Asset Sale Of Business Tax In Alameda

Category:

State:

Multi-State

County:

Alameda

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

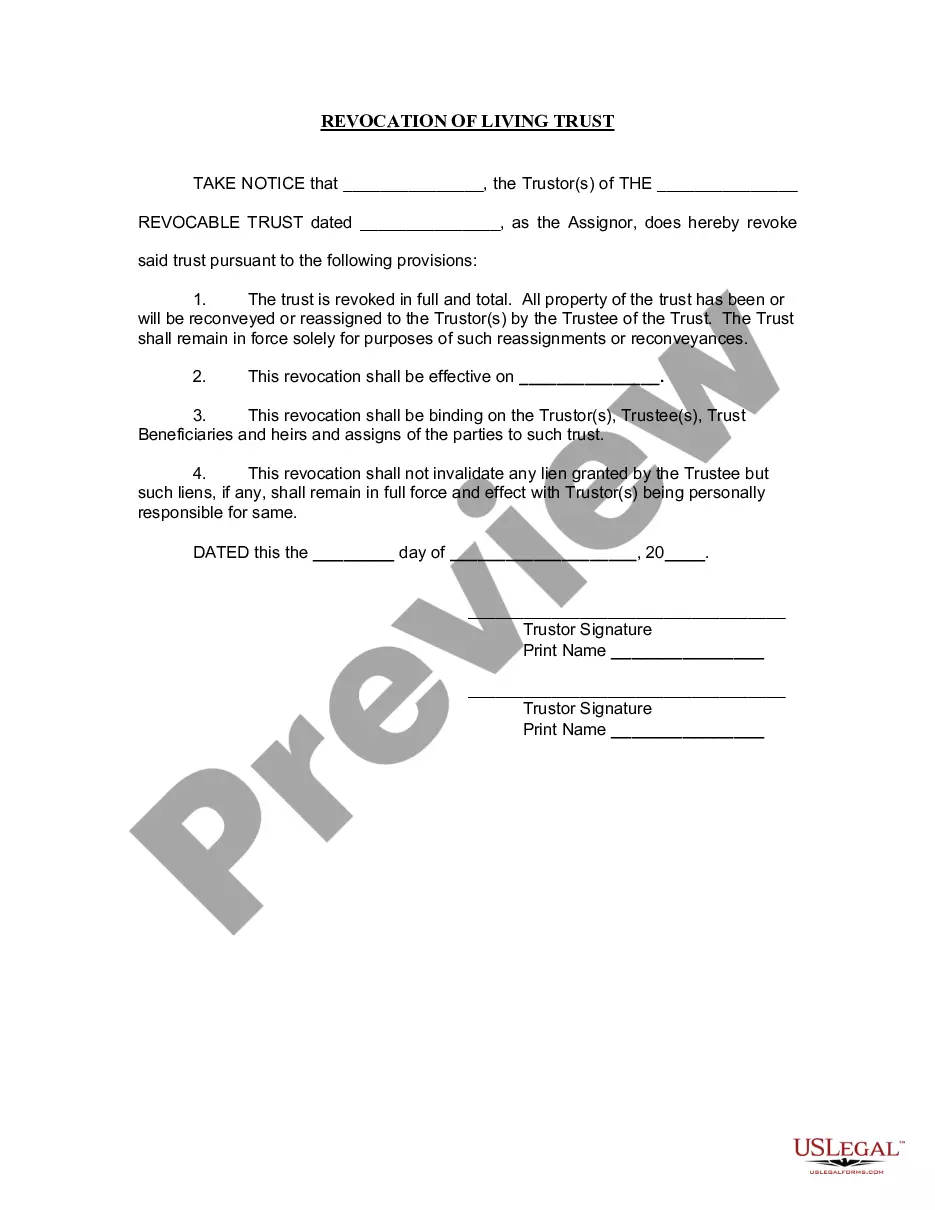

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

If you are unable to file electronically, please call our office at and a BPS will be mailed to you. A Business License is an annual tax you pay each calendar year for doing business within the unincorporated area of the County of Alameda.Most business owners will be able to take full advantage of e-filing. Who must obtain a seller's permit? What does engaged in business mean? You Can Easily File Your Return Online. Filing your return online is an easy and efficient method of filing your sales and use tax return. Page with information about business licenses a new license in Alameda County, including information regarding unincorporated areas and renewing licenses. This section provides information to help you get started. Click through the steps above for a complete guide to starting a business in Alameda.