Partition And Exchange Agreement With Qualified Intermediary In Pennsylvania

Instant download

Description

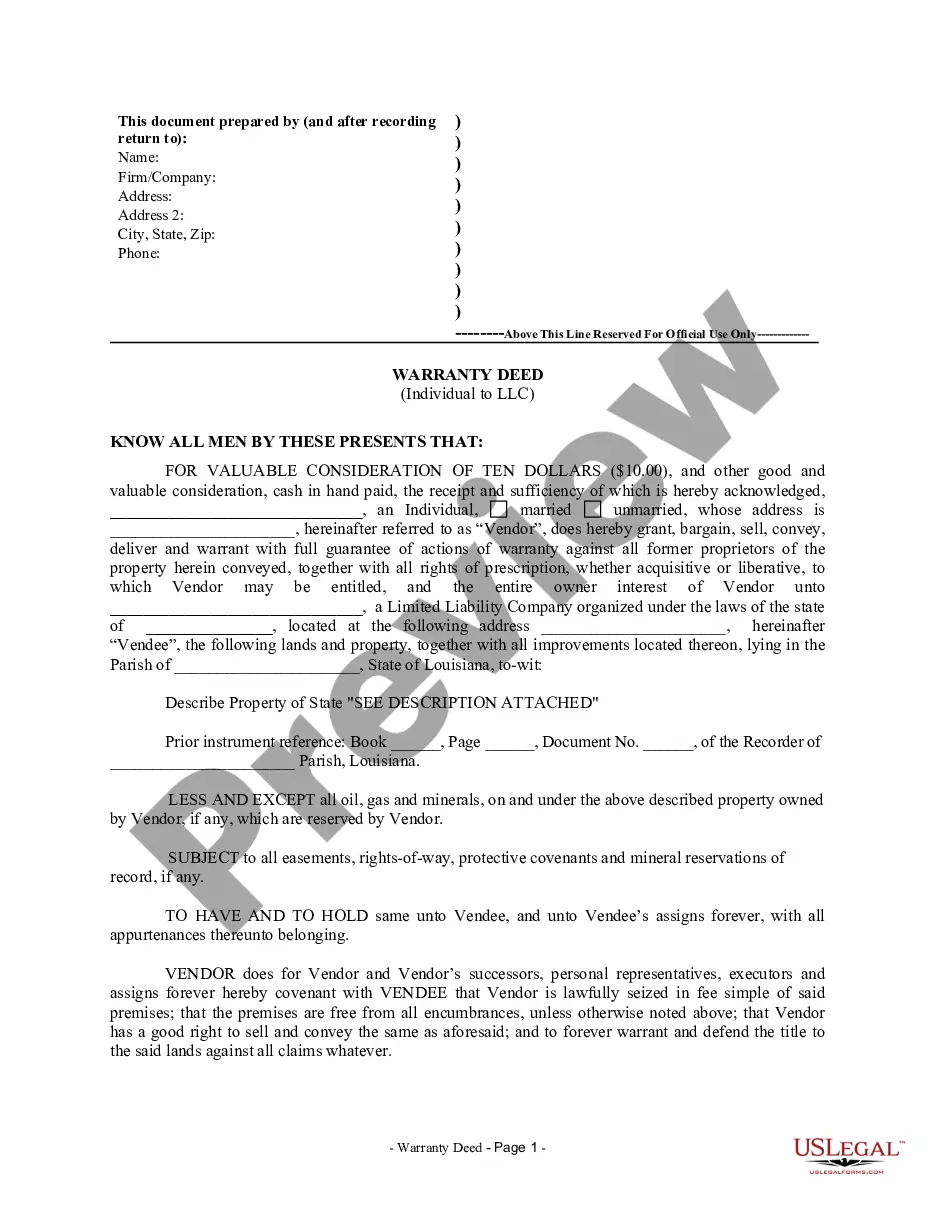

The Partition and Exchange Agreement with Qualified Intermediary in Pennsylvania outlines the process by which co-owners of real property can voluntarily partition and divide their land. This agreement specifies the property details and confirms that the co-owners are the sole stakeholders. It includes provisions for dividing the property in-kind, with specific tracts assigned to each co-owner as detailed in attached exhibits. Each co-owner must execute quitclaim deeds to finalize the ownership transfer, ensuring clarity of future property rights. This form is crucial for resolving disputes among co-owners and facilitating smooth property transactions. Attorneys, partners, owners, associates, paralegals, and legal assistants can effectively utilize this form to advise clients, negotiate terms, and handle various real estate matters involving co-owned properties. Completing this form requires careful attention to detail, and it is advisable to consult with legal professionals to ensure compliance with state laws, documentation standards, and recording requirements.

Free preview