Title: Understanding Chase Direct Deposit Form with Voided Check: Types and Process Explained Introduction: Chase direct deposit forms with voided checks are essential documents that facilitate the direct deposit process for individuals or companies using Chase bank services. This detailed guide outlines the purpose, types, and application process for different Chase direct deposit forms with voided checks, ensuring you have a comprehensive understanding of their significance. 1. What is a Chase Direct Deposit Form with Voided Check? A Chase direct deposit form with a voided check is an authorization document used to establish a direct deposit relationship between a Chase account holder and an employer or any other payee. By submitting this form along with a voided check, account holders provide accurate account information for electronic fund transfers. 2. Types of Chase Direct Deposit Form with Voided Check: a. Personal Direct Deposit Form: This form is primarily used by individuals to set up direct deposits for their personal accounts, enabling recurring payments such as salaries, pensions, or government benefits to be directly deposited into their Chase account. b. Business Direct Deposit Form: Designed specifically for businesses, this form allows companies to establish direct deposit services for their payroll, facilitating efficient and secure payment transfers to employees' accounts. 3. Purpose and Benefits of Completing a Chase Direct Deposit Form with Voided Check: — Convenient and timely transfer of funds: Direct deposit ensures hassle-free, automated receipt of payments directly into the designated account on time, eliminating the need for physical checks or visits to the bank. — Safety and security: By opting for direct deposit, individuals and businesses mitigate the potential risks associated with lost or stolen paper checks. — Easily trackable transactions: Direct deposits provide clear records of all incoming payments, making it simpler to manage finances and reconcile accounts accurately. — Quick availability of funds: Unlike traditional checks that may require clearing periods, direct deposits offer immediate access to funds, enhancing financial flexibility. 4. How to Complete a Chase Direct Deposit Form with Voided Check: a. Personal Direct Deposit Form: Step 1: Obtain a Chase direct deposit form from your local branch or download it from the Chase official website. Step 2: Fill in your personal details, including name, account number, routing number, and contact information. Step 3: Attach a voided personal check to confirm accurate bank account information. Step 4: Submit the form to your employer or relevant payment issuer. b. Business Direct Deposit Form: Step 1: Access the Chase business direct deposit form on the Chase website or obtain it from a local branch. Step 2: Complete the business details section, including company name, account number, routing number, and contact information. Step 3: Attach a voided business check to verify account details. Step 4: Submit the duly filled form along with the voided check to the payroll department or payment processor. Conclusion: Understanding the Chase direct deposit form with voided check is crucial for individuals and businesses seeking a streamlined and automated payment process. By carefully completing and submitting the appropriate form, users can enjoy the benefits of direct deposit, ensuring efficient fund transfers and improved financial management. Be sure to consult Chase's official website or visit a local branch for accurate and up-to-date information on their specific direct deposit requirements.

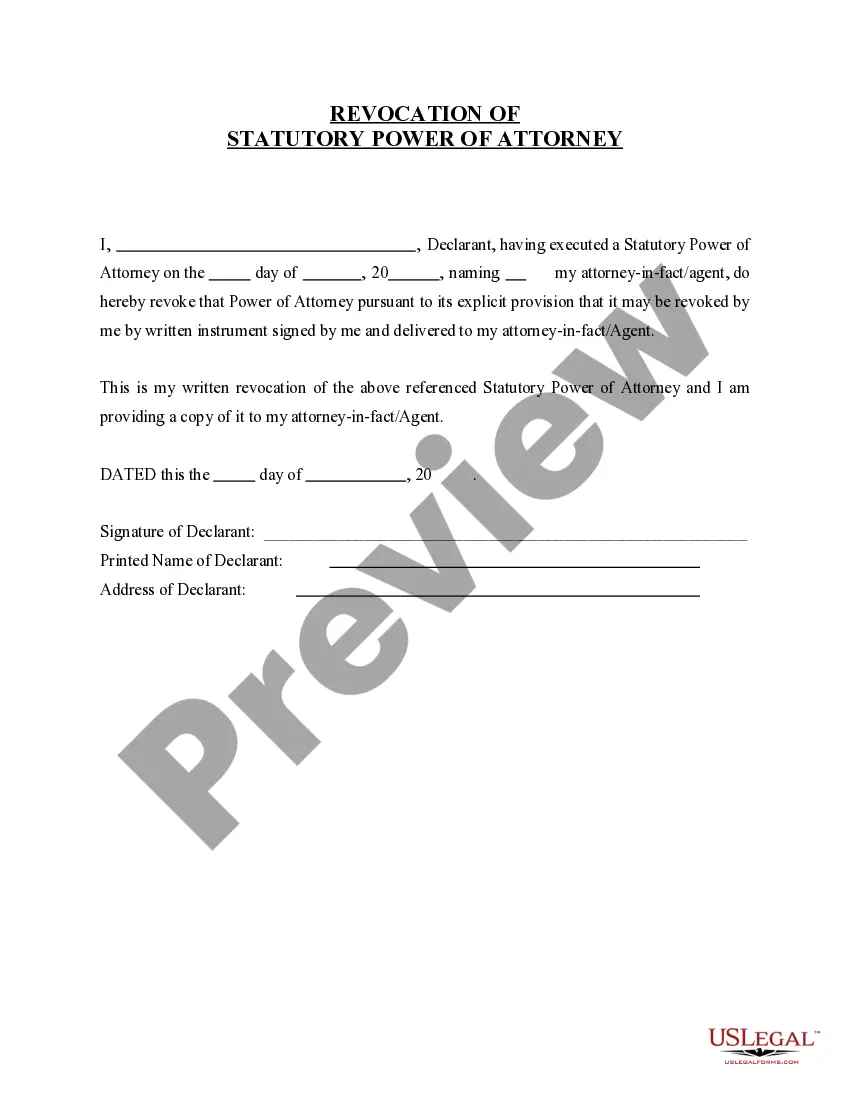

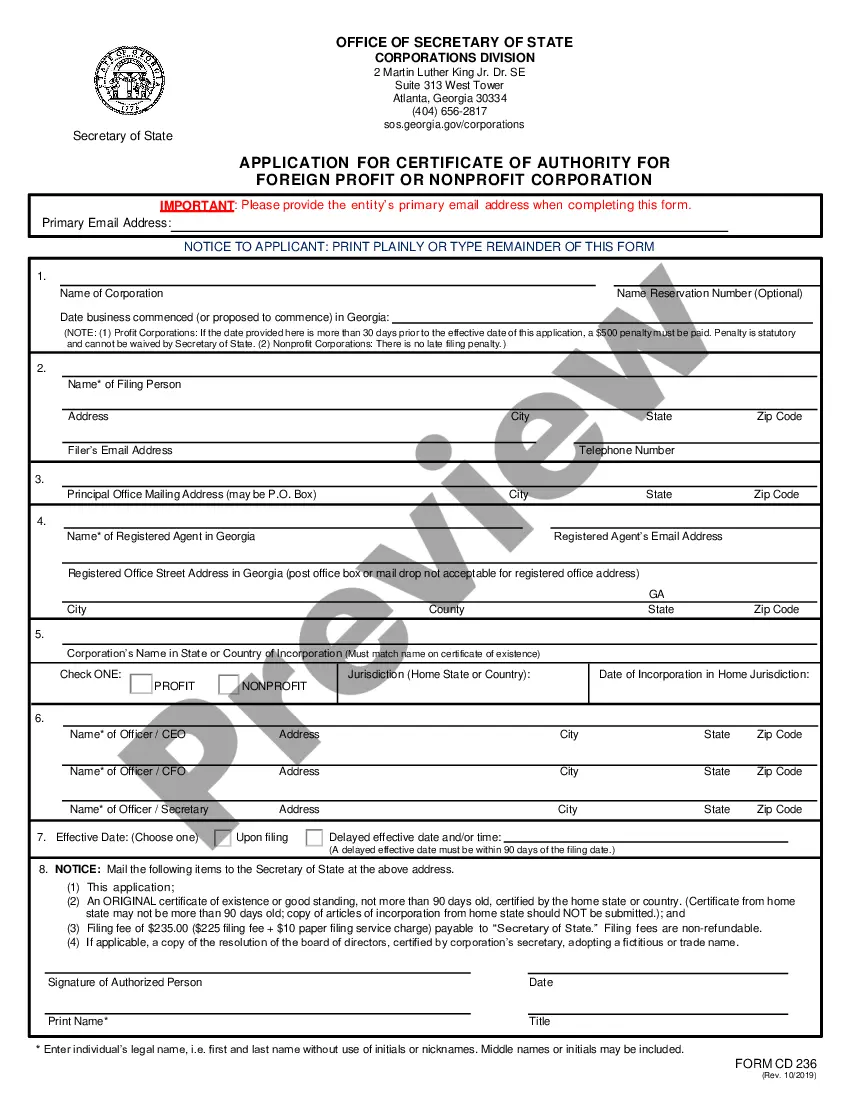

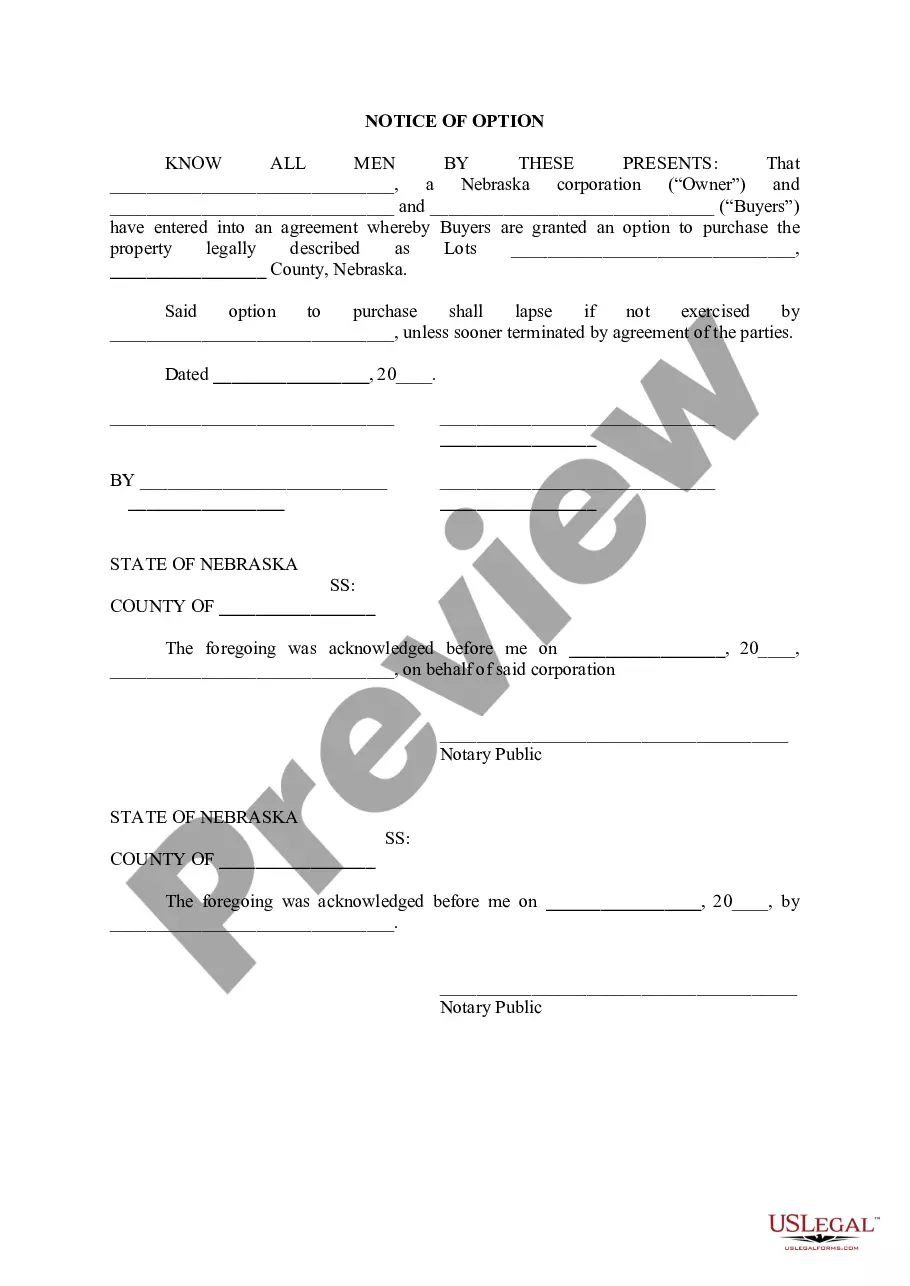

Chase Direct Deposit Form With Voided Check

Description

How to fill out Chase Direct Deposit Form With Voided Check?

Managing legal documents can be overwhelming, even for experienced experts.

If you're looking for a Chase Direct Deposit Form With Voided Check but lack the time to search for the correct and updated version, the process can be daunting.

US Legal Forms caters to all your requirements, ranging from personal to business documentation, all in one place.

Utilize advanced features to complete and manage your Chase Direct Deposit Form With Voided Check.

Here’s what to do after obtaining the desired form: Confirm it is the right document by previewing and reading its description, ensure it is accepted in your state or county, click Buy Now when ready, choose a monthly subscription plan, select the desired format, and Download, fill out, eSign, print, and send your document. Enjoy the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Elevate your daily document management process with ease and simplicity today.

- Access a library of articles, guides, and materials relevant to your situation and requirements.

- Save time and effort searching for the forms you need by using US Legal Forms' sophisticated search and Review tool to locate the Chase Direct Deposit Form With Voided Check.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check your My documents section to review the documents you've previously downloaded and manage your folders as necessary.

- If this is your first experience with US Legal Forms, create a complimentary account and gain unlimited access to all platform benefits.

- A robust web form repository can be transformative for anyone wanting to handle these matters effectively.

- US Legal Forms is a leading provider of online legal templates, offering over 85,000 state-specific legal documents available at your convenience.

- With US Legal Forms, you can access legal and business forms tailored to your state or county.

Form popularity

FAQ

Do you need an operating agreement in Kansas? No, it's not legally required in Kansas under § 17-76,134. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Your LLC must file a IRS Form 1065 and a Kansas Partnership Return (Form K-120S). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Kansas Department of Revenue to pay your Kansas income tax. Check with your accountant to make sure you file all the correct documents.

Filing the formation paperwork to start your Kansas LLC will cost $165 ($160 online). You'll also need to pay $55 ($50 online) every year to file your Kansas Annual Report.

Filing the formation paperwork to start your Kansas LLC will cost $165 ($160 online). You'll also need to pay $55 ($50 online) every year to file your Kansas Annual Report.

1. Kentucky. Kentucky is the cheapest state to form an LLC, with a filing fee of just $40. The state also offers business owners incentive programs that provide small businesses with financial assistance.

How to start a Kansas LLC Name your Kansas LLC. Create a business plan. Get a federal employer identification number (EIN) File Kansas LLC Articles of Organization. Choose a registered agent in Kansas. Obtain a business license and permits. Understand Kansas state tax requirements. Prepare an operating agreement.

This is the document that officially forms your Kansas LLC. You can file your Kansas Articles of Organization by mail or online. If you file by mail, the state fee is $165 and the approval time is 2-3 business days (plus mail time). If you file online, the state fee is $160 and filings are approved immediately.

How to Start an LLC in Kansas Step 1: Name your Kansas LLC. Select a unique name for your LLC. ... Step 2: Appoint a Kansas resident agent. Name a resident agent for your LLC. ... Step 3: File Kansas Articles of Organization. File the LLC paperwork. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Filing the formation paperwork to start your Kansas LLC will cost $165 ($160 online). You'll also need to pay $55 ($50 online) every year to file your Kansas Annual Report.

Do you need an operating agreement in Kansas? No, it's not legally required in Kansas under § 17-76,134. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.