Board Resolution Format For Gst Registration In Alameda

Description

Form popularity

FAQ

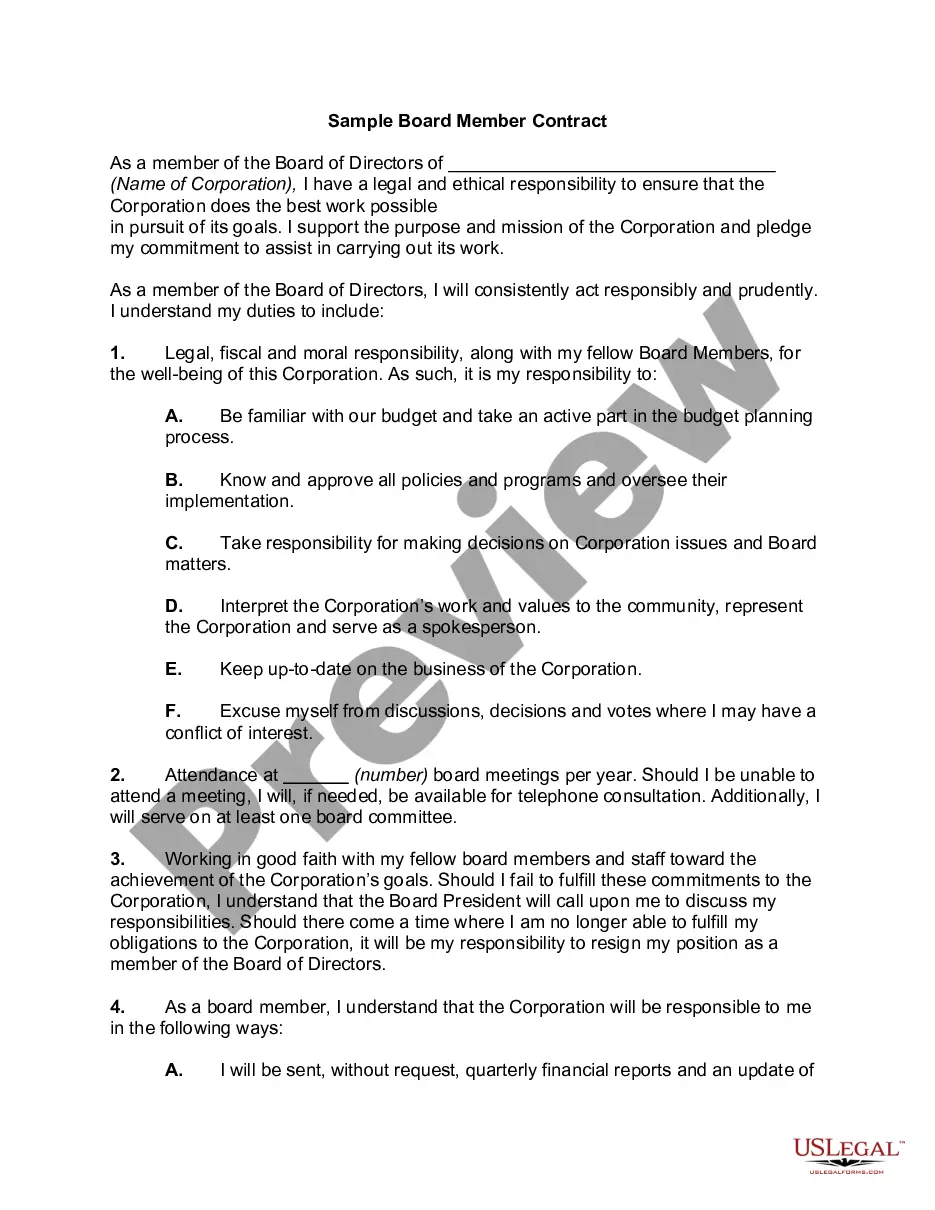

How to Write a Board Resolution (Step-by-Step) Establish Resolution Title. The resolution title should capture the board's name and a concise statement about the issue you want to record. Document Resolution. Use formal language to record the resolutions. Document Board of Director Votes.

How do you draft a Letter of Authorization for GST registration? Start with the Header: Include the business name, address, and GSTIN at the top. Date: Mention the date of issuing the letter. Recipient Details: Address the letter to the concerned tax authority or department.

Sample Format of GST Authority Letter I/we…………….. (Owner/Karta/Partner/Promoter/Director) of M/s……………… (Name of Business/Partnership firm/ Company) hereby declare that we appoint Mr……………, who is partner/director/Accounts officer/Chief financial officer of the company, as the Authorized signatory on behalf of the M/s…….

Formal Authorization Letter Format Your Name Your Address City, State, PIN Code Email Address Phone Number Date To, Recipient's Name Recipient's Designation Company/Organization Name Company Address ... Sincerely, Your Signature (if sending a hard copy) Your Name Your Designation, if applicable

I/We (Name of Proprietor/business owner/ all Partners/Karta or name of the business) hereby solemnly affirm and declare that (name of the third party authorized signatory) to act as an authorized signatory for the business (Name of the Business mentioned during GST registration) having GST Registration Number (Goods ...

I/We _____________________________ do hereby authorize Mr./Ms. He/She is duly authorized to sign all necessary correspondence in this regard on our behalf. His/Her explanations / statements will be binding on me/us without exception.

Dear Sir/Madam, I, Your Name, the Your Designation of Company Name, holding GSTIN Your GSTIN, hereby authorise Authorised Person's Name to act on behalf of our company for all matters related to GST compliance.