Nebraska Homestead Exemption Form 458 Schedule 1 In Houston

Category:

State:

Multi-State

City:

Houston

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

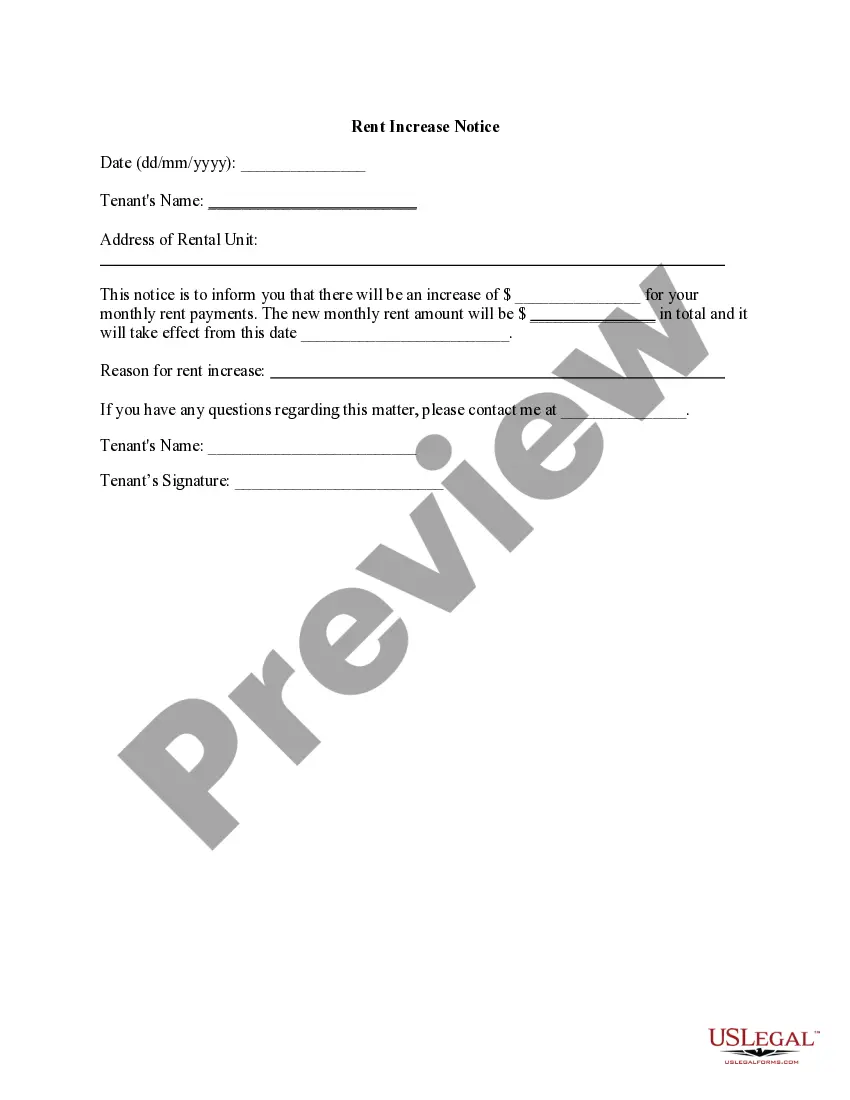

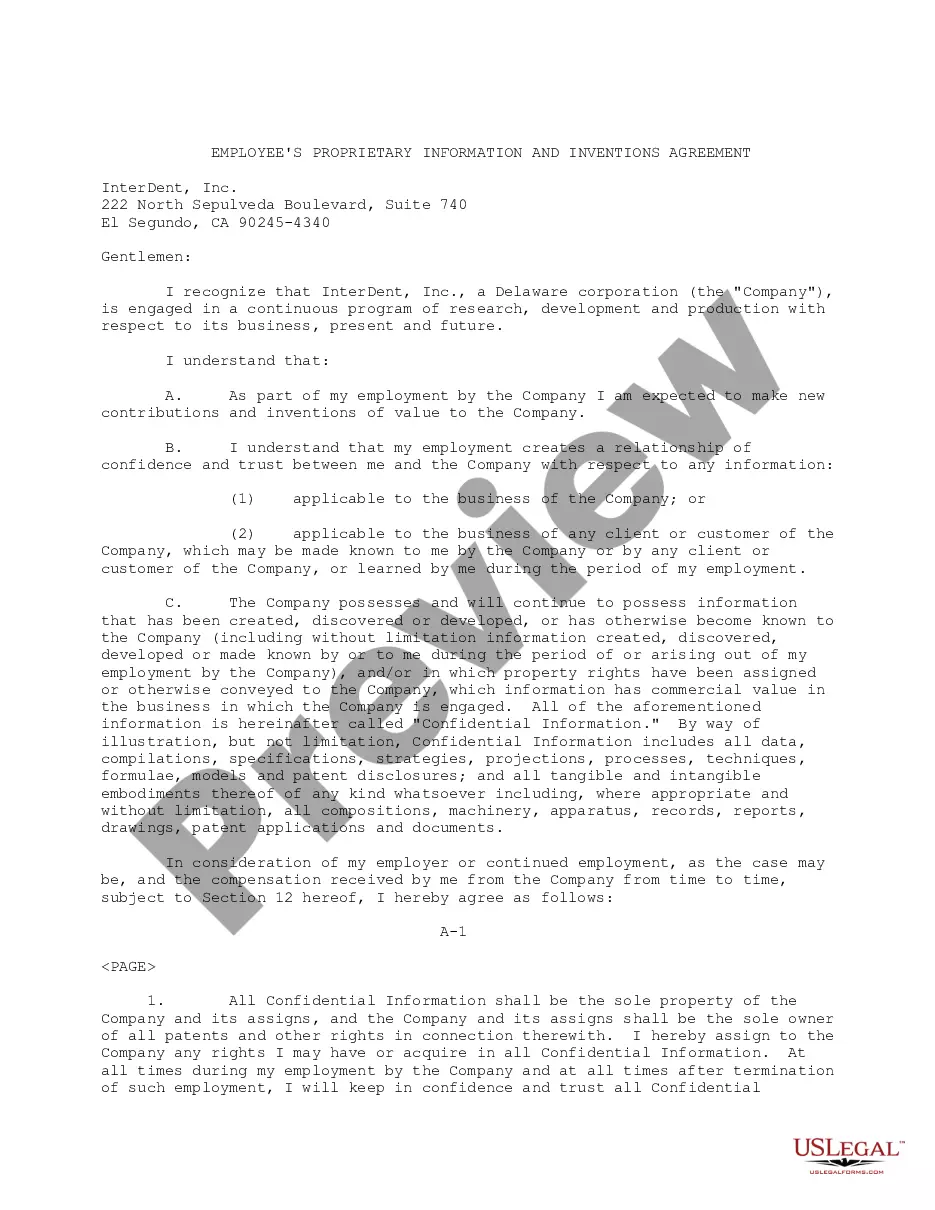

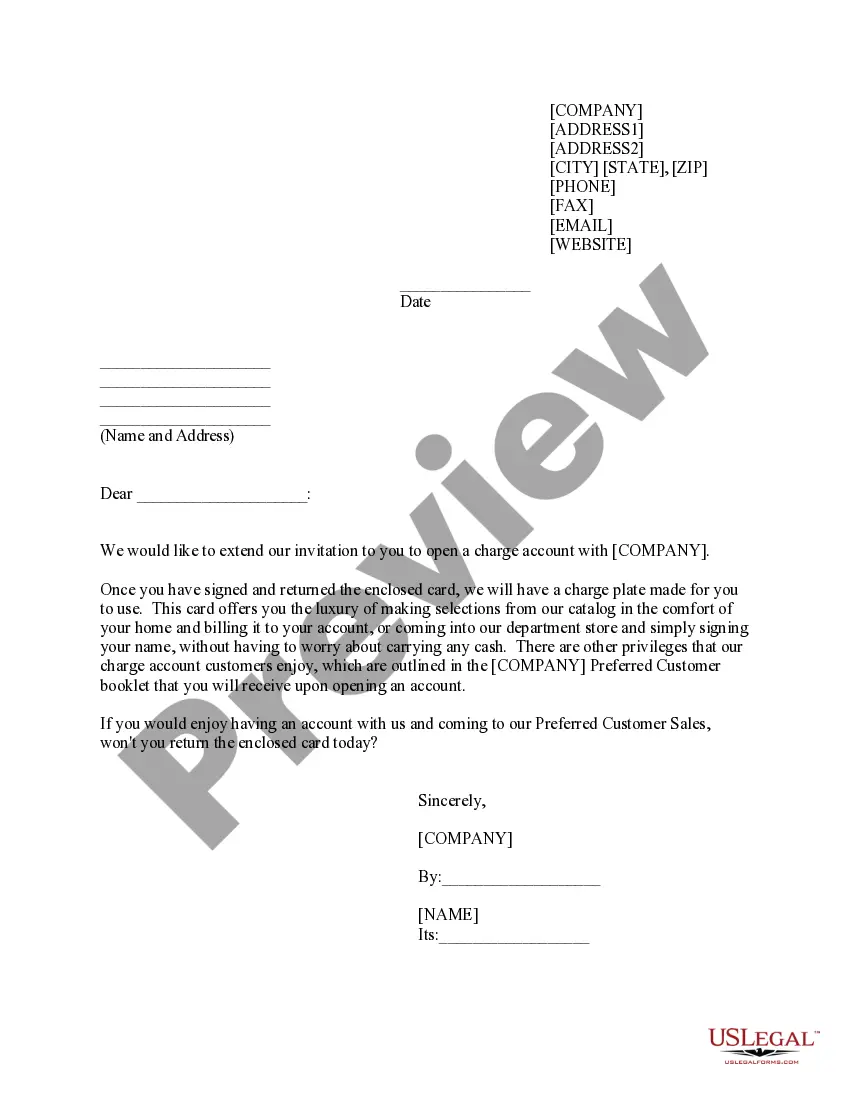

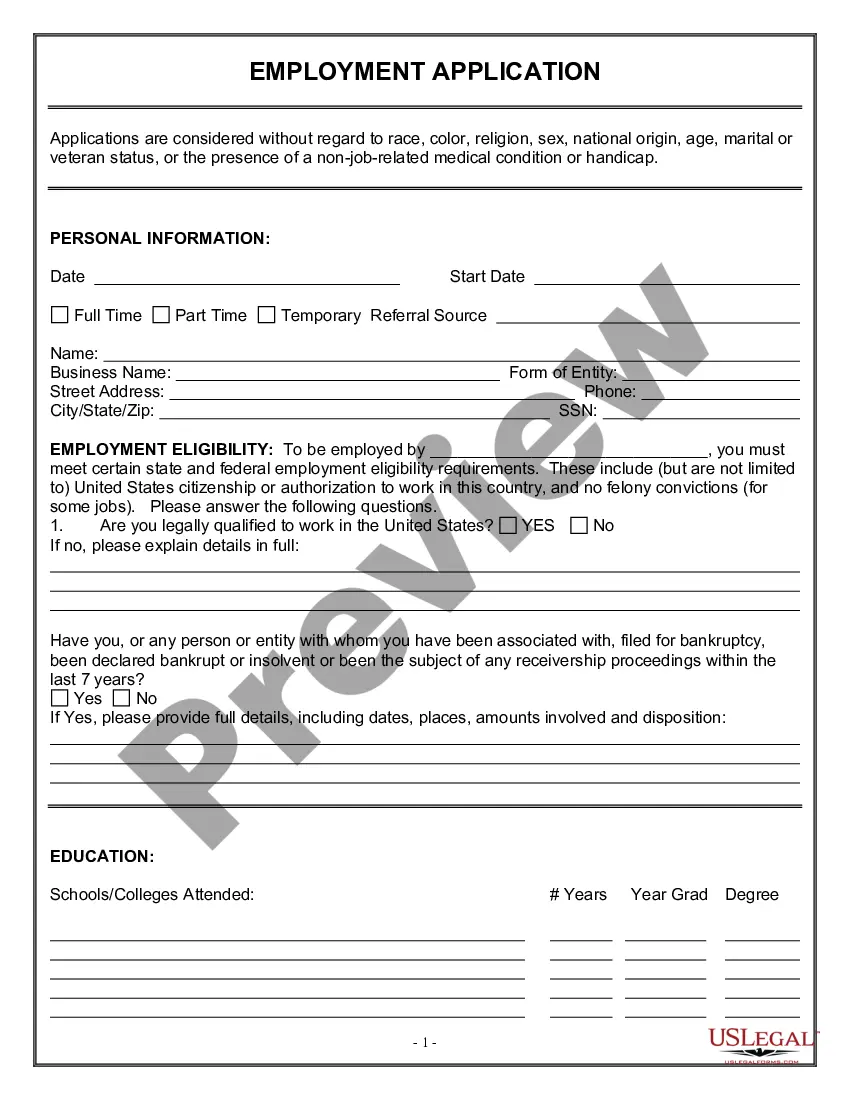

The Nebraska Homestead Exemption Form 458 Schedule 1 is a critical document used in Houston to claim a homestead exemption, which can offer significant property tax relief for eligible homeowners. This form requires the applicant to provide details about their residential property, including its address, ownership status, and whether it qualifies for the exemption based on specific criteria, such as age or disability status. The form is designed for ease of use and can be filled out in a straightforward manner, ensuring accessibility for users with varying levels of legal understanding. Legal professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, can utilize this form to assist clients in securing their tax benefits. Completing the form accurately can help prevent delays in the exemption process, benefiting clients financially. To ensure compliance, it is essential to follow the filling instructions carefully, including providing all necessary supporting documents. Users should also be aware of the deadlines associated with the submission of this form to maximize their exemption claims. Overall, the Nebraska Homestead Exemption Form 458 Schedule 1 is a valuable tool for property owners seeking to reduce their tax liabilities.