Agreement Unmarried With Child Filing Taxes In Middlesex

Category:

State:

Multi-State

County:

Middlesex

Control #:

US-00414BG

Format:

Word;

Rich Text

Instant download

Description

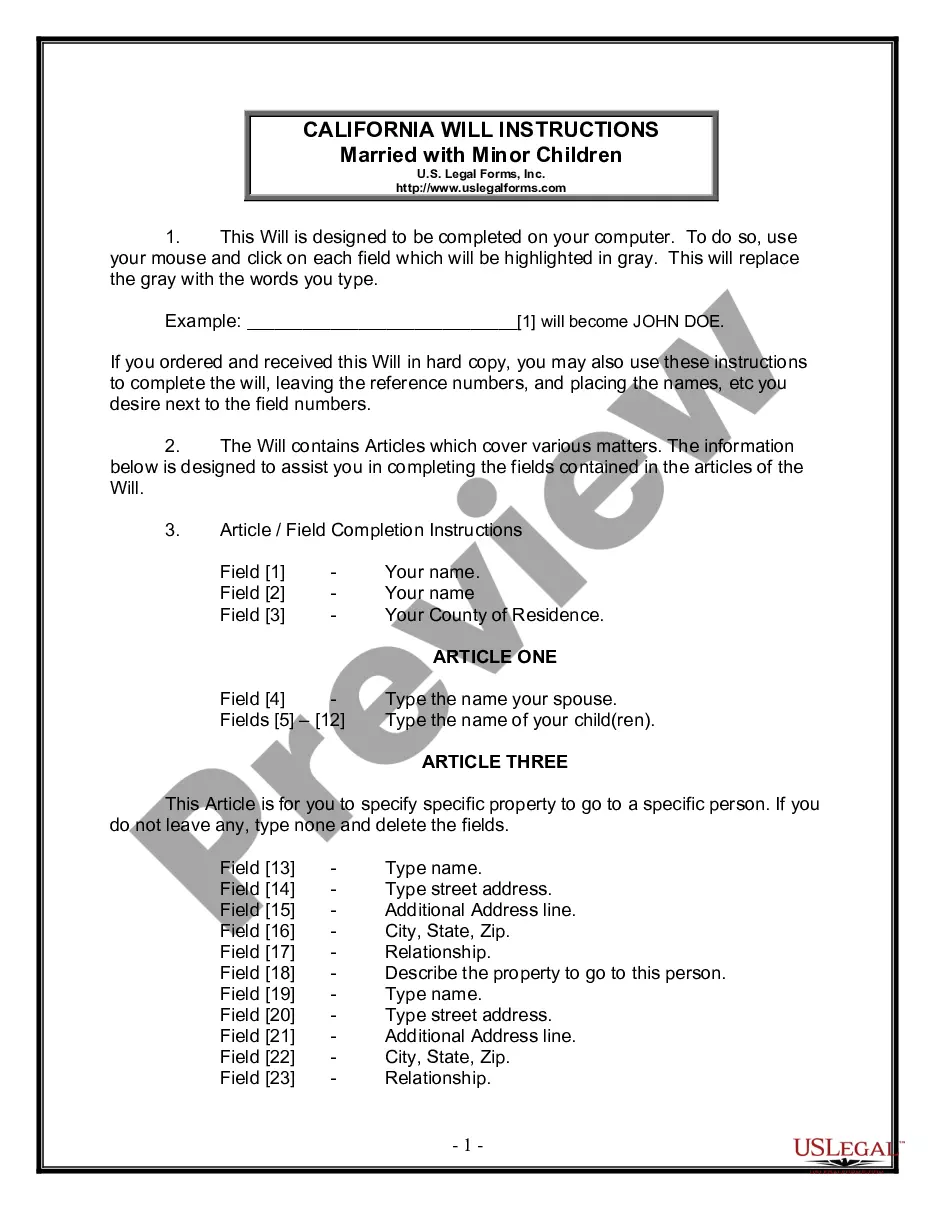

The Agreement Unmarried With Child Filing Taxes in Middlesex is designed for unmarried individuals intending to jointly purchase and hold a residence as joint tenants. This form includes vital provisions for joint ownership, financial responsibilities, and the process for selling or transferring interests in the property. Key elements include establishing a joint checking account for shared expenses, outlining payment responsibilities for mortgage, taxes, and utilities, and specifying procedures for selling interests in the property. Users must collaborate to determine property valuations annually and adhere to restrictions on encumbering property without mutual consent. This document is particularly relevant for attorneys, partners, owners, associates, paralegals, and legal assistants who facilitate real estate transactions for unmarried couples with children. It provides structure and legal safeguards, ensuring clarity in ownership and financial obligations, which can help in resolving disputes that may arise. The clear language and directives make it accessible for users lacking extensive legal backgrounds.

Free preview