Homestead Exemption Forms With Multiple Owners In Queens

Category:

State:

Multi-State

County:

Queens

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

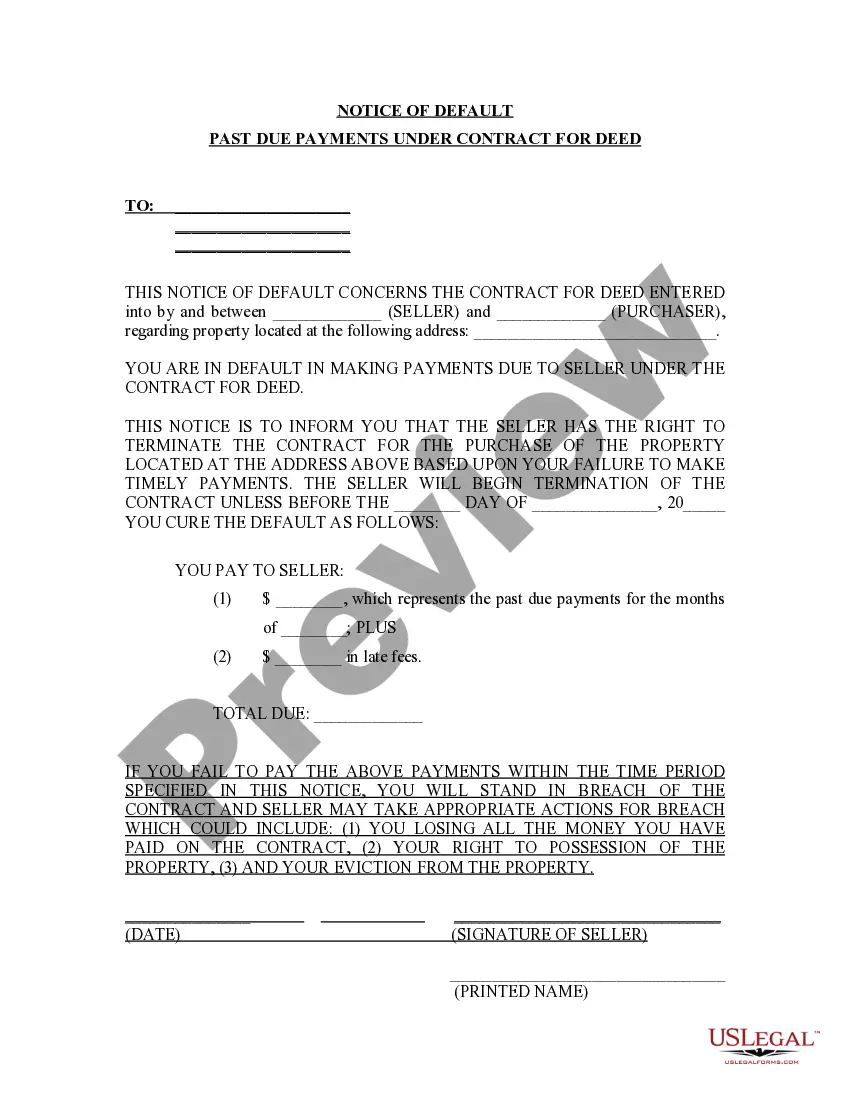

The Homestead Exemption Forms with Multiple Owners in Queens are essential documents for homeowners who wish to claim the homestead exemption, which provides property tax relief. These forms allow for joint ownership situations, catering to various partnerships and ownership structures. Key features include sections for listing all owners, eligibility criteria, and specific instructions for filling out each section accurately. The forms must be completed with accurate personal and property details to ensure compliance with local regulations. Users, including attorneys, partners, owners, associates, paralegals, and legal assistants, can utilize these documents to navigate the exemption process efficiently. For attorneys and legal staff, understanding this form enhances their ability to assist clients in optimizing their property tax benefits. It is also vital for partners or co-owners to understand their rights and responsibilities when filing these forms collaboratively. Proper filling and editing are crucial to avoid delays in processing, making attention to detail a key aspect of this form's utility.