Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Ohio Homestead Exemption For Veterans In Washington

Description

Form popularity

FAQ

Eligible Veterans can exempt $50,000 of the assessed value of their primary residential home from property taxes. Who is eligible for the Ohio Disabled Veteran Homestead Property Tax Relief?

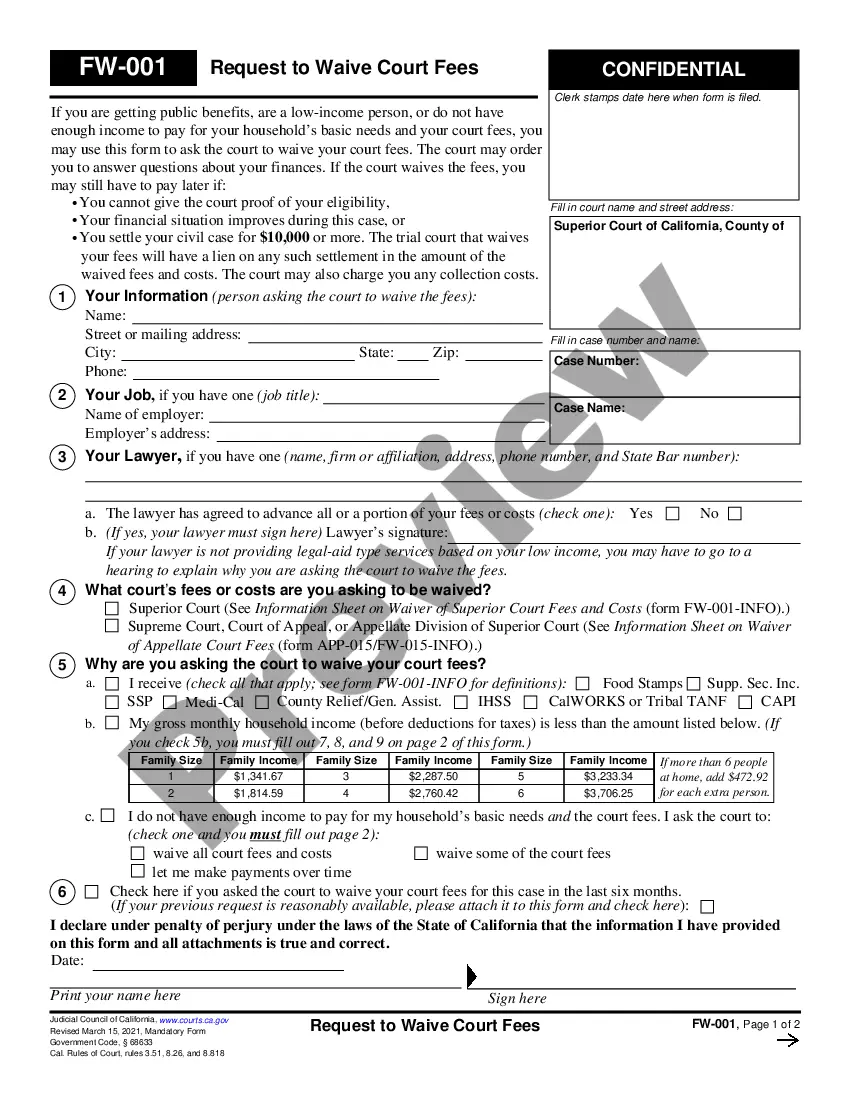

To apply, complete the application form (DTE 105A, Homestead Exemption Application Form for Senior Citizens, Disabled Persons, and Surviving Spouses), then file it with your local county auditor. The form is available on the Department of Taxation's website and is also available from county auditors.

Summary of Washington State Military and Veterans Benefits: Washington State offers special benefits for service members, Veterans and their families including property tax exemptions, state employment preferences, education and tuition assistance, vehicle tags, as well as hunting and fishing license privileges.

You qualify for this 100% homestead exemption if you meet these requirements: You own a home and occupy it as your residence homestead. You are receiving 100% disability compensation from the US Department of Veterans Affairs for a service-connected disability.

Ohio has three types of Homestead Exemptions: (1) senior and disabled persons, (2) disabled veterans, and (3) surviving spouses of public safety personnel killed in the line of duty.

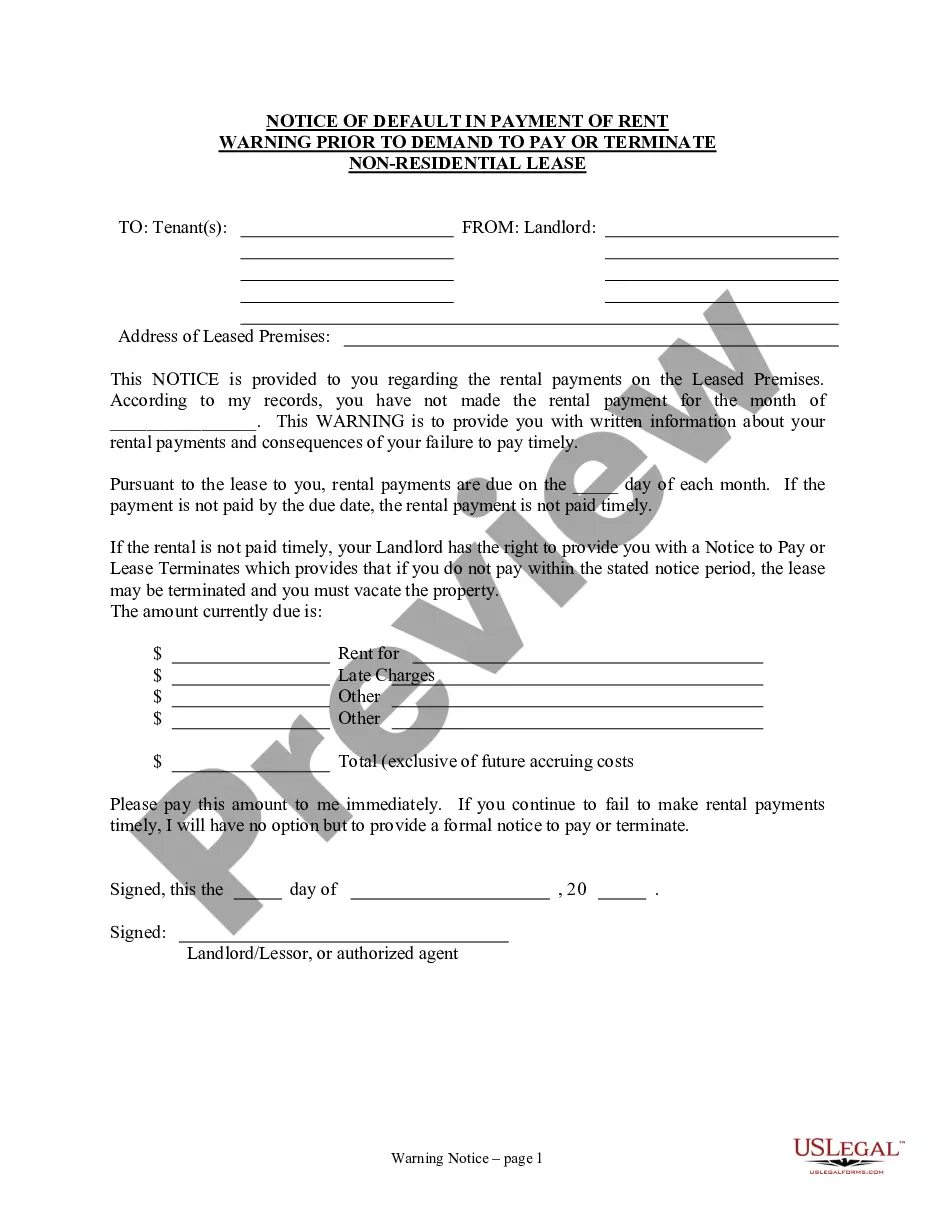

The homestead exemption provides a reduction in property taxes to qualified disabled veterans, or a surviving spouse, on the dwelling that is that individual's principal place of residence and up to one acre of land of which an eligible individual is an owner.

Who is eligible for the Homestead Exemption program? Those eligible must be 65 years of age or older or be permanently or totally disabled, meet annual state set income requirements, and own the home where they live as of January 1st or the year in which they apply.

Washington State Disabled Veteran Property Tax Reduction: Washington offers a property tax reduction for eligible disabled Veterans. Veterans receive a reduction in the amount of property taxes due based on their income, the value of the residence, and local levy rates.

Ohio Disabled Veteran Homestead Property Tax Relief: Veterans who have a 100% disability rating from the VA are eligible for expanded Homestead Exemption property tax relief on their primary residential home.

Who is eligible for the Homestead Exemption program? Those eligible must be 65 years of age or older or be permanently or totally disabled, meet annual state set income requirements, and own the home where they live as of January 1st or the year in which they apply.