Homestead Exemption Application Deadline In Alameda

Category:

State:

Multi-State

County:

Alameda

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

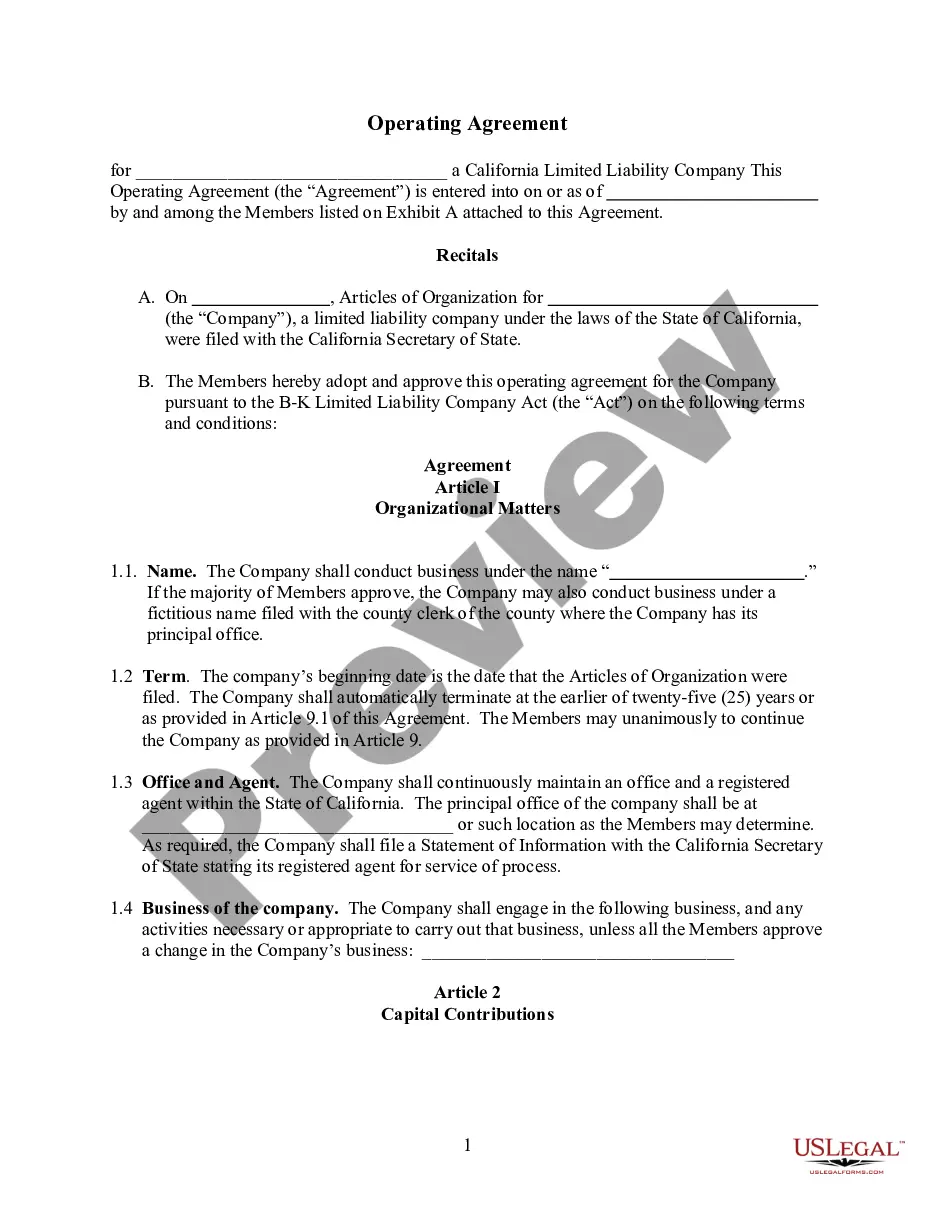

The Homestead Exemption Application Deadline in Alameda is a critical timeline for homeowners seeking to protect their property from creditors and reduce property taxes. This application allows eligible individuals to claim exemptions, ensuring that a portion of their home’s value remains protected. For those involved in the legal field, such as attorneys, partners, owners, associates, paralegals, and legal assistants, understanding this deadline is essential for advising clients effectively. Users should promptly complete the application well in advance of the deadline to ensure eligibility for the exemption. Importantly, the process includes gathering necessary documentation, including proof of residence and prior exemption statuses. Detailed instructions on filling out the form are provided, emphasizing clarity and adherence to local regulations. Though the form is user-friendly, any required edits should be made directly to reflect the individual circumstances of each client. This form is particularly useful in safeguarding clients’ homes, making it a valuable resource in any legal practice that deals with property or financial matters.