Non Profit Resolution Template With Calculator In Sacramento

Description

Form popularity

FAQ

Below is our list of top five states where it's the easiest and most beneficial to start your nonprofit. Delaware. Home to over 5,500 nonprofits , Delaware is a small but popular state to start a charitable organization (even if they operate from another state). Wisconsin. Arizona. Texas. Nevada.

Required annual filings File IRS Form 990. Agency. File California Corporate Tax Returns. Agency. File California Corporate Tax Exemption Renewals. Agency. File California Sales Tax Exemption Renewals. File California Statement of Information. Renew the Charitable Solicitation Registration.

Percentage spent on program activities. This ratio gives you a good idea of how much of your total budget is used to provide direct services. To calculate this ratio, divide your total program service expenses by total expenses. Higher than 65% is widely considered to be good, and 85% and above is usually excellent.

Net Profit = Total Revenue – Total Expenses To calculate Net profit of a company, its total expenses are deducted from the total revenue it generates.

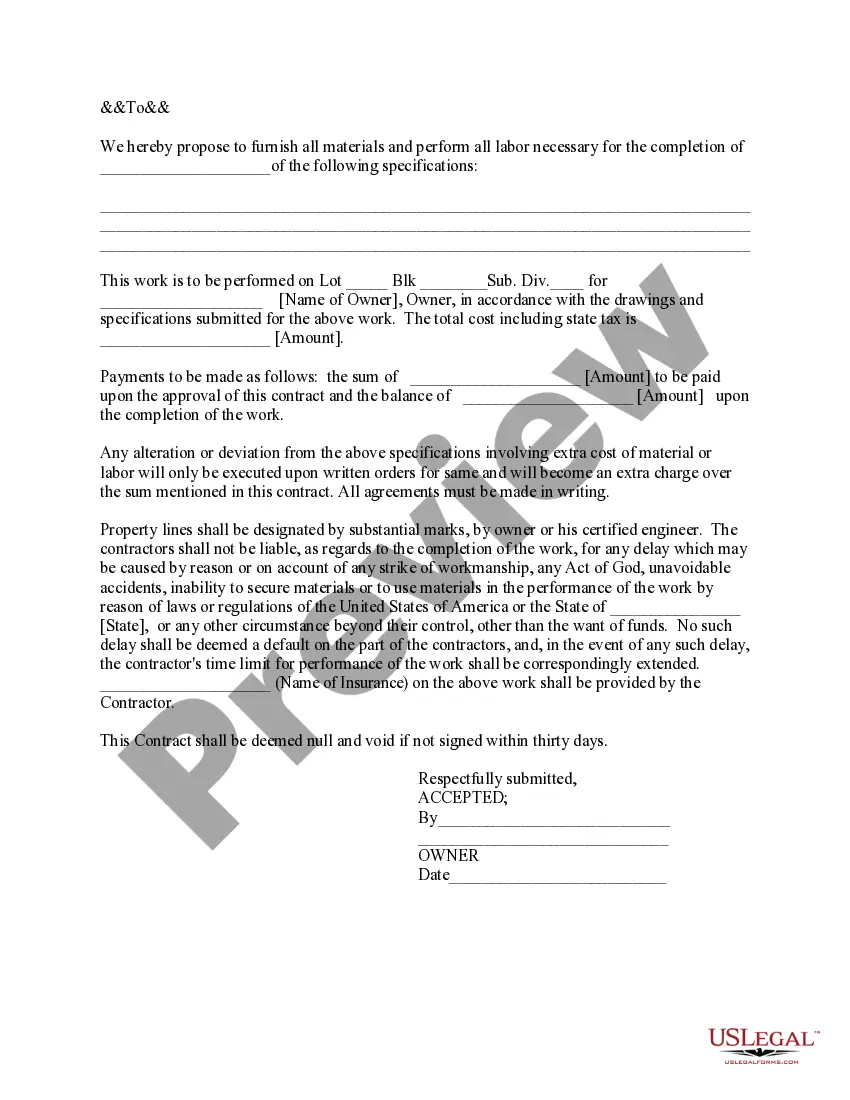

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

In a profit making organization, the accounting equation is Assets = Capital + Liabilities while in non profit making organizations, the accounting equation is Assets = Accumulated Fund + Liabilities.

For a nonprofit balance sheet, use the equation: assets = liabilities + net assets (instead of owner's equity).

Every California nonprofit corporation must keep records of bylaws and amendments. This means having up-to-date copies at their main office and keeping detailed records of every change. And if the changes are significant, the bylaws should be restated altogether.

A California nonprofit corporation must have: 1) either a chairperson of the board or a president or both; 2) a secretary; and 3) a treasurer or a chief financial officer or both.