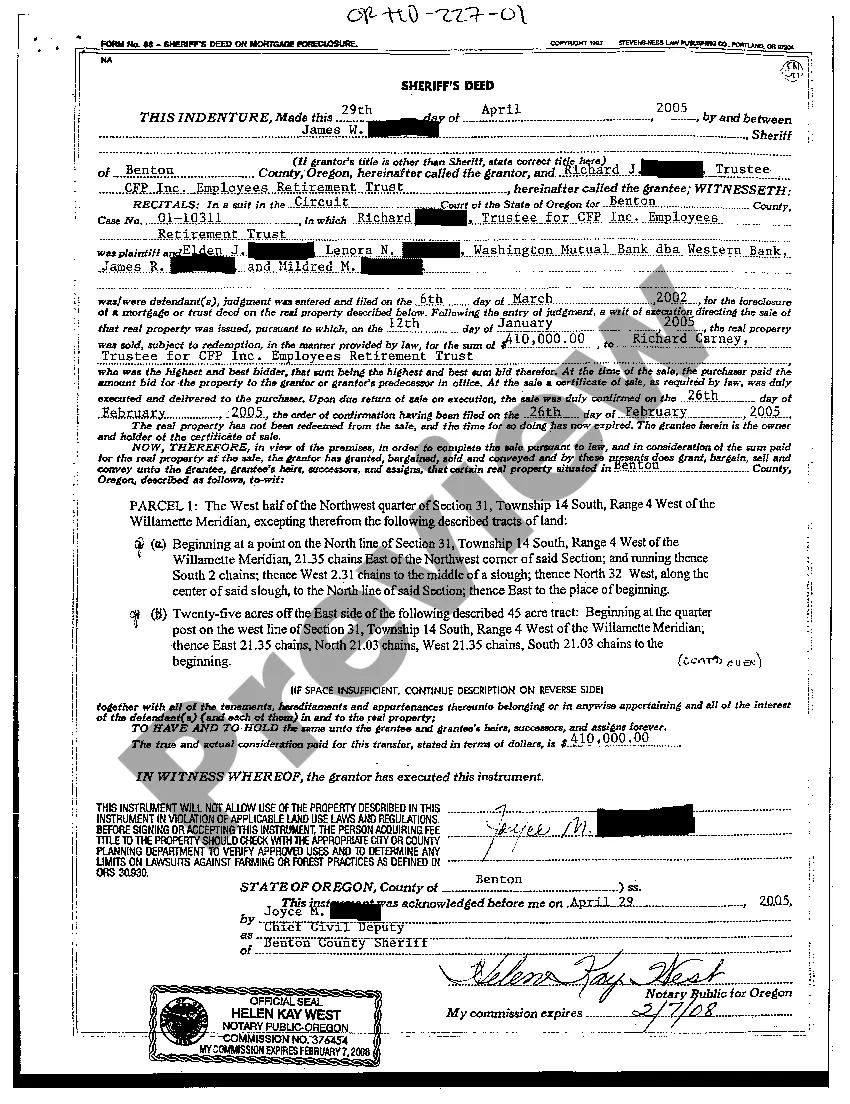

The Sales of Assets Agreement is a legal document designed to facilitate the transfer of a seller's business assets to a buyer. This form outlines the key terms of the sale, including the assets being sold, liabilities assumed, purchase price, and conditions preceding the closing date. For business professionals in Cook, the advantages of using this agreement include clear terms that minimize legal risks and provide a structured process for asset acquisition, while disadvantages may involve potential liabilities due to undisclosed issues with the assets. Attorneys, partners, and legal assistants may find this form particularly useful for drafting and negotiating terms, while associates and owners could benefit from understanding the implications of asset sales on their business strategy. Filling out this form requires careful attention to detail, particularly in listing assets and liabilities accurately, and ensuring all parties have access to necessary documentation. It is critical to adapt the agreement to meet specific business needs and comply with local regulations.

Free preview