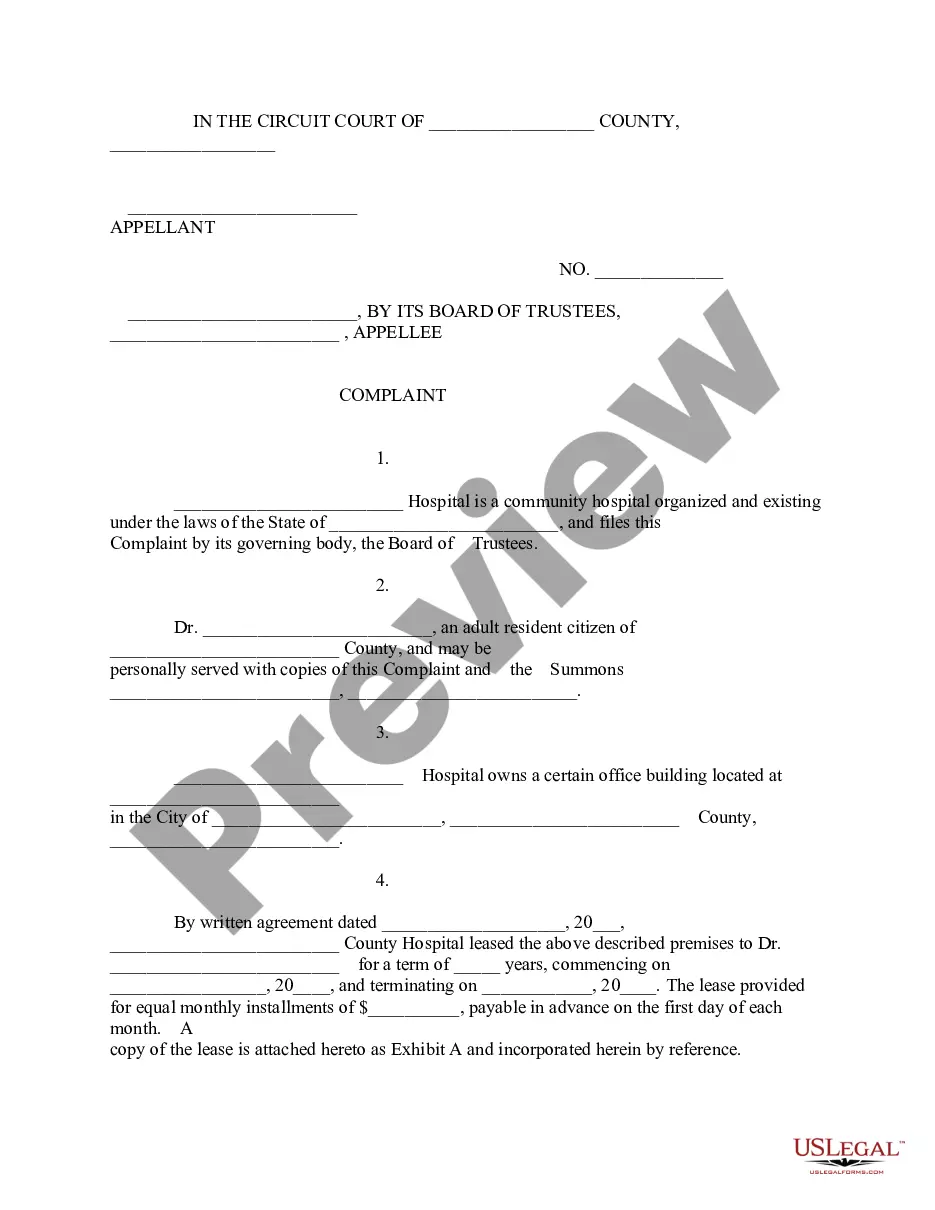

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Information For Texas In New York

Description

Form popularity

FAQ

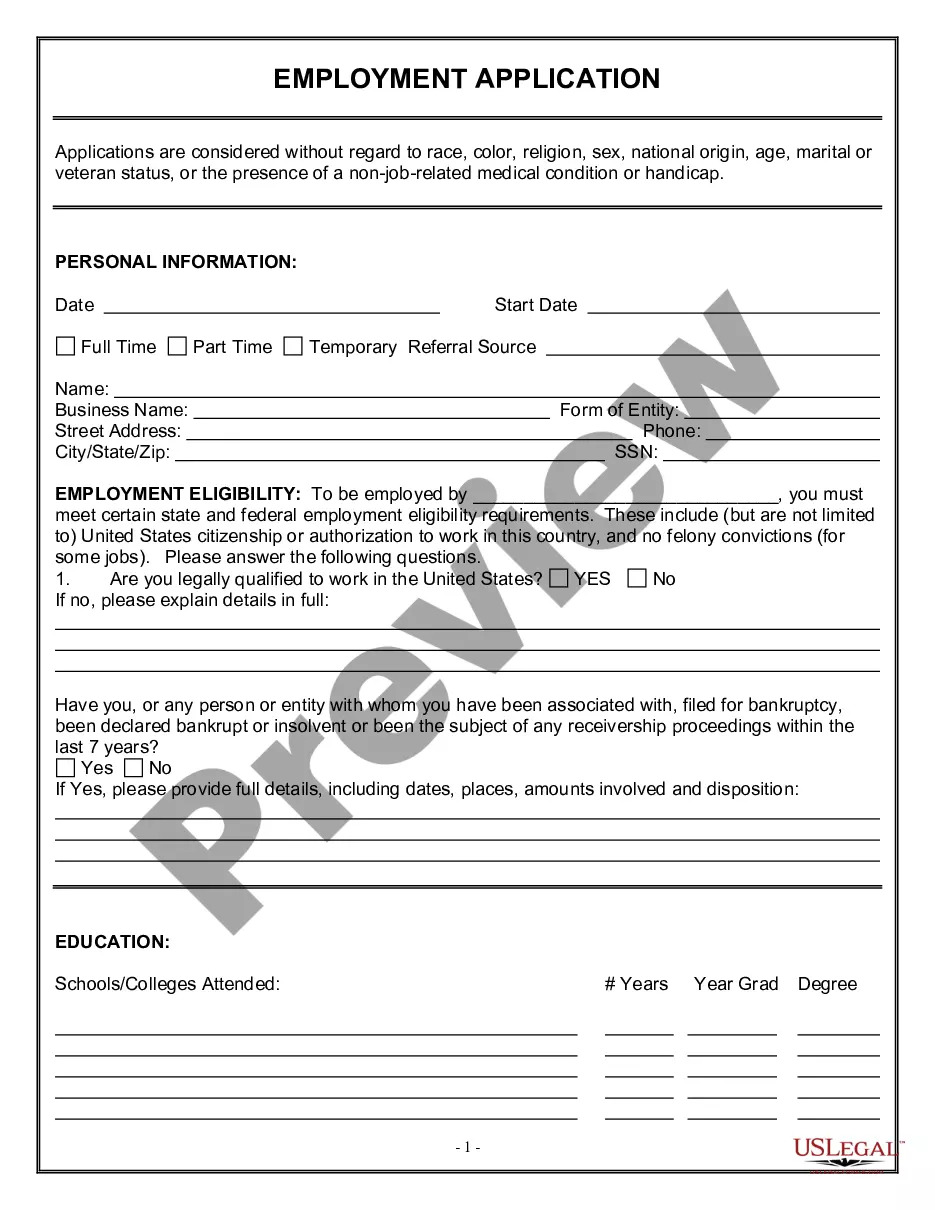

You must own the property and have an equity interest in it. This includes houses, condominiums, co-ops, and mobile homes. Your home equity must fall within the exemption limits for your county: $179,950 for the counties of Kings, Queens, New York, Bronx, Richmond, Nassau, Suffolk, Rockland, Westchester, and Putnam.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

State homestead protection laws help prevent people from becoming homeless in the event of a foreclosure or change in economic circumstances. In Texas, every family and every single adult person is entitled to a homestead exempt from seizure passed on the claims of creditors, except for a pre-existing mortgage or lien.

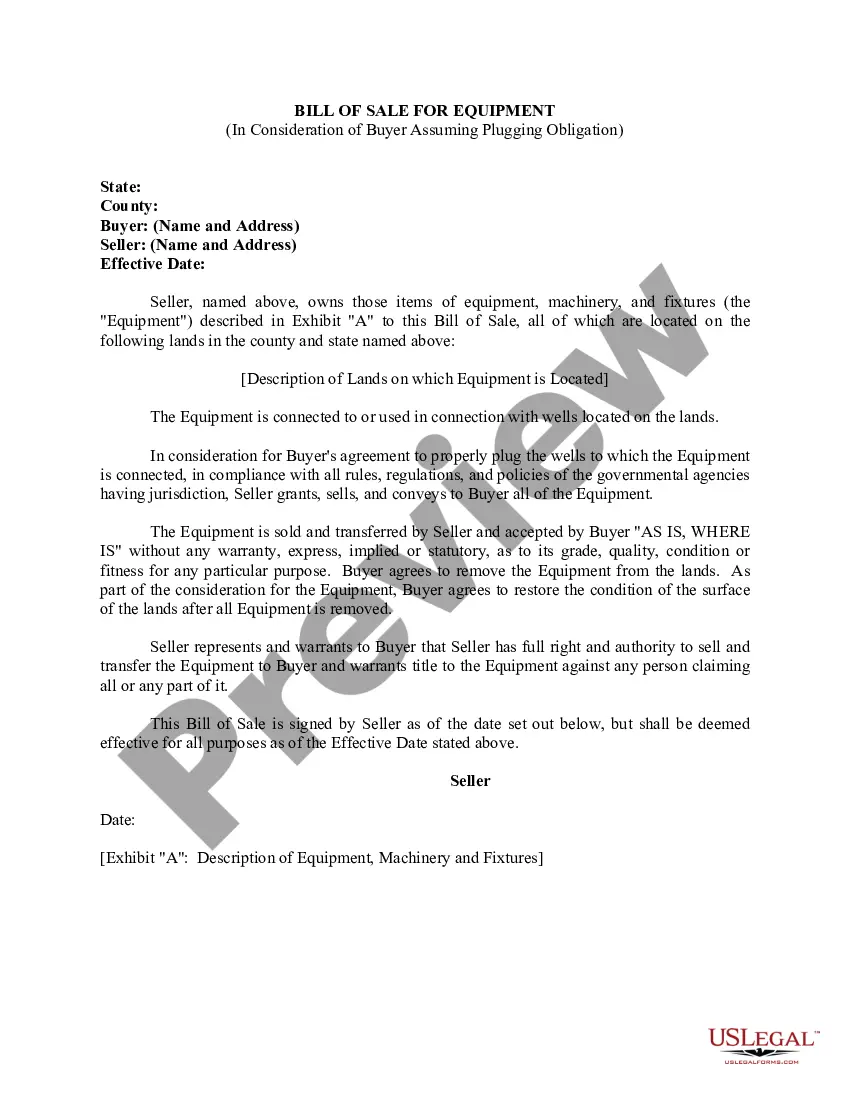

Requirements of the Homestead Act Land titles could also be purchased from the government for $1.25 per acre following six months of proven residency. Additional requirements included five years of continuous residence on the land, building a home on it, farming the land and making improvements.

The exemptions apply only to property that you own and occupy as your principal place of residence. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan. 1 and April 30 of the year for which the exemption is requested.

What if I miss the filing deadline? A late application for a residence homestead exemption, including for a person age 65 or older or disabled, may be filed up to two years after the filing deadline has passed.

You may file a late application for a residential homestead exemption up to two years after the date the taxes become delinquent.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

Exemption Status LookUp Under 'Property Search,' type in the address or Quick Reference ID Number of the property. Click on the Owner Information that populates pertaining to the property you are searching. On the Details page, under 'More Resources' select 'Exemption Status LookUp.

While the federal bankruptcy exemption provides a baseline level of protection for your primary residence, New York State's Homestead Exemption offers significantly higher exemption amounts, no residency requirement, and the ability for married couples to double their protection.