Non Profit Corporate Resolution Example With Bank Account In San Jose

Description

Form popularity

FAQ

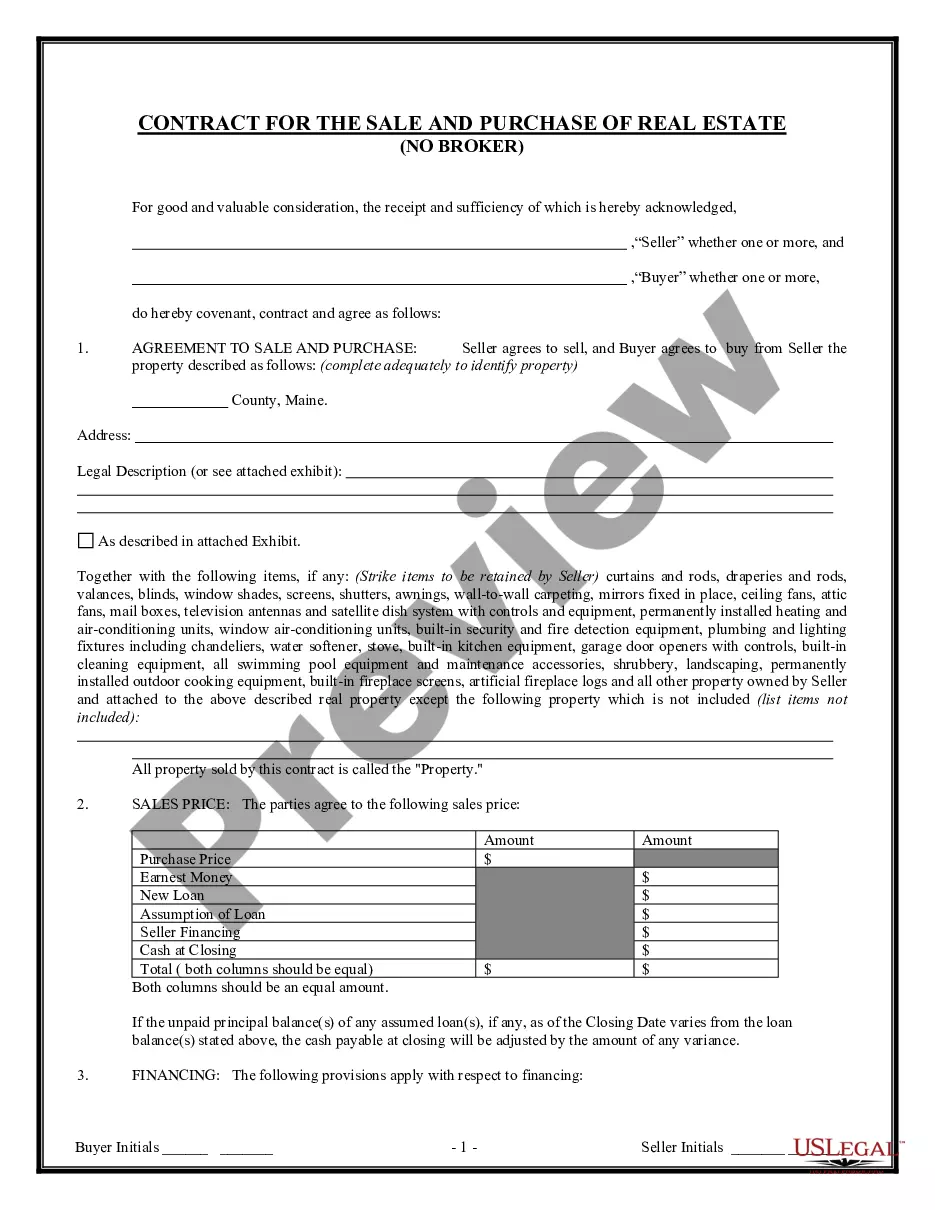

Banking resolutions are generally part of the process for opening a bank account for your company. Check with your bank to see what their requirements are. To authenticate it as a stand-alone document, the banking resolution is signed by the corporate secretary and stamped with the corporation's corporate seal.

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

“RESOLVED THAT a Current Account in the name of the Company be opened with ____________ Bank, _____________ , for the operations of the activities of the Company and the said Bank be and is hereby authorized to honour all cheques, drafts, bills of exchange, promissory notes and other negotiable instrument, signed drawn ...

What documents do I need to open a nonprofit bank account? Nonprofit Articles of Incorporation or the Certificate of Formation. Nonprofit Bylaws signed and executed. Employer Identification Number (EIN) Social Security and driver's licenses of the directors (ones with access to the account)

“RESOLVED THAT a Current Account in the name of the Company be opened with ____________ Bank, _____________ , for the operations of the activities of the Company and the said Bank be and is hereby authorized to honour all cheques, drafts, bills of exchange, promissory notes and other negotiable instrument, signed drawn ...

Banks often require banking resolutions from companies. They serve as proof that the person opening a business bank account is authorized to do so. Some banks have a standard form that companies must use for their banking resolution.

What should a resolution to open a bank account include? LLC name and address. Bank name and address. Bank account number. Date of meeting when resolution was adopted. Certifying signature and date.

Simply put, a banking resolution is a formal authorization to open a corporate bank account, whether for profit or nonprofit. This document identifies any member of the nonprofit with permissions to perform transactions and account procedures while outlining what role and privileges are granted to these individuals.