Single Member Llc Corporate Resolution Template With Logo In San Bernardino

Description

Form popularity

FAQ

As mentioned, any LLC member can propose a resolution, but all members have to vote on it. The majority of LLC members must vote in favor of the resolution to pass it, but every LLC can have its own voting rules. For example, some LLCs may assign different values to different member votes.

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

Single-member LLCs do not need resolutions, but they can still come in handy in certain situations, like if the company must defend itself in court. Documenting changes or actions not covered in the original bylaws or articles of incorporation can help an LLC protect itself from lawsuits or judicial investigations.

If your LLC fails to file Form 568 on or before the extended due date, you will be assessed a penalty. The penalty is 5% of the unpaid tax for each month or part of the month, and the return remains unfiled from the due date until it is filed. The maximum penalty is 25% of the unpaid tax.

To submit Form SI-100, you may file it online at the California Secretary of State's website or mail it to the Statement of Information Unit at P.O. Box 944230, Sacramento, CA 94244-2300. For in-person submissions, visit the Sacramento office located at 1500 11th Street, Sacramento, CA 95814.

If the LLC has a single member, it will be disregarded as separate from its owner, and will be treated as a sole proprietorship or a division of its owner, unless it elects to be taxable as a corporation. In general, all the owners (members) are shielded from individual liability for debts and obligations of the LLC.

While a single member LLC does not file California Form 565, they must file California Form 568 which provides details about the LLC. Per the CA FTB Limited Liability Company (LLC) website: If your LLC has one owner, you're a single member limited liability company (SMLLC).

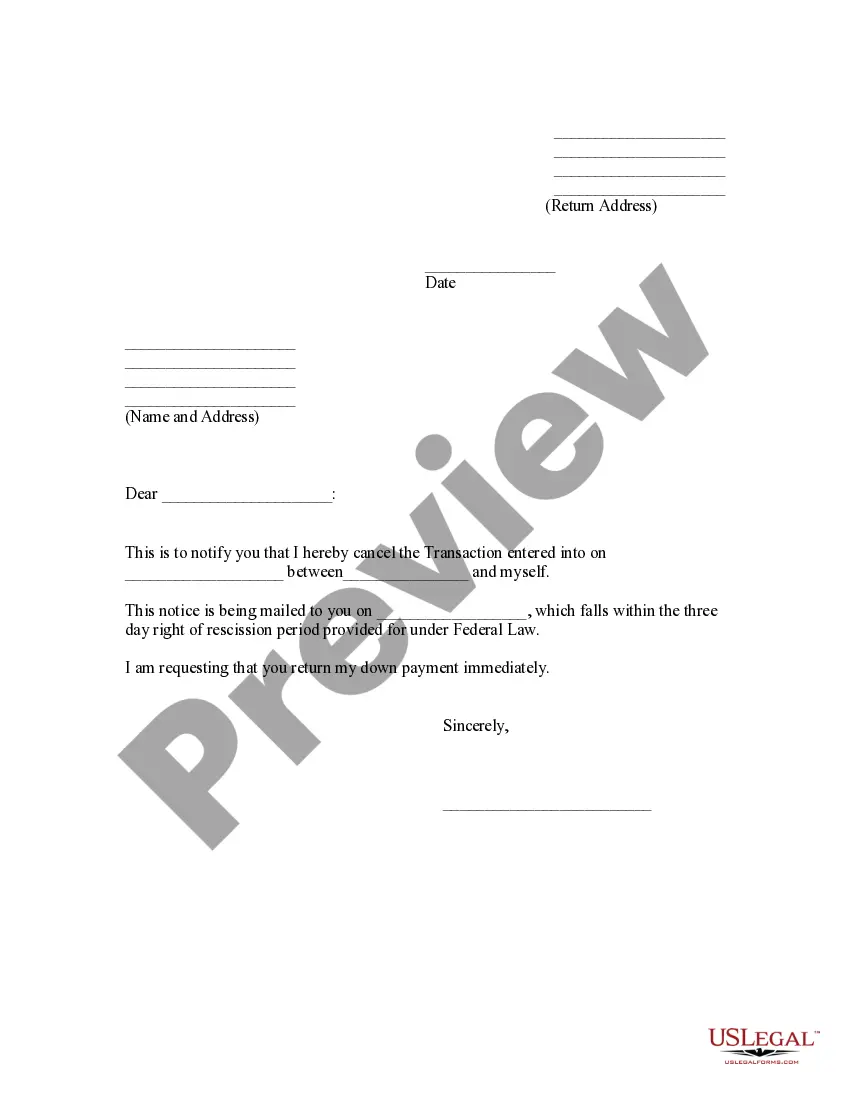

An LLC's corporate resolution form will need to include the following: The business name. Member signatures. If a vote is taken, a record of who voted and their vote. Signatures of others involved/present (secretaries, corporate officers, lawyers, third-party representatives, etc.) Date and location.

The law does not require an LLC Resolution to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.