Homestead Exemption Forms With Persons With Disabilities In Texas

Description

Form popularity

FAQ

Optional age 65 or older or disabled exemptions: Any taxing unit may offer an additional homestead exemption amount of at least $3,000 for taxpayers age 65 or older or disabled.

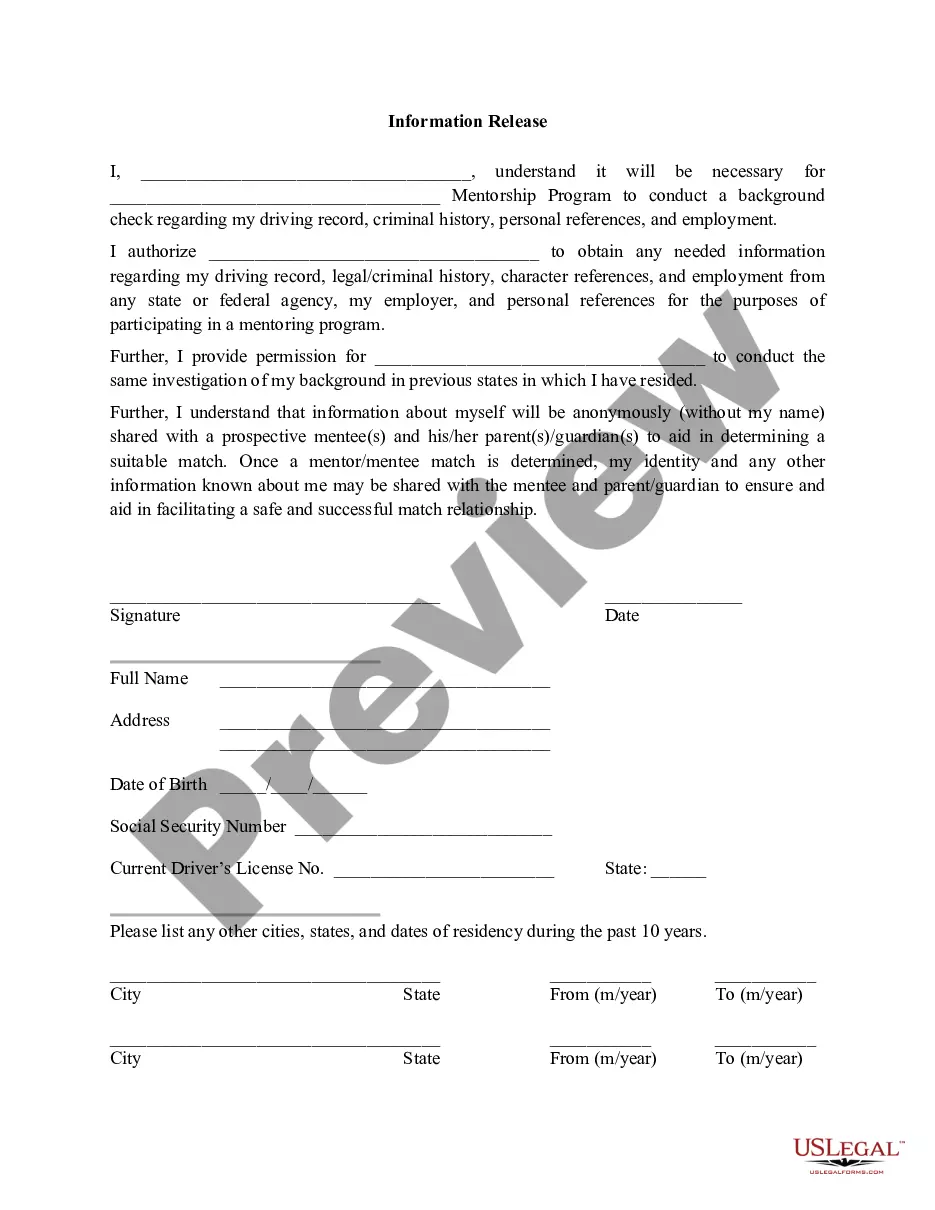

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

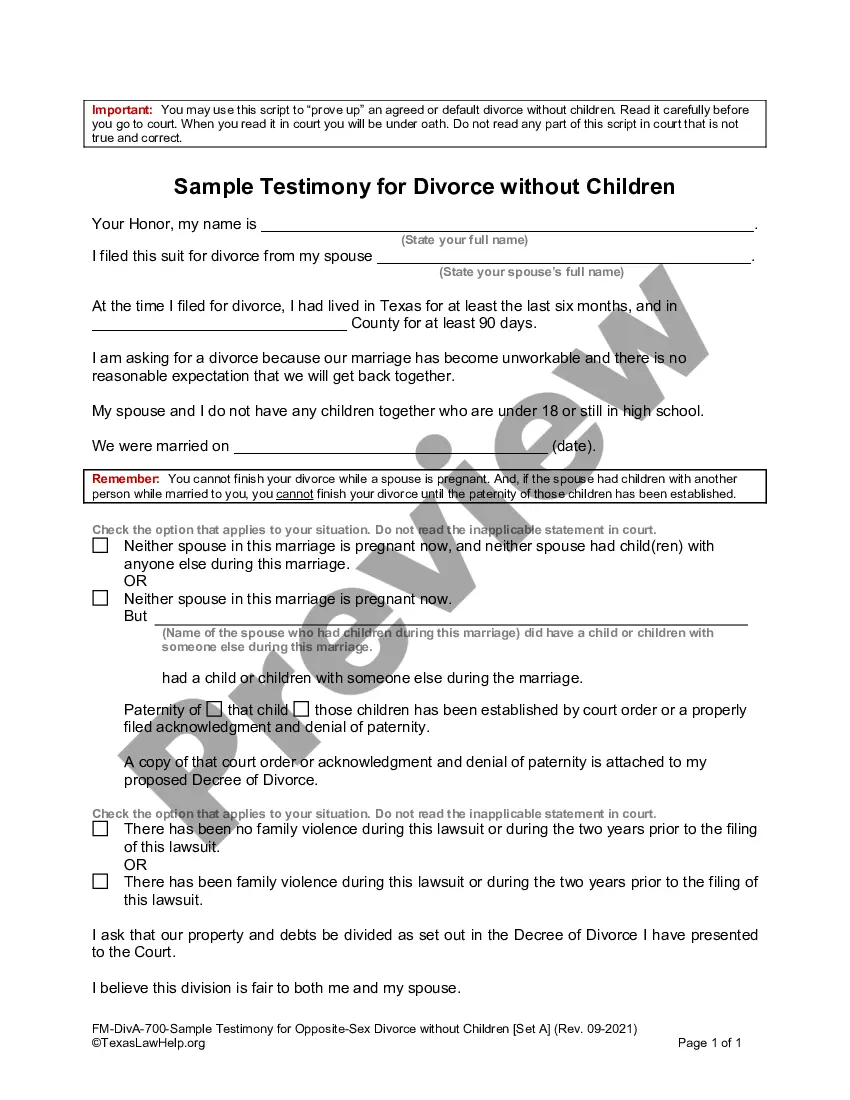

The amount of the exemption is based on the disabled veteran's disability rating. The application for the exemption under Tax Code Section 11.132 is Form 50-114, Residence Homestead Exemption Application (PDF).

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

The amount of the exemption is based on the disabled veteran's disability rating. The application for the exemption under Tax Code Section 11.132 is Form 50-114, Residence Homestead Exemption Application (PDF).

Homestead Application: Form 50-114 Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon owning and occupying the property as their principal residence, if the preceding owner did not receive the exemption that tax year.

A person with a disability may get exemptions if: you can't engage in gainful work because of physical or mental disability or. you are 55 years old and blind and can't engage in your previous work because of your blindness.

Michigan veterans with 100% disability status are eligible to receive full disabled veteran property tax exemption. Minnesota. Mississippi. Missouri. Montana. Nebraska. Nevada. New Hampshire. New Jersey.