Nonprofit Resolution Template For 501c3 In Illinois

Description

Form popularity

FAQ

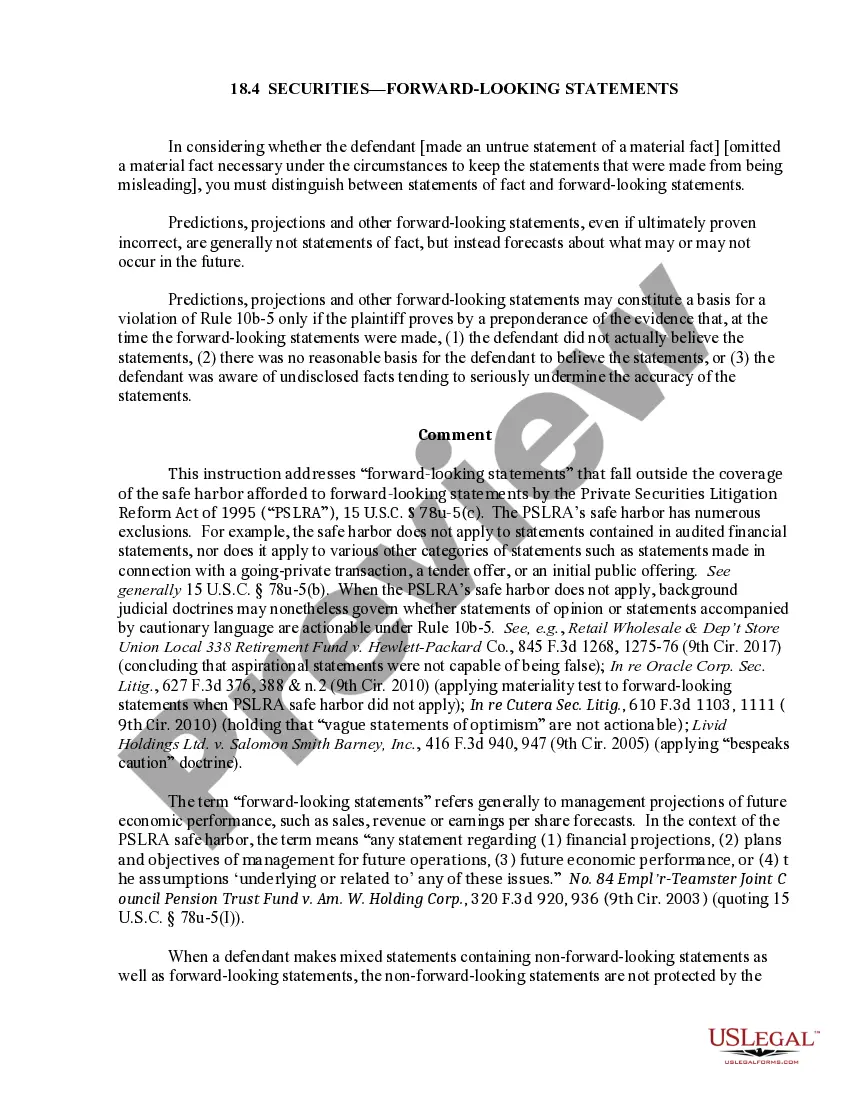

In order for a corporation or other qualifying entity to receive 501(c)(3) status, it must apply to the IRS for recognition by filing Form 1023 (or Form 1023-EZ), Application for Recognition of Tax Exemption. The application is a thorough examination of the organization's structure, governance, and programs.

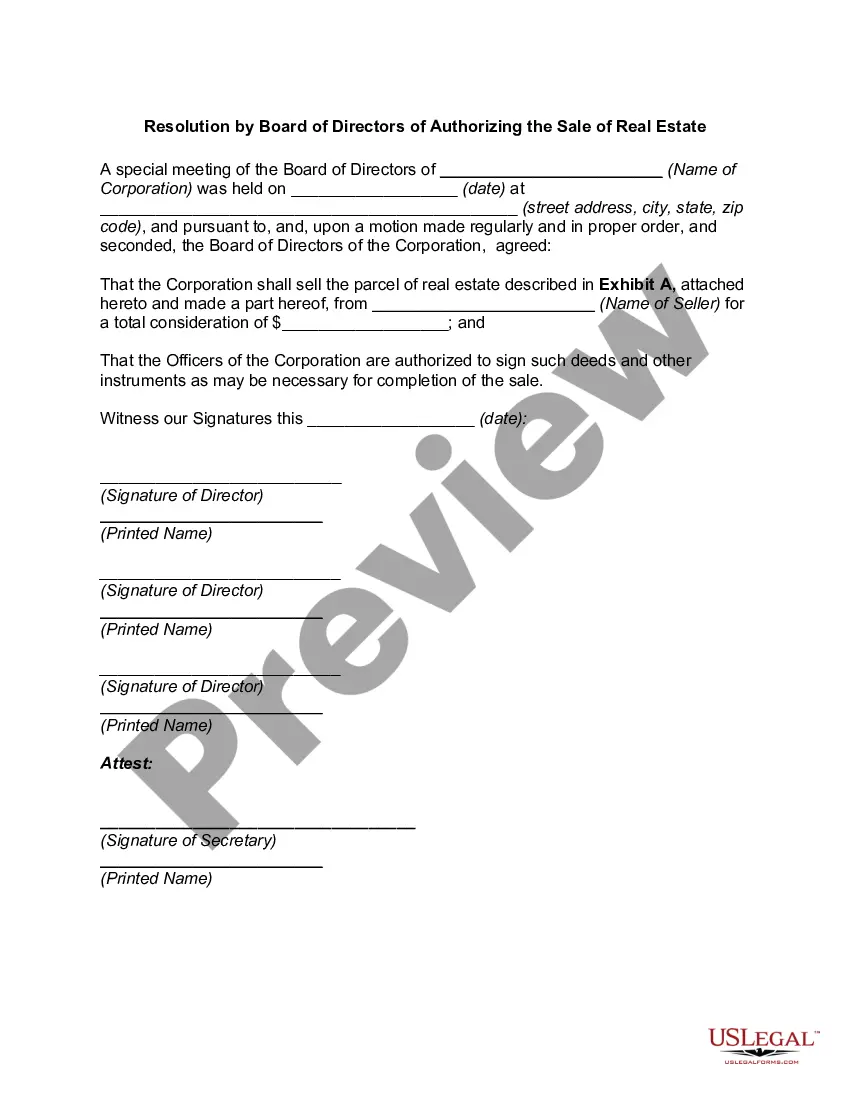

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

Churches and religious organizations, like many other charitable organizations, may qualify for exemption from federal income tax under Section 501(c)(3).

There must be at least three directors. They do not have to be Illinois residents or corporation members, but you may require these and any other qualifications you choose. Restrictions and qualifications may be outlined in the Articles of Incorporation under the Other Provisions section or in the corporate by-laws.

501(c)(3) organization. A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

The IRS determination letter notifies a nonprofit organization that its application for federal tax exemption under Section 501(c)(3) has been approved. This is an exciting day for an emerging nonprofit! Having your IRS determination letter in hand affords your nonprofit organization several unique advantages.

Nonprofit Employer Identification Number (EIN) is a Federal nine-digit tax ID number that IRS assigns to nonprofits, charities, organizations, and businesses in the following format: XX-X. EIN is used to identify the tax accounts of employers and certain others who have no employees.

The five steps to becoming a 501(c)(3) corporation are: choose a purpose, form a corporation, file paperwork with the IRS, comply with state and local requirements, and maintain your nonprofit status. Becoming a nonprofit means you are exempt from certain tax requirements that apply to other types of businesses.