Days Of Sales Receivables In Massachusetts

Category:

State:

Multi-State

Control #:

US-00402

Format:

Word;

Rich Text

Instant download

Description

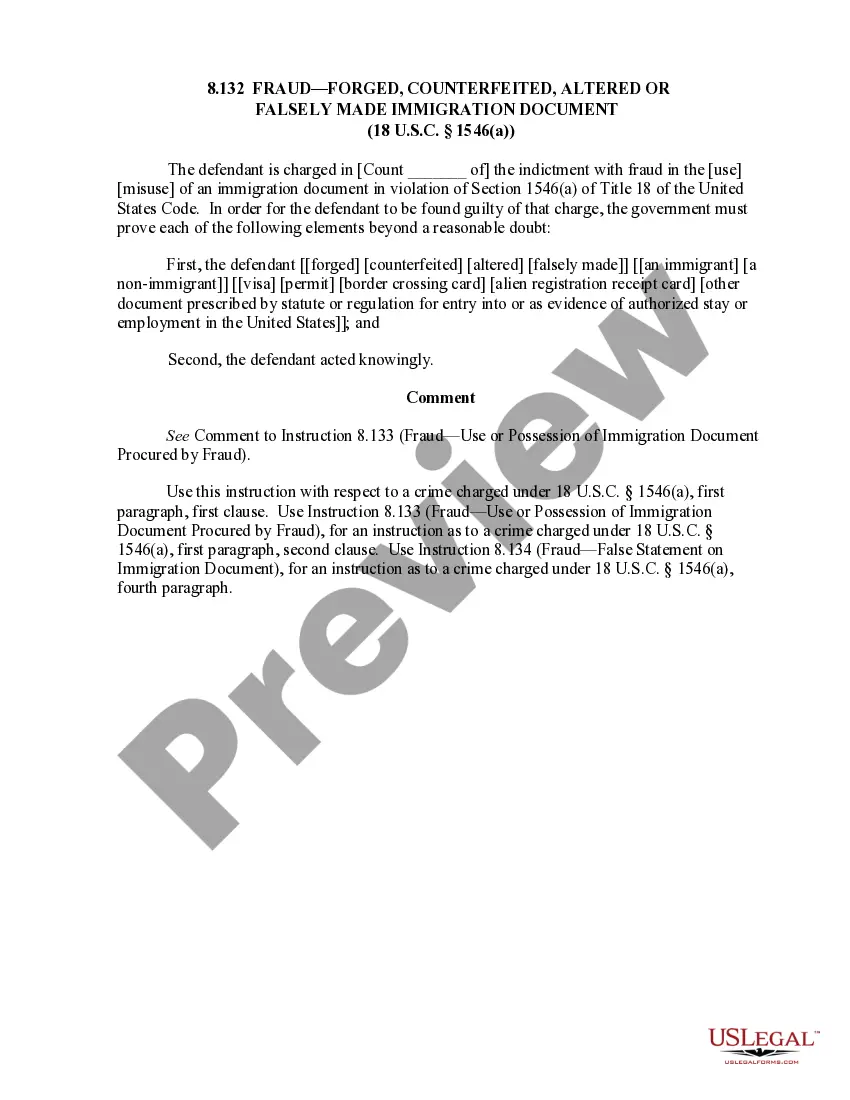

Accounts Receivable -Contract to Sale is a Contract to convey all accounts to a third party at a discount. The Seller agrees to sell to the Buyer all of Seller's right title and interest in all accounts as listed on the attached Exhibit, together with all invoices representing, and all money due or to become due on the assigned accounts and all other rights in the assigned accounts of any type. This Contract can be used in any state.

Free preview

Form popularity

More info

In May, your accounts receivable are superior to your gross sales, so you can add the days of the month straight to your AR days calculation. This is the average number of days it takes customers to pay their debt.MA (Mastercard) Days Sales Outstanding as of today (November 30, 2024) is 50.83. Days Sales Outstanding explanation, calculation, historical data and more. Then, you take out your gross sales from your accounts receivable to report it to the next month's accounts receivable. Days in AR = 61 days. Fill in if the applicant made the retail sales for which tax was collected and remitted. If sales tax was not collected and remitted on retail sales, the. First metric:calculate DSO on AR and Actual Billings. Average days delinquent (ADD) is a metric that lets companies know the average number of days that late payments take to get collected.