Resolution Format For Partnership Firm In Massachusetts

Description

Form popularity

FAQ

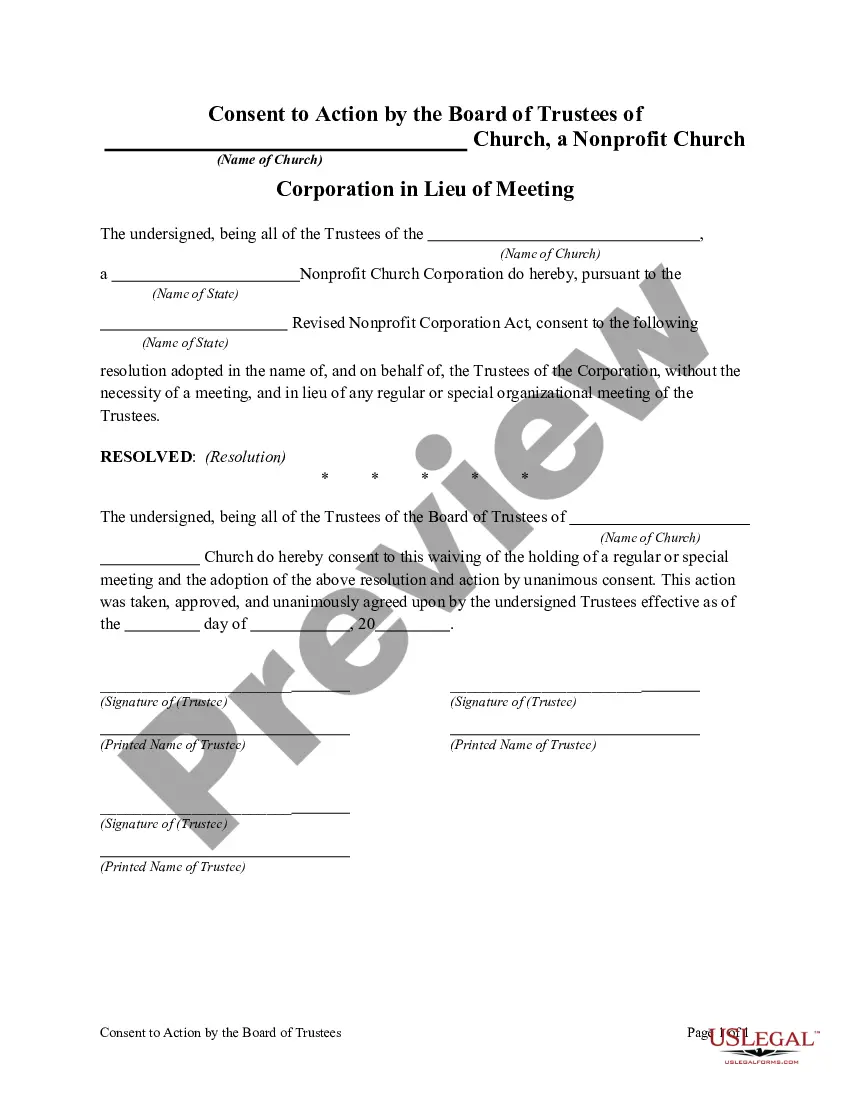

Massachusetts Corporate Resolution Template If you need to put major company decisions in writing then use a corporate resolution. A company's board of directors uses a corporate resolution to put decisions in writing. It shows that the business had the authority to make a specific choice or action.

A resolution, on the other hand, describes one action taken by the board at a meeting, is prepared separately during the meeting, and is attested to by the secretary of the corporation before the president approves it.

Corporate resolution (also known as a board resolution) is a written legal document , issued by the board of directors of a corporation , documenting a binding decision made on behalf of the corporation.

Unlike corporations, LLCs don't need to file business resolutions with the state. Single-member LLCs (SMLLCs) can also use business resolutions, even though there is no chance of disagreement among the members.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

The corporate resolution will be adopted at a board meeting, and can be found in the minutes of the meeting detailing the decisions made by the board.

Obtain a copy of the corporate resolution form California from the Secretary of State's website or local office. Fill in the necessary information on the form, such as the name of the corporation, its address, and the date of the resolution.

A partnership must annually file a Form 3, Partnership Return, to report the partnership's income to the MA DOR if: It has a usual place of business in Massachusetts, or. Receives federal gross income of more than $100 during the taxable year.

Reporting partnership income Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner.

Partnership resolution definition refers to resolving a dispute between partners in a business partnership. The way certain disputes in partnership will be handled should be spelled out in the partnership agreement.