Nebraska Homestead Exemption Application Form 458 In Riverside

Description

Form popularity

FAQ

Homestead Exemption 2025 Household Income Table Single Married or Closely Related Percentage of Relief $0 — 36,000.99 $0 — 42,300.99 100% $36,001 — 37,900.99 $42,301 — 44,600.99 90% $37,901 — 39,800.99 $44,601 — 46,900.99 80%9 more rows

Homestead Exemption 2025 Household Income Table Single Married or Closely Related Married, Closely Related, or Widowed $0 — 36,000.99 $0 — 42,300.99 $0 — 46,500.99 $36,001 — 37,900.99 $42,301 — 44,600.99 $46,501 — 48,700.99 $37,901 — 39,800.99 $44,601 — 46,900.99 $48,701 — 51,000.999 more rows

A county or local tax assessor's website or office will provide details on available homestead tax exemptions. Some states require an application, available online, and have deadlines.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

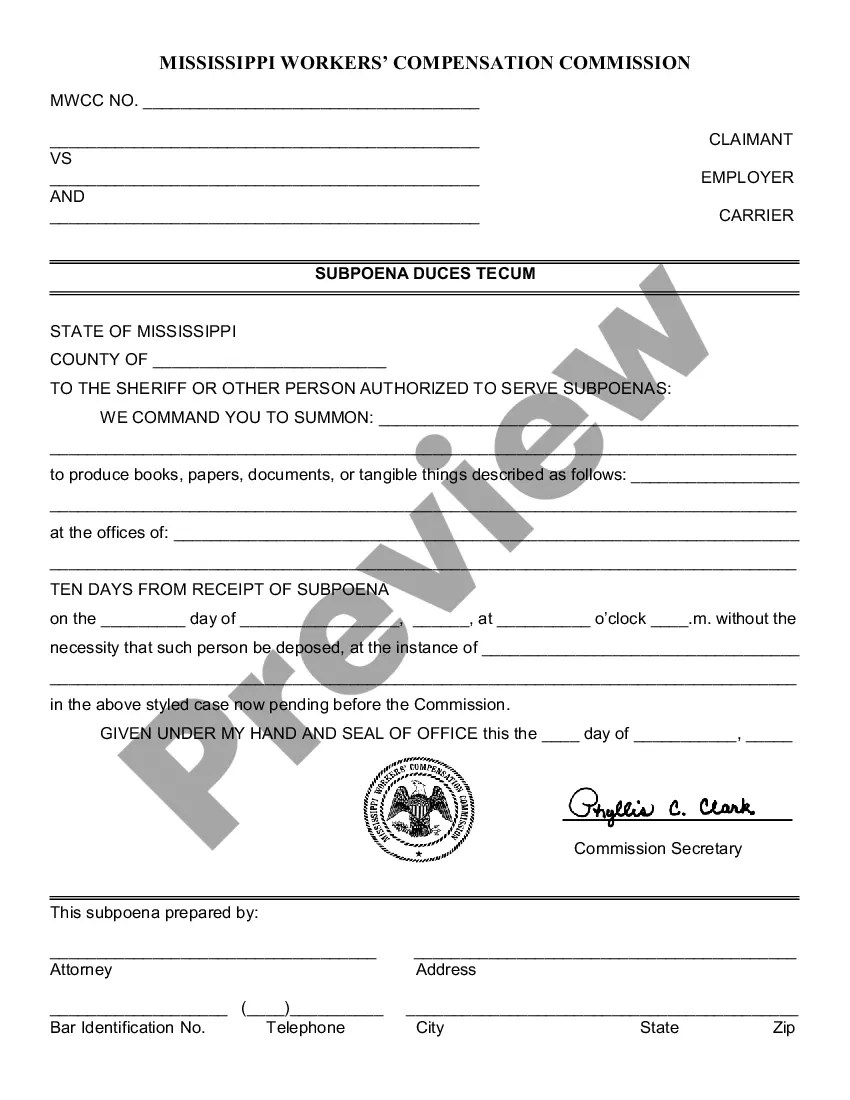

Form 458, Nebraska Homestead Exemption Application. Form 458, Schedule I - Income Statement and Instructions. Form 458B, Certification of Disability for Homestead Exemption.

Applicants must file a Tax year 2024 Form 458, Tax Year 2024 Form 458 Schedule I, and the Form 458L by June 30, 2025 if they meet one of the following conditions: Applicant had a medical condition that required inpatient care in a hospital, hospice, or residential care facility.

You can also access a homestead exemption form to print to fill out here Please submit your completed form with a copy of your driver's license to info@hayscad or by brining it in person to our office located at 21001 N IH 35, Kyle, Texas 78640.

If a new homestead is purchased and occupied in the same or different Nebraska county by August 15, the Form 458T must be filed with the county assessor in the county where the new homestead was purchased by August 15. I - Income Statement, after February 1 and on or before June 30.

You must file the application (Form 458) with the county assessor's office where the original home resides between February 2 to June 30. You will then file a Form 458T - Transfer of Homestead Exemption on or before August 15 with the county assessor's office where the new home resides.