Deferred Compensation Form For 2023 In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-00417BG

Format:

Word;

Rich Text

Instant download

Description

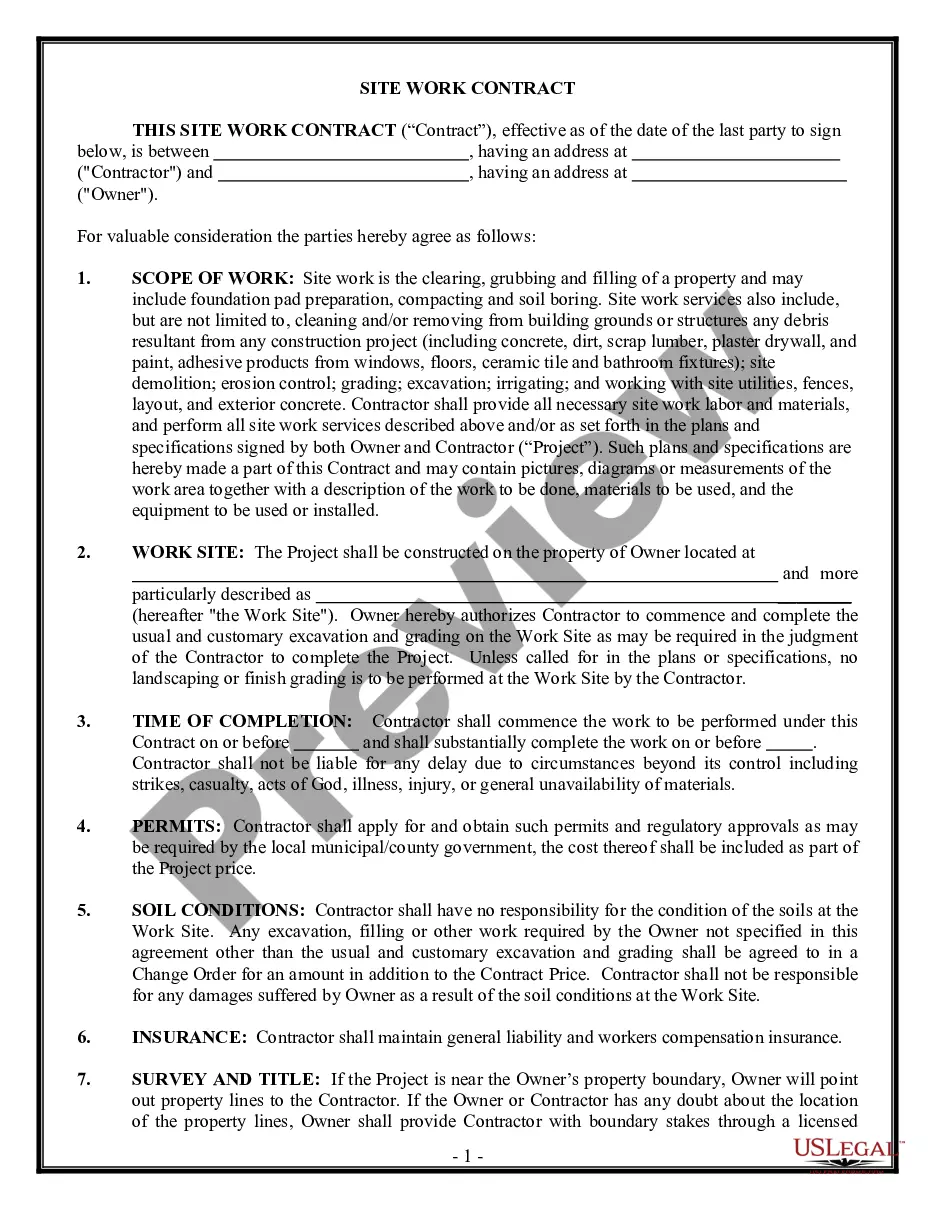

The Deferred Compensation Form for 2023 in Clark provides a structured agreement between an employer and a key employee, aiming to secure the employee's services until retirement by offering additional compensation post-retirement. This agreement outlines the obligations of the employee, including the requirement to refrain from working for other entities without the employer's consent, to qualify for payments. Compensation is specified as a total sum distributed in equal monthly installments, with stipulations for payment in the event of the employee's death. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in drafting employment agreements, as it simplifies the process of establishing deferred compensation arrangements. Users can expect clear guidelines for filling out and editing the form, facilitating compliance with organizational policies and legal standards. Proper completion of this form helps maintain attractive compensation packages that enhance employee retention, serving the interests of both employers and employees.

Free preview