Deferred Agreement Sample With Answers In Illinois

Description

Form popularity

FAQ

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2023 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

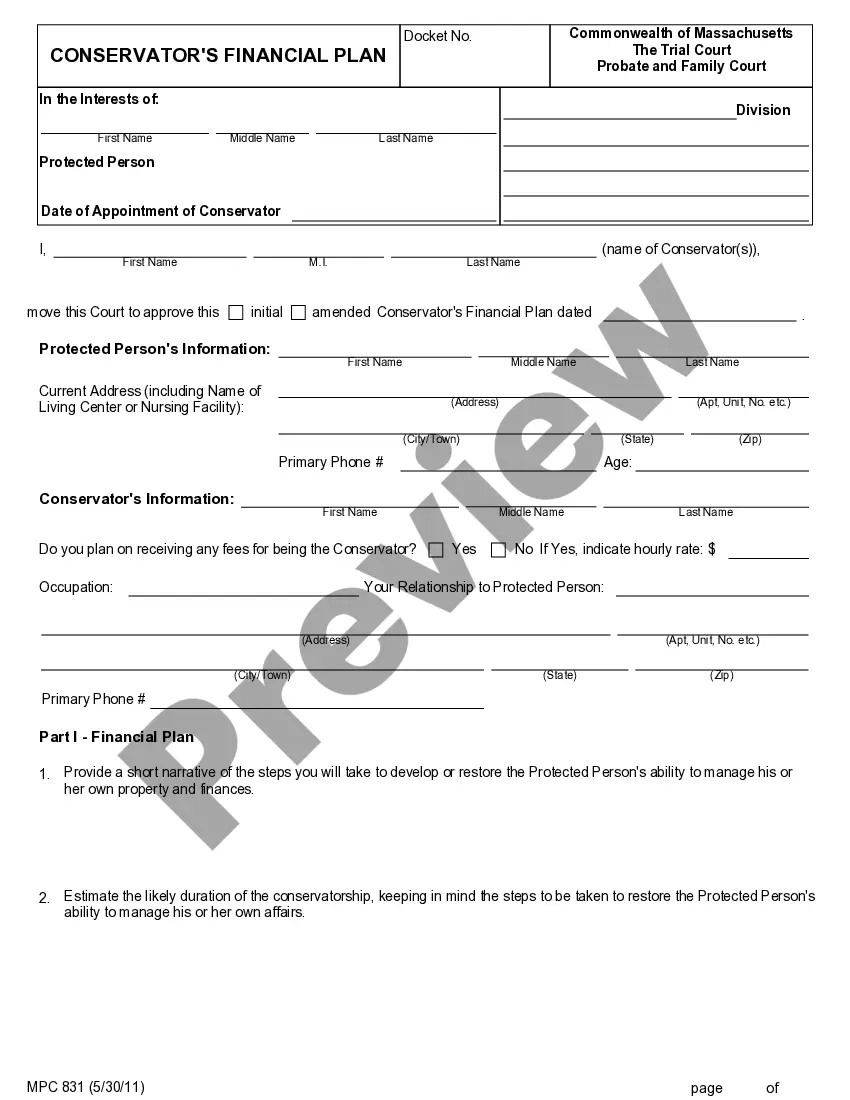

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

The target population identified for the purposes of this Section are persons age 60 and older with an identified service need.

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1959 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2023 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

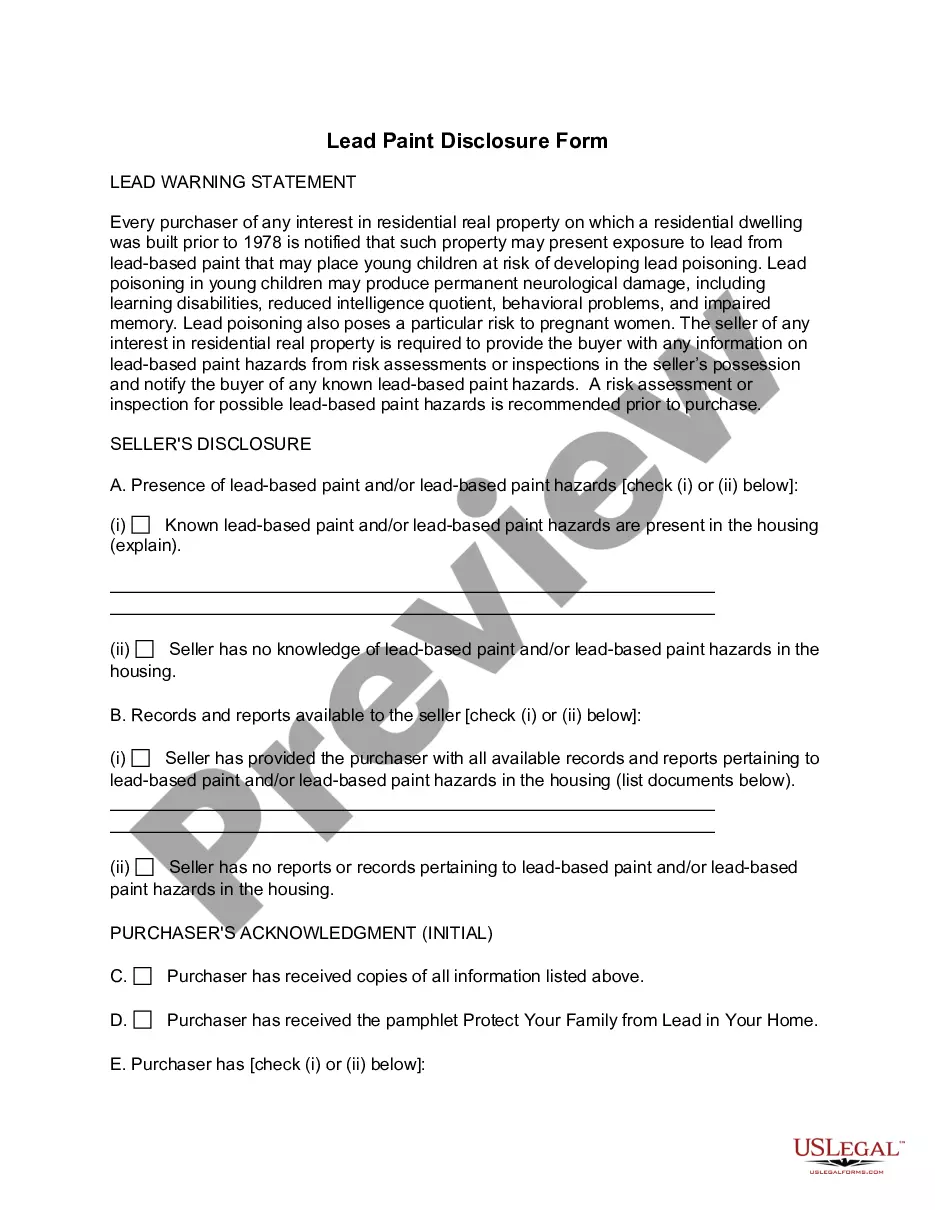

Filing for a Homestead Exemption Another way to lower your property taxes is to apply for a homestead exemption, which would result in a reduction in your property's assessed value and, in turn, in the amount of property tax.

The Deferred Retirement Option Plan, commonly known as DROP, is a retirement benefit that allows Tier 1 public safety members who are already eligible for retirement to continue working while collecting a salary and accumulating monthly pension benefits that will become available upon retirement.

Once distributions begin, the distributed monies are fully taxable as ordinary income for federal tax purposes. The funds are never taxed by the State of Illinois.

The State of Illinois Deferred Compensation Plan is a supplemental retirement program for State employees. Contributions to the Plan can be made on a pre-tax or Roth basis through salary deferrals. The combined pre-tax and Roth contributions cannot exceed the limit set by the IRS.

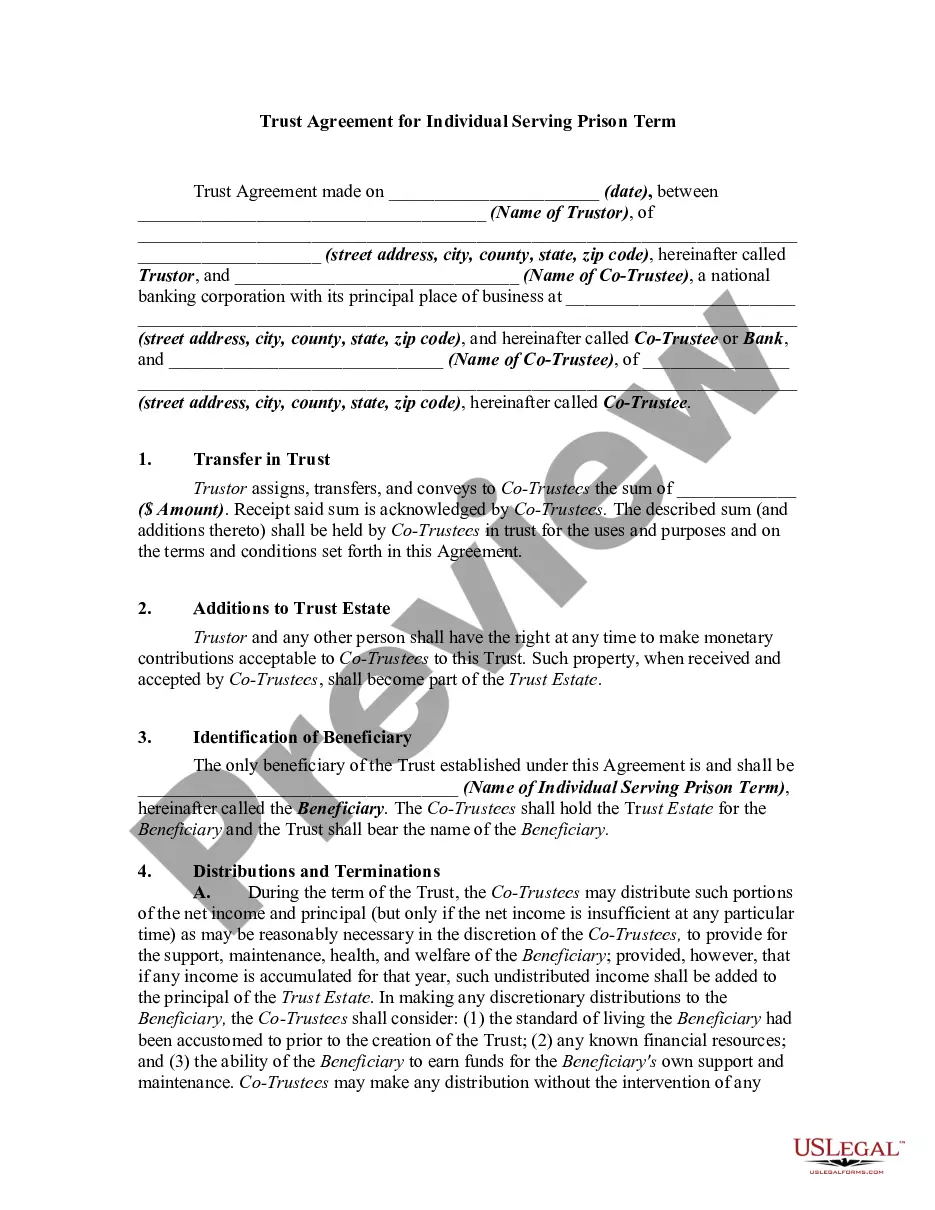

A deferral agreement is a legally binding document between parties that agree to postpone a specific action or obligation to a later date.