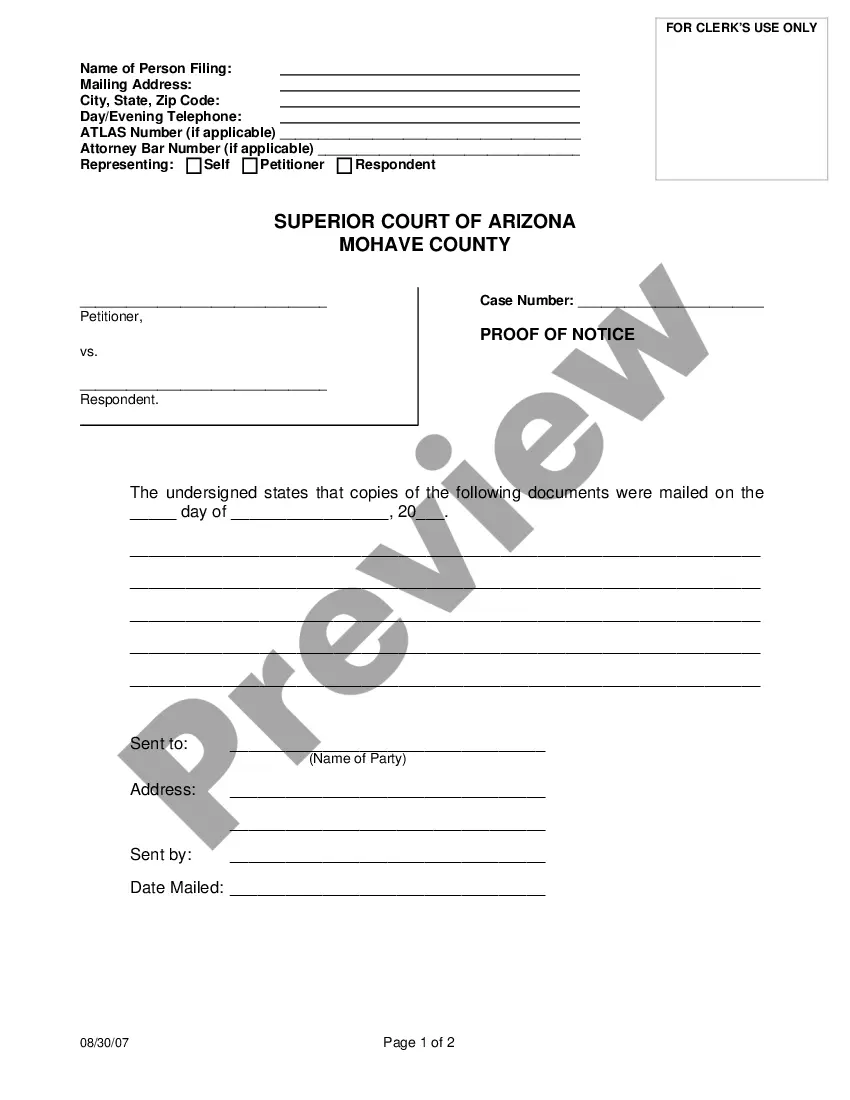

This form is a sample letter in Word format covering the subject matter of the title of the form.

Account Estate Bank With Bonus In Wayne

Description

Form popularity

FAQ

How to open an estate account Step 1: Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Step 2: Obtain a tax ID number for the estate account. Step 3: Bring all required documents to the bank. Step 4: Open the estate account.

The best banks to open an estate account Schwab One Estate Account. Fidelity Estate Account. Estate Services. USAA Survivor Relations.

Honesdale, PA – American Banker has conducted its rankings of the top-performing banks of 2023. Wayne Bank has been evaluated by American Banker on profitability, efficiency, capital adequacy, and asset quality based on a three-year average return.

Who We Are. We're the leading commercial bank built for growth—with over $62 Billion in assets and more than 200 consumer branches and commercial banking offices in communities across the US.

Contact the bank in advance to ensure you arrive with the appropriate documents, but you'll likely need to bring a notarized or certified copy of the death certificate and proof of your identity, such as a driver's license or passport. You'll also need the decedent's legal name and Social Security number.

In order to open a checking account, you generally need to present to the bank a copy of the death certificate as well as your legal appointment paperwork, e.g., a certificate of qualification or Letters Testamentary. You should gather these ahead of time before going to the bank.

State laws typically govern the specific timeframe for keeping an estate open after death, but the average is about two years. The duration an estate remains open depends on how fast it goes through the probate process, how quickly the executor can fulfill their responsibilities, and the complexity of the estate.

How to open an estate account Step 1: Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Step 2: Obtain a tax ID number for the estate account. Step 3: Bring all required documents to the bank. Step 4: Open the estate account.

What Do I Need to Do When I'm Opening an Estate Bank Account? The death certificate. The person's Social Security number. An Employer Identification Number for the estate, since the estate is considered a separate entity — it's not the same as the person who died. Other documents needed by your bank.

The best banks to open an estate account Schwab One Estate Account. Fidelity Estate Account. Estate Services. USAA Survivor Relations.