Board Resolution For Opening Bank Account For Partnership Firm In Maricopa

Description

Form popularity

FAQ

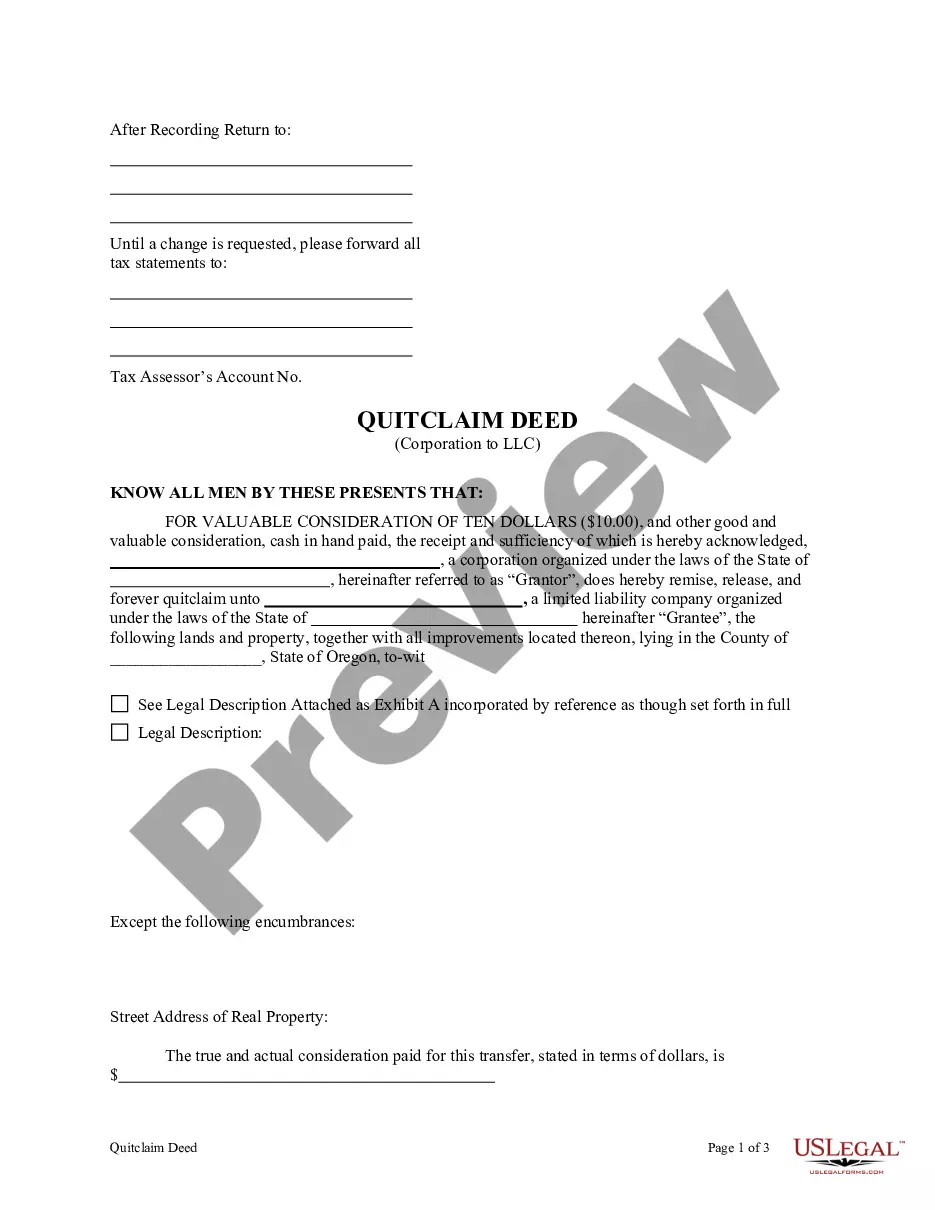

For opening a current bank account, a firm needs to submit the following documents: Partnership deed. Partnership firm PAN card. Address proof of the partnership firm. Identity proofs of all the partners. Partnership registration certificate (if partnership has been registered)

Partnership Bank Account means the bank account designated as such by the Partnership pursuant to the Funding Notice.

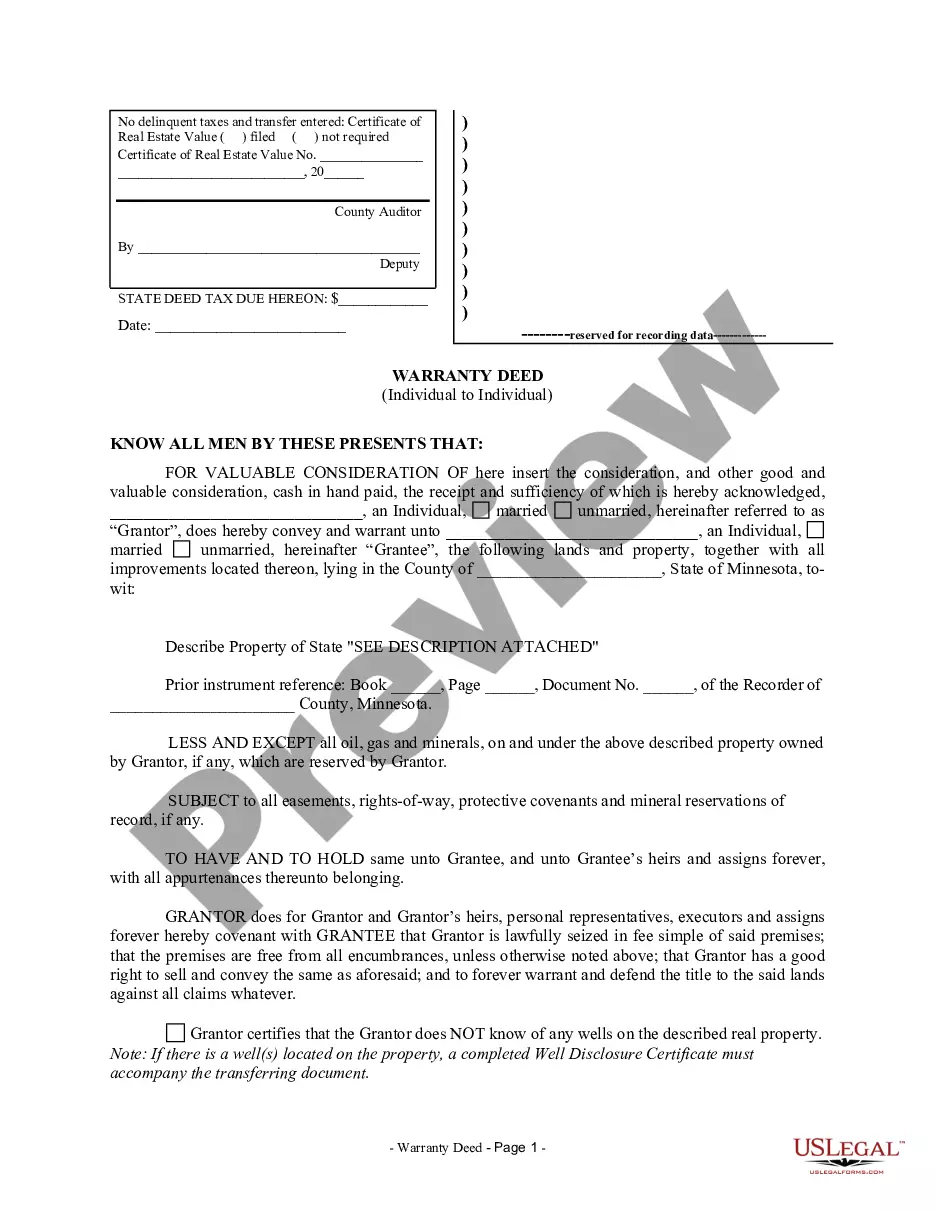

When drafting a banking resolution, here are the key elements to include: Title of the Document. Statement of Board Agreement. Detailed List of Authorized Individuals. Specific Powers Granted to These Individuals. Time Frame for the Resolution's Validity. The Signature of the Company's Board of Directors or Members.

If you are a partner in a limited liability partnership (LLP), you will need a separate business account. This is because the business is a separate legal entity from the individual partners. But if you are in a general partnership, made up of two or more people, you don't have to have a business bank account.

Authority does not enable a partner to open an account on behalf of the firm in his own name. Hence, the manager should ensure that the acts of the partner bind the firm, and that a. partner does not act on his own behalf. the relation between persons who have agreed to share the profits of a business, carried on.

For opening a current bank account, a firm needs to submit the following documents: Partnership deed. Partnership firm PAN card. Address proof of the partnership firm. Identity proofs of all the partners. Partnership registration certificate (if partnership has been registered)

What is a Banking Resolution? Whether it be for a corporation or LLC, the banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.