Formulario Seguro Withholding Tax In Orange

State:

Multi-State

County:

Orange

Control #:

US-00416BG-9

Format:

Word;

Rich Text

Instant download

Description

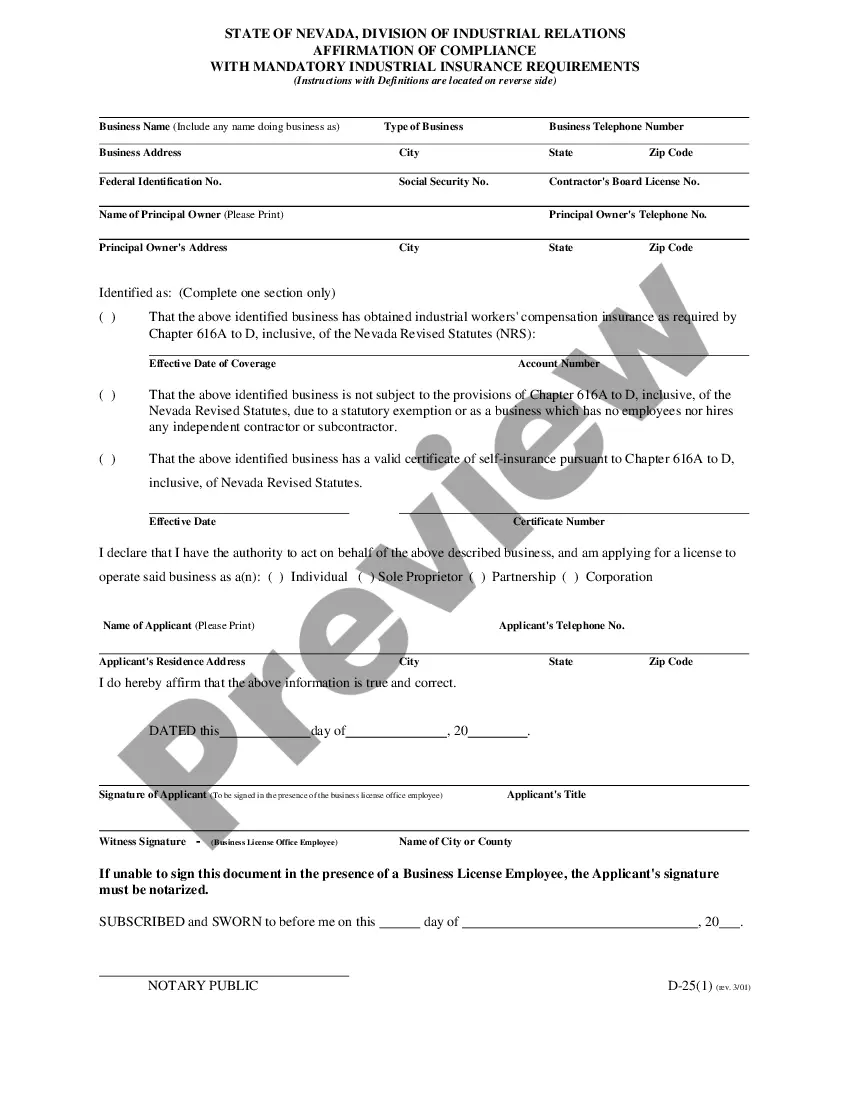

The Formulario seguro withholding tax in Orange is a key document for managing tax withholdings related to direct deposits. It enables employees to authorize their employer to make electronic debit and credit entries to their bank account. Key features of the form include sections for the employer's authorization, account details, and conditions for termination of the agreement. Users must fill out the date, employer details, and personal bank information, ensuring accuracy to avoid payment discrepancies. This form is particularly useful for attorneys, partners, and associates in setting up payroll processes efficiently. Paralegals and legal assistants benefit from understanding this document to facilitate employee relations and compliance with employment laws. The straightforward instructions help individuals with varying legal knowledge complete the form correctly, emphasizing timely notice for termination. It is essential for employees to retain the original signed document along with a voided check for verification purposes, ensuring clarity and record-keeping.