Nebraska Homestead Exemption Application Form 458 In New York

Description

Form popularity

FAQ

All property in the State of Nebraska is subject to property tax, unless an exemption is mandated or permitted by the Nebraska Constitution or by legislation. Government-owned property used for a public purpose is exempt. If the government-owned property is not used for public purpose, it may be considered taxable.

A county or local tax assessor's website or office will provide details on available homestead tax exemptions. Some states require an application, available online, and have deadlines.

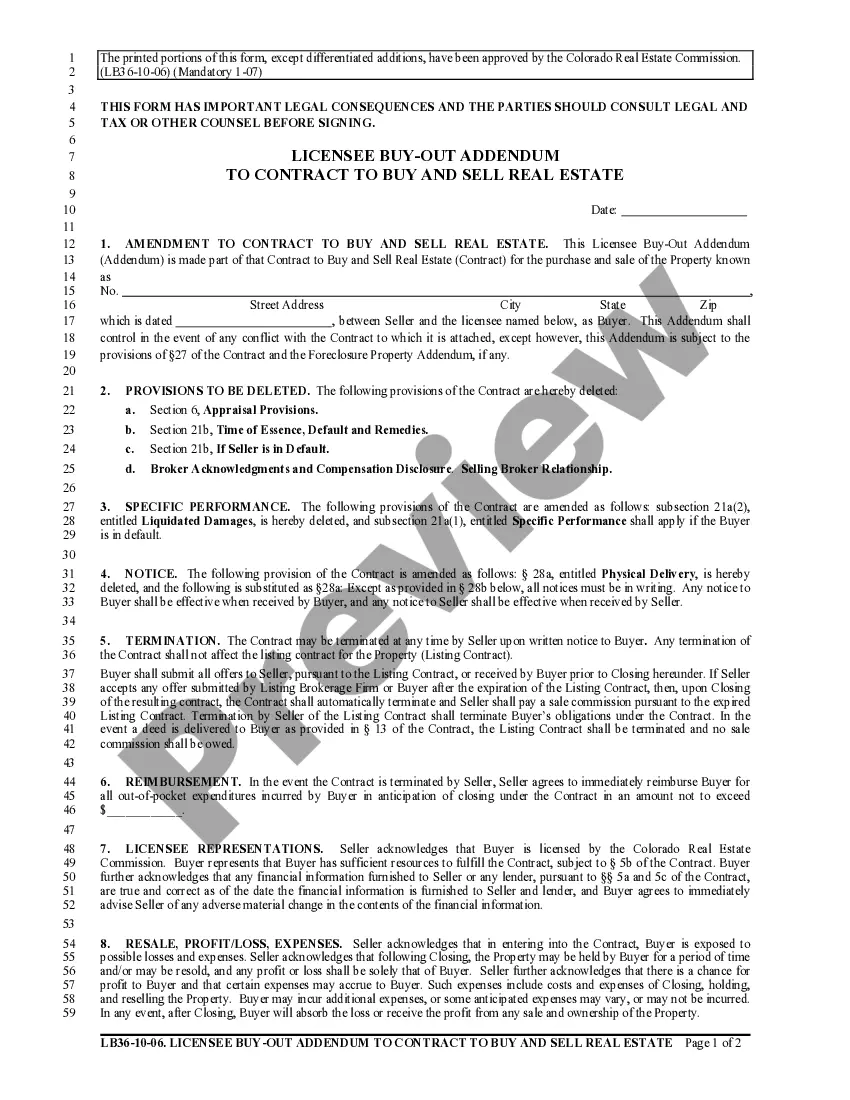

Form 458, Nebraska Homestead Exemption Application. Form 458, Schedule I - Income Statement and Instructions. Form 458B, Certification of Disability for Homestead Exemption.

A surviving spouse of a decedent who was domiciled in this state is entitled to a homestead allowance of seven thousand five hundred dollars for a decedent who dies before January 1, 2011, and twenty thousand dollars for a decedent who dies on or after January 1, 2011.

Homestead exemption requires the applicant to own the home. Ownership means the owner of record or surviving spouse, a joint tenant or tenant in common or surviving spouse, a vendee in possession under a land contract, or the beneficiary of a trust if certain conditions are met.

In Nebraska, a homestead exemption is available to the following groups of persons: Persons age 65+ Have an income below $52,901 for an individual or $62,801 in combined income for a couple. Qualified disabled individuals. Qualified disabled veterans and their widow(er)s. Own and live in your home.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services.

To qualify for a homestead exemption under this category, an individual must: ❖ Be 65 or older before January 1 of the application year; ❖ Own and occupy a homestead continuously from January 1 through August 15; and ❖ Have qualify income-See income table page 5.