Single Member Llc Resolution Template For Sell Real Estate In New York

Description

Form popularity

FAQ

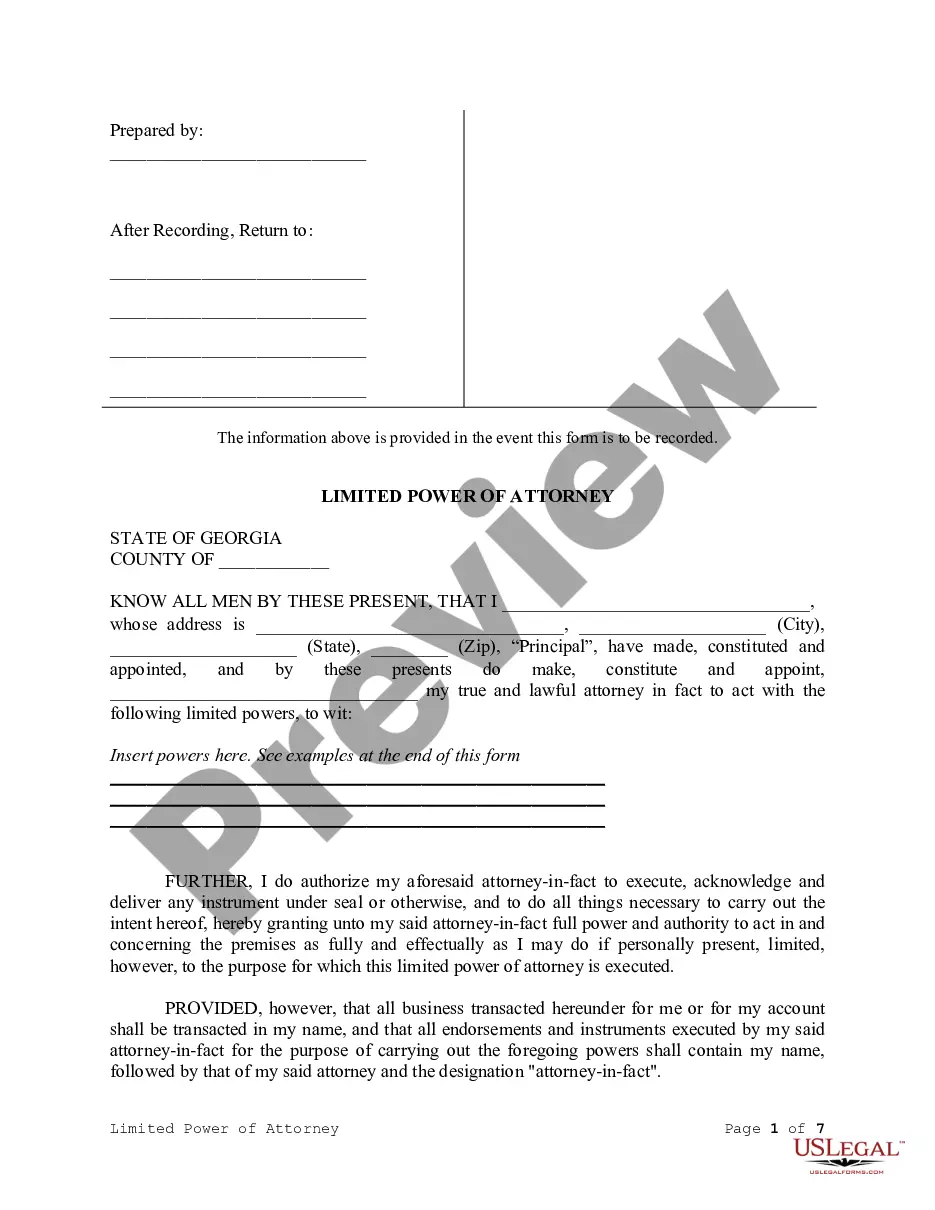

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

The law does not require an LLC Resolution to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.

The law does not require an LLC Resolution to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

Corporate Resolution Sample An LLC banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one. Depending on the rules of the bank, you may be required to fill in an additional proprietary form before creating a business bank account.

Unlike corporations, LLCs don't need to file business resolutions with the state. Single-member LLCs (SMLLCs) can also use business resolutions, even though there is no chance of disagreement among the members. Some LLC corporate resolution examples are: Protect the SMLLC in a lawsuit by leaving a legal paper trail.

An LLC resolution is a legal document that describes the roles members of an LLC should play. This document also highlights situations that which voting might be required. For our company, the main objective of the resolution is to set clear guidelines that ensure smooth operations of the entity.

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

Start a New York SMLLC in six steps Step 1: Pick a name for your New York single-member LLC. Step 2: Get a registered agent for your New York SMLLC. Step 3: File your New York Articles of Organization. Step 4: Create a NY single-member LLC operating agreement. Step 5: Get a single-member LLC EIN.

New York uniquely requires all LLCs (including SMLLCs) to have a written operating agreement. An SMLLC operating agreement is usually made between the SMLLC's sole member and the SMLLC itself. You must enter into the agreement before, at the time of, or within 90 days after filing your articles of organization.