Non Profit Resolution Template With Calculator In Arizona

Description

Form popularity

FAQ

There are legal, ethical, and practical reasons to build a board when a nonprofit is created. These reasons create the foundation for good governance and are explained in-depth in this article from BoardSource. All nonprofit organizations need a board.

Nonprofits must have at least three board members when they form. Many boards have more than the minimum three. Tuple can't tell you who should be on your board, but we can help you prevent and navigate important issues, such as: Board members' legal duties to the organization.

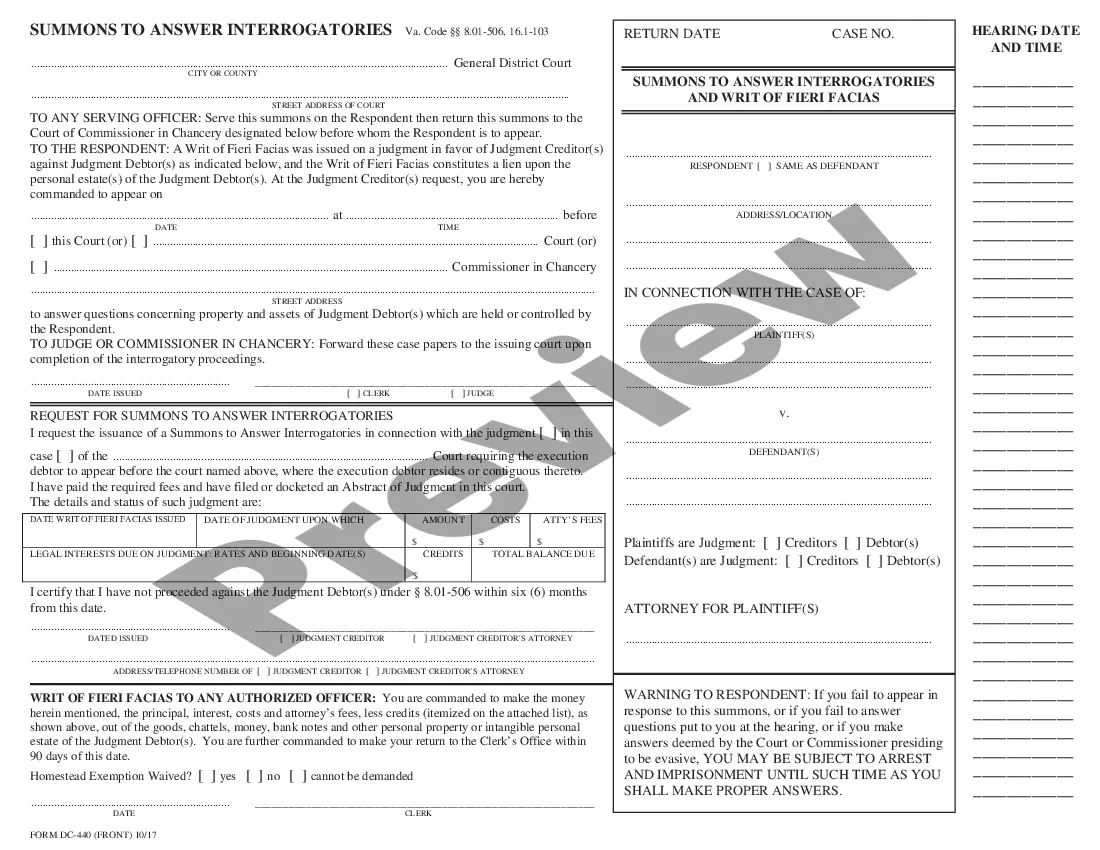

Steps to Write a Corporate Resolution Write the Company's Name. Indicate Further Legal Identification. Include Location, Date, and Time. List the Board Resolutions. Sign the Document and Write the Document.

Nonprofit charities are under the jurisdiction of state and national laws, so they must comply with both legal systems. With that in mind, the federal government requires a minimum of three board members to acquire coveted 501c3 tax-exempt status.

“RESOLVED FURTHER THAT, any one of the above officials of the Company/Bank/Cooperative Society/Trust/legal entity, be and is hereby authorized to do all such acts, deeds, things, sign all such papers, documents, power of attorneys, indemnities, correspondence and to do and perform all such acts, deeds and things and ...

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

The minimum number of board members is set by state statute. Arizona requires one board member.

You must have at least one director who will serve a term of one year. They don't need to live in Arizona and there are no membership requirements. Be aware that the IRS requires you to have at least three directors over the age of 18 when you apply for tax-exempt status.