Single Member Llc Resolution Template For Bank Account In Queens

Description

Form popularity

FAQ

If you run a small business, you might wonder if you can use your personal checking account for business purposes. The short answer is no; it is not a good idea. While it might seem easier at first, mixing your personal and business finances can cause trouble later.

You could simply appoint yourself as the sole member of your SMLLC without making any initial investment. However, you'd probably be taking a significant risk if you didn't invest at least a small amount at the outset. Without any capitalization, your business might not appear to be truly separate from you, personally.

Using your personal bank account for your LLC is generally not recommended, as it can blur the line between personal and business finances, potentially causing legal and financial issues, so it's usually advisable to open a separate business bank account for your LLC.

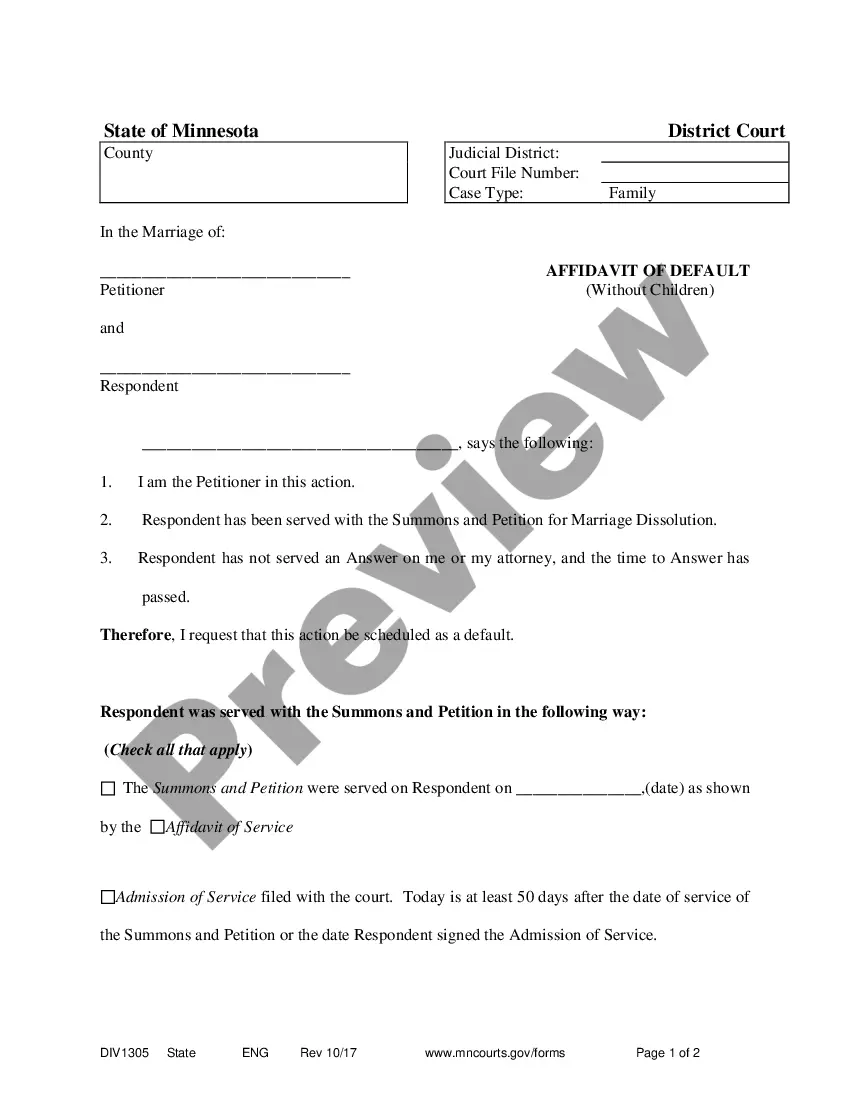

When you create a resolution to open a bank account, you need to include the following information: The legal name of the corporation. The name of the bank where the account will be created. The state where the business is formed. Information about the directors/members.

What should a resolution to open a bank account include? LLC name and address. Bank name and address. Bank account number. Date of meeting when resolution was adopted. Certifying signature and date.

As the owner of an LLC, you're under no legal obligation to open a separate business bank account. Technically, you can use a personal bank account in your LLC, but it's ill-advised to do so. If you use a personal account, it's a lot more difficult to file taxes and could lead to serious complications down the line.

Unlike corporations, LLCs don't need to file business resolutions with the state. Single-member LLCs (SMLLCs) can also use business resolutions, even though there is no chance of disagreement among the members. Some LLC corporate resolution examples are: Protect the SMLLC in a lawsuit by leaving a legal paper trail.

“RESOLVED THAT the Company's Banking Current Account No___________ with (Name of the Bank with address) , be closed and the amount, if any, lying in the said account be returned to the Company by way of issuance of Bankers' Cheque payable at …………… or transfer to other Current Account in the name of the Company, and the ...

(1) A company that has only 1 member may pass a resolution by the member recording it and signing the record.

Three forms of resolutions are available: ordinary resolution, special resolution and unanimous resolution. There is no concept of special resolution in board meetings and very few unanimous resolutions are also required. However, all three are covered in the case of general meetings.