Homestead Exemption Without Drivers License In Fulton

Description

Form popularity

FAQ

Gather What You'll Need Homeowner's name. Property address. Property's parcel ID. Proof of residency, such as a copy of valid Georgia driver's license and a copy of vehicle registration. Recorded deed for new owners, if county records have not been updated. Trust document and affidavit, if the property is in a trust.

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

Georgia homestead laws allow creditors to exempt up to $10,000 worth of their home under certain conditions. For example, if your house is worth $100,000 and you owe $90,000 on your mortgage, you have $10,000 of equity in your home, and that equity cannot be taken by creditors.

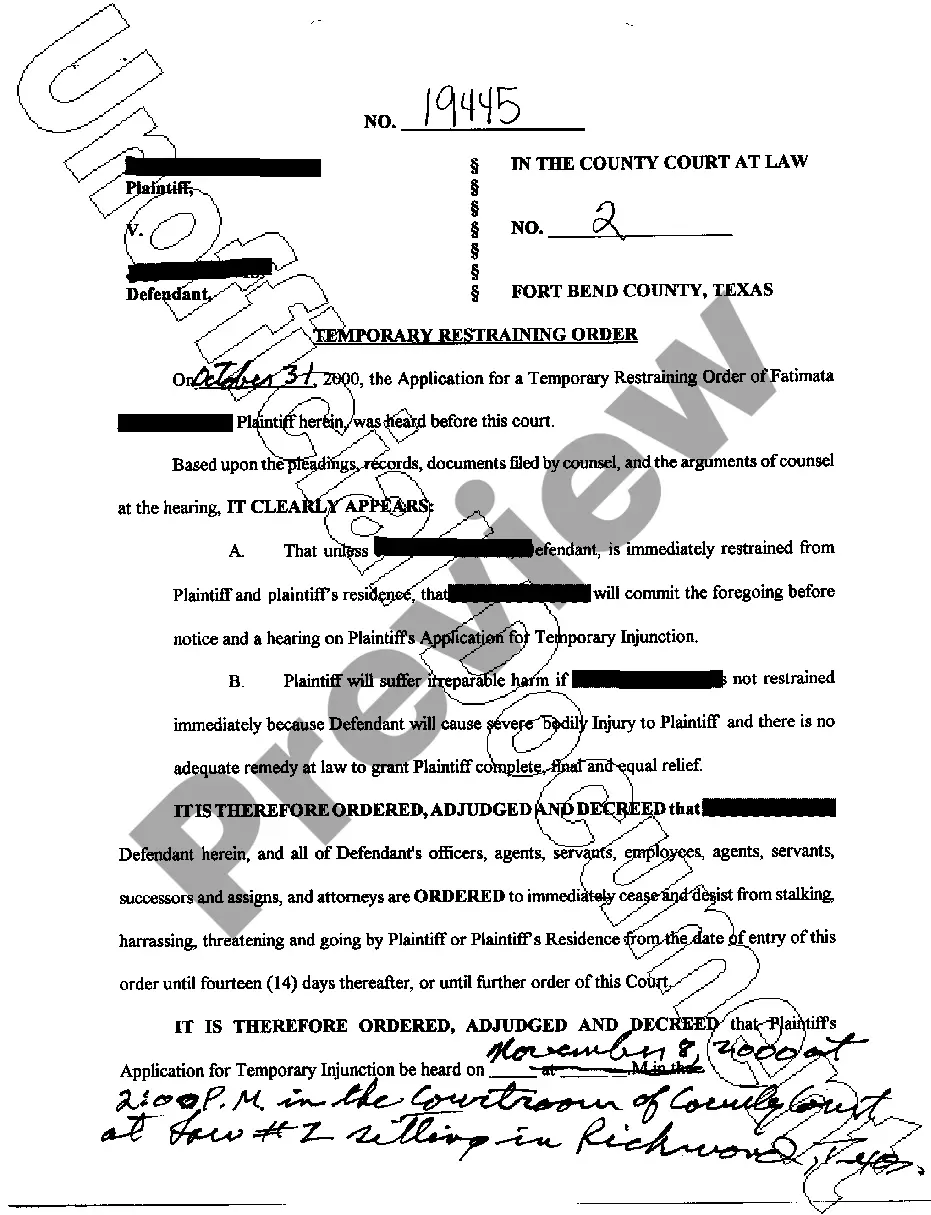

Exemption Requirements You must provide legal evidence of residency and United States citizenship, such as a Georgia driver's license or Georgia ID card. Exemptions are not automatic and each exemption must be applied for individually.

Information you may need to provide details such as your name address or other identifying.MoreInformation you may need to provide details such as your name address or other identifying. Information once you locate your property the property ID should be displayed prominently.

Homestead exemption applicants must submit a copy of Texas Driver License (Texas ID for non licensed drivers) Applicants must affirm no other Homestead is claimed in or outside of Texas.

Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system, cities, and Fulton County. Once granted, exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership.