Homestead Exemption For Disabled Veterans In Wake

Description

Form popularity

FAQ

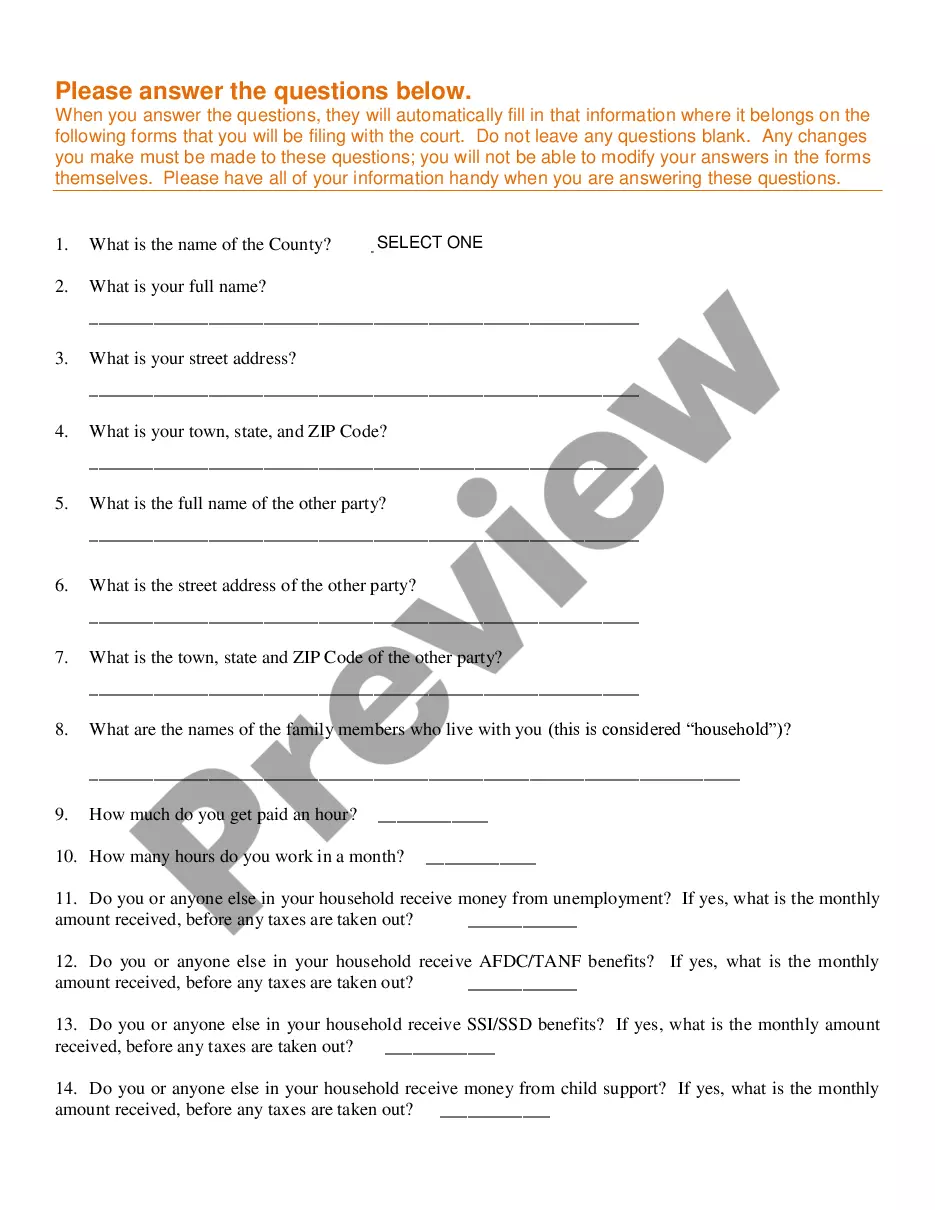

(1) Is at least 65 years of age or totally and permanently disabled. (2) Has an income for the preceding calendar year of not more than the income eligibility limit. (3) Is a North Carolina resident. (a1) Temporary Absence.

Michigan veterans with 100% disability status are eligible to receive full disabled veteran property tax exemption. Minnesota. Mississippi. Missouri. Montana. Nebraska. Nevada. New Hampshire. New Jersey.

You qualify for this 100% homestead exemption if you meet these requirements: You own a home and occupy it as your residence homestead. You are receiving 100% disability compensation from the US Department of Veterans Affairs for a service-connected disability.

2101 or (3) a veteran who died as a result of a service-connected condition. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value.

In Texas, veterans with a disability rating of: 100% are exempt from all property taxes. 70 to 100% receive a $12,000 property tax exemption.

Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA. The following are the exemptions based on Veterans Administration disability ratings: 100% disability ratings are exempt from all property taxes.

Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The veteran must establish this exemption with the county tax official in the county in which he or she resides by providing documentation of this disability.

To request an application for exemption, please call our office at 919-856-5400. The completed application must be filed with the Department of Tax Administration during the regular listing period, which is from January 1 through January 31 each year.