Generic form with which a corporation may record resolutions of the board of directors or shareholders.

Corporate Resolution For In Maricopa

Description

Form popularity

FAQ

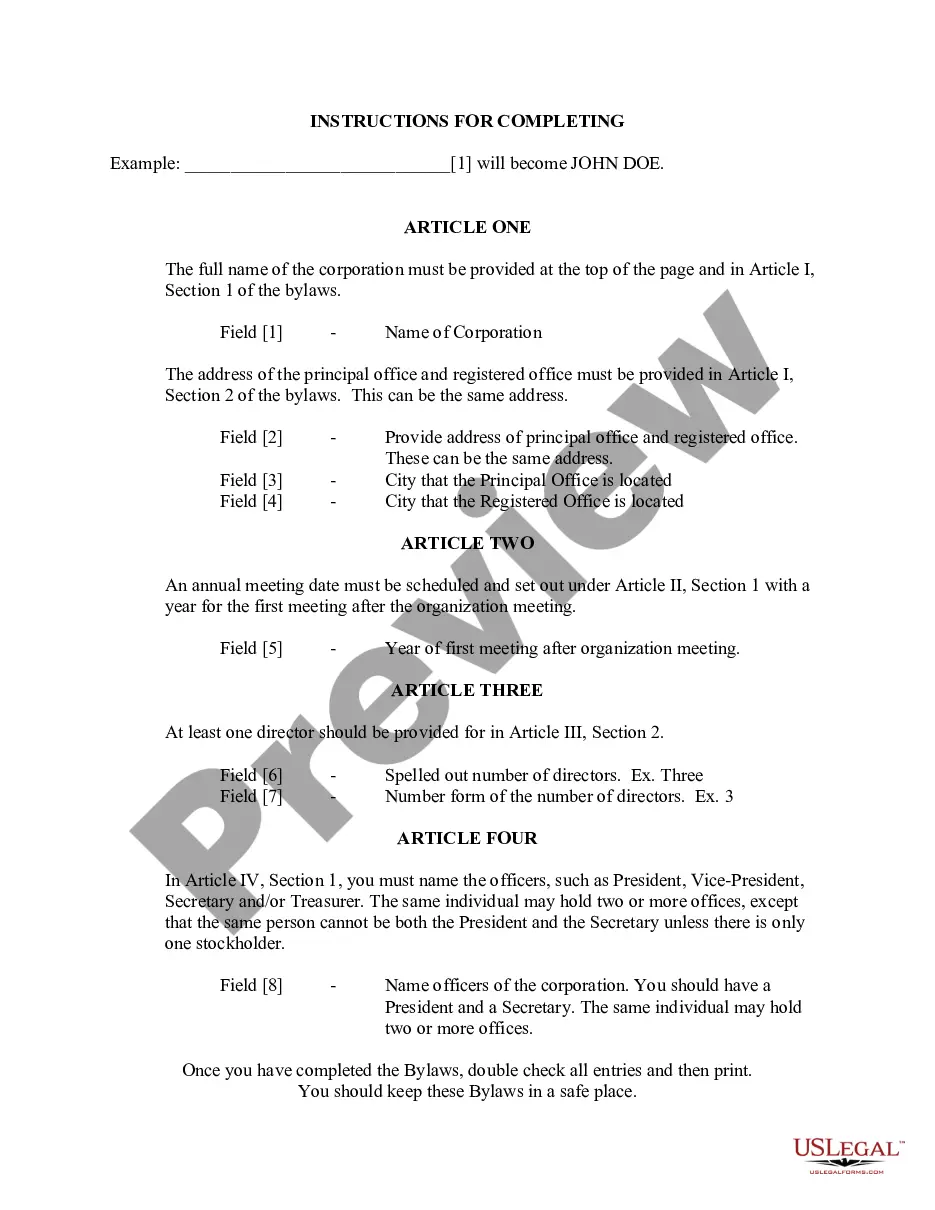

What should corporate resolutions include? Your corporation's name. Date, time and location of meeting. Statement of unanimous approval of resolution. Confirmation that the resolution was adopted at a regularly called meeting. Resolution. Statement authorizing officers to carry out the resolution.

A corporate resolution document does not need to be notarized, although if it involves other transactions then those might have to be notarized. Once the document has been signed off and dated by the chairperson, vice-chairperson, corporate treasurer, and secretary, it becomes a binding document.

Examples of corporate resolutions include the adoption of new bylaws, the approval of changes in the board members, determining what board members have access to certain finances, such as bank accounts, deciding upon mergers and acquisitions, and deciding executive compensation.

Resolutions begin with "Whereas" statements, which provides the basic facts and reasons for the resolution, and conclude with "Resolved" statements which, identifies the specific proposal for the requestor's course of action.

Arizona Rule of Family Law Procedure 49 (Rule 49) requires both parties to share information in family law cases.

A Resolution Statement is a detailed description of the position. a party proposes to resolve all the issues in a Family Law case. The Resolution Statement is one part of the fact sharing process required by Rule 49 of the Arizona Rules of Family Law Procedure.

7 steps for writing a resolution Put the date and resolution number at the top. Give the resolution a title that relates to the decision. Use formal language. Continue writing out each critical statement. Wrap up the heart of the resolution in the last statement.

The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed. For the corrective deed to be valid, all parties who signed the erroneous deed must sign the corrective deed in the presence of a notarial official.

The refund checks are the result of a court ruling in the case of Qasimyar et al. v. Maricopa County, which addressed changes in property classifications and how they impacted property taxes.

Maricopa County class action lawsuit. The Qasimyar decision found that starting in 2015, Maricopa County incorrectly classified certain residences for tax purposes, resulting in substantial errors in how the County assessed property taxes.