Filing Lis Pendens In Pa In Clark

Description

Form popularity

FAQ

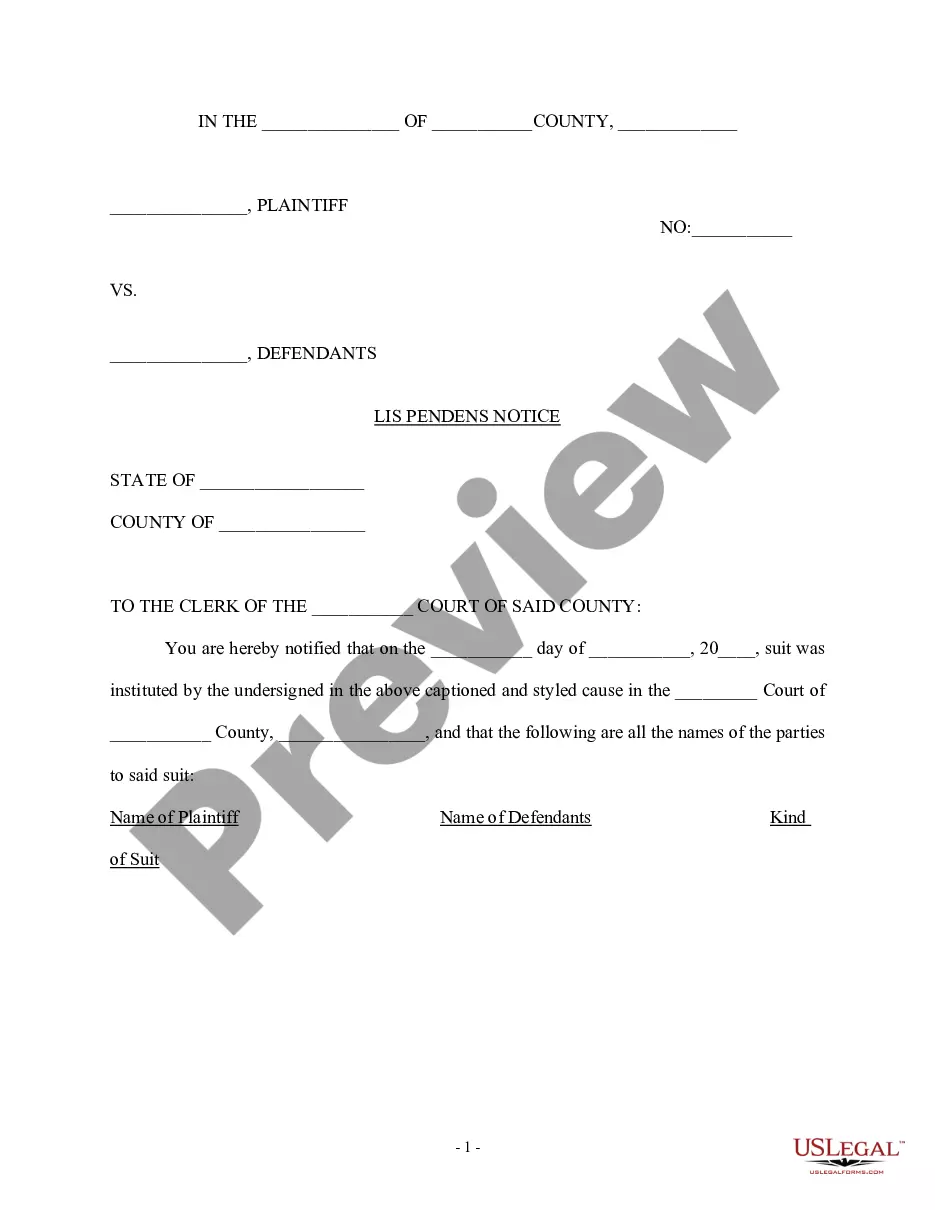

The Lis Pendens A lis pendens is a document that is filed in the public records that alerts the world that someone is asserting claim over the property. A lis pendens is not, by itself, a legal bar to purchasing the property—someone can still legally close on property with a lis pendens filed on it.

Other than resolution of the pending lawsuit, the only way to remove a lis pendens is by expungement, which requires a court order from a circuit judge. If you refuse service or the action is otherwise delayed, the lis pendens remains intact, making it difficult to sell or otherwise transfer a property.

To file a lis pendens, the party filing must have or show one of two things: That there is a recorded instrument, usually some mortgage or encumbrance, or perhaps something related to a construction mechanics lien—that potentially provides the filer the right to the property on or in the document.

The lien will stay in effect for five years, but can be renewed, if the debtor does not sell the property within that time period.

How Long Does a Lis Pendens Last in Pennsylvania? Under Pennsylvania law, a Lis Pendens typically remains recorded for a period of fifteen years. This duration provides adequate notice to interested parties about ongoing litigation or other legal actions involving the real property.

After the action is resolved, the attorney for the plaintiff should file a praecipe to remove the lis pendens and resulting cloud on title. Note that if a defendant believes a lis pendens has been filed improperly, it may make a motion with the court to have it stricken.

A Quiet Title action is a powerful legal tool which asks the court to clear up “clouds” or “quiet” the title to property. Relative to an Upset Sale, after you receive a tax deed, you will need to file a lawsuit with the county court.

In Pennsylvania, a lawsuit involving a claim of $12,000.00 or less can be filed in Magisterial District Court.