Sample Letter Of Death Notification To Bank With Bank In Middlesex

Description

Form popularity

FAQ

A letter of instruction is a document that lists all of your important financial account information in one place. This important estate planning document is intended to help your family members (or executors) if something happens to you.

It's a good way to let to those trusted to take care of your affairs know what you would want them to know. Since the letter of instruction is not a legal document, it does not need to be notarized or signed in the presence of witnesses or with any other special formality.

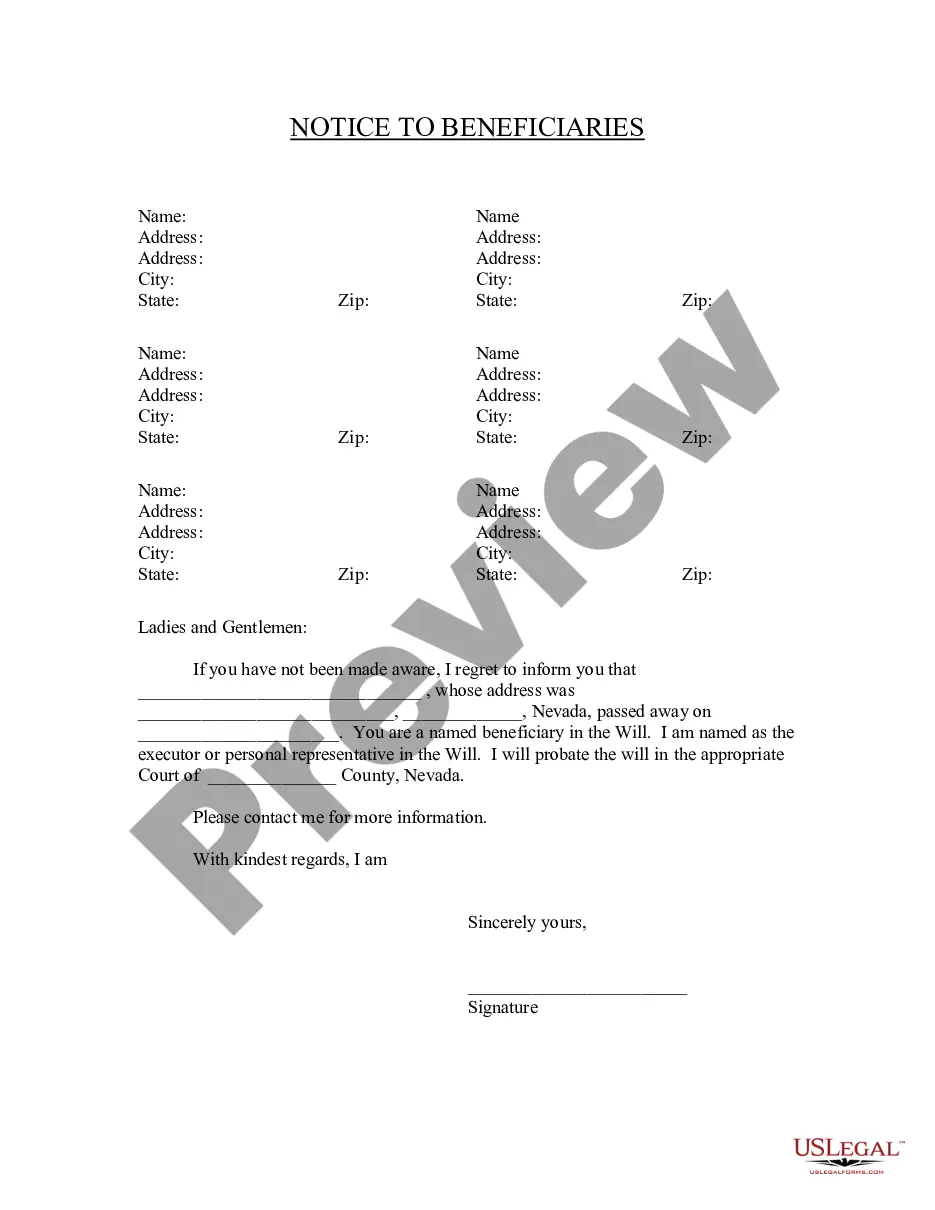

A letter of instruction is an informal letter to an executor, personal representative, and/or other family members that provides important information about your assets and final wishes after death.

The next of kin must notify their banks of the death when an account holder dies. This is usually done by delivering a certified copy of the death certificate to the bank, along with the deceased's name and Social Security number, bank account numbers, and other information.

The bank is likely to ask for two forms of your identification (usually a passport or driver's licence, or a proof of address with a utility bill) and a copy of the will. If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate.

Who typically notifies the bank when an account holder dies? Family members or next of kin generally notify the bank when a client passes. It can also be someone who was appointed by a court to handle the deceased's financial affairs. There are also times when the bank learns of a client's passing through probate.

The bank needs to be notified of the accountholder's passing as soon as possible, as any bank accounts of the deceased remain active until the bank is notified of the death. This typically entails providing the original Death Certificate for verification purposes and the Will, if one is available.