Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Form Harris County In Houston

Description

Form popularity

FAQ

A general residence homestead exempts a portion of your residence homestead's value from taxation, potentially lowering your taxes.

The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home is worth $100,000 less than its appraised value. For example, if your home is appraised at $300,000, you will only be taxed on $200,000. Local Residence Homestead Exemptions.

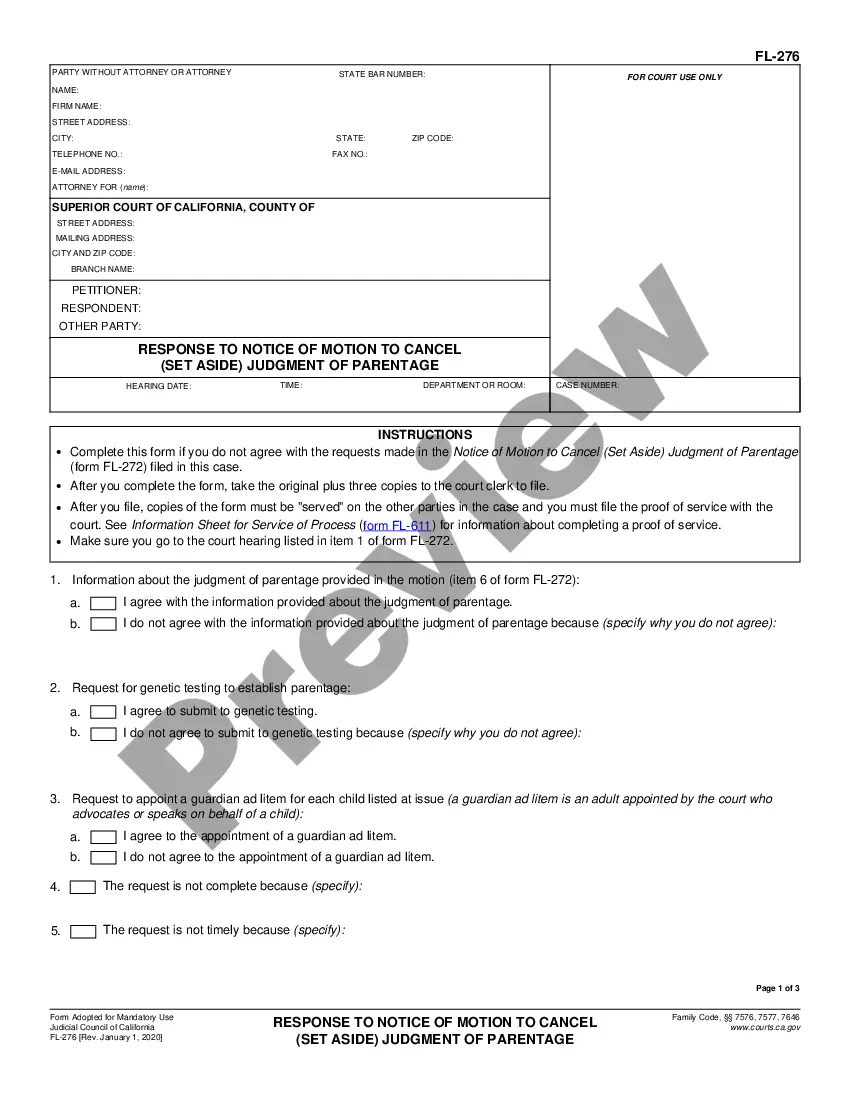

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

Using the HCAD app to file your Homestead Exemption The app is called the HCAD Information and Exemption App and it allows a property owner to submit a residence homestead exemption application by providing images of the front and back of their driver's license as well as check the status of the application.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

First, apply to HCAD for the exemption. We will send an application for the homestead exemption, or you may obtain the form directly from HCAD online at .hcad/ or by calling 713-957-7800. Once the exemption is approved by HCAD, the refund will be processed directly to the name and address on the tax roll.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

What if I miss the filing deadline? A late application for a residence homestead exemption, including for a person age 65 or older or disabled, may be filed up to two years after the filing deadline has passed.

The property must be your principal residence and you cannot claim a homestead exemption on any other property. You must provide a valid Texas driver's license or Texas identification card and the address listed must match the address for which the exemption is requested.

This law increased the annual Texas homestead tax exemption from $40,000 to $100,000, starting with January 2023 taxes. While tax savings relief stole the headlines, another law was enacted that may require homeowners to renew their application for their homestead exemptions every five years.