Installment Contract In Law Definition In Washington

Description

Form popularity

FAQ

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

An installment contract offers a buyer less protection than a traditional mortgage. This is true mainly because of forfeiture provisions, which give the buyer no right of redemption and allow a buyer to lose all interest in the property for even the slightest breach.

Installment loans are often distributed in a lump sum and then repaid in equal amounts over time. Personal loans, auto loans, mortgages and student loans are all examples of installment loans.

Real estate installment contracts are a financing option that allows for periodic payments instead of a lump sum payment. Also known as a land contract, contract for deed, or contract for sale in the real estate industry.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

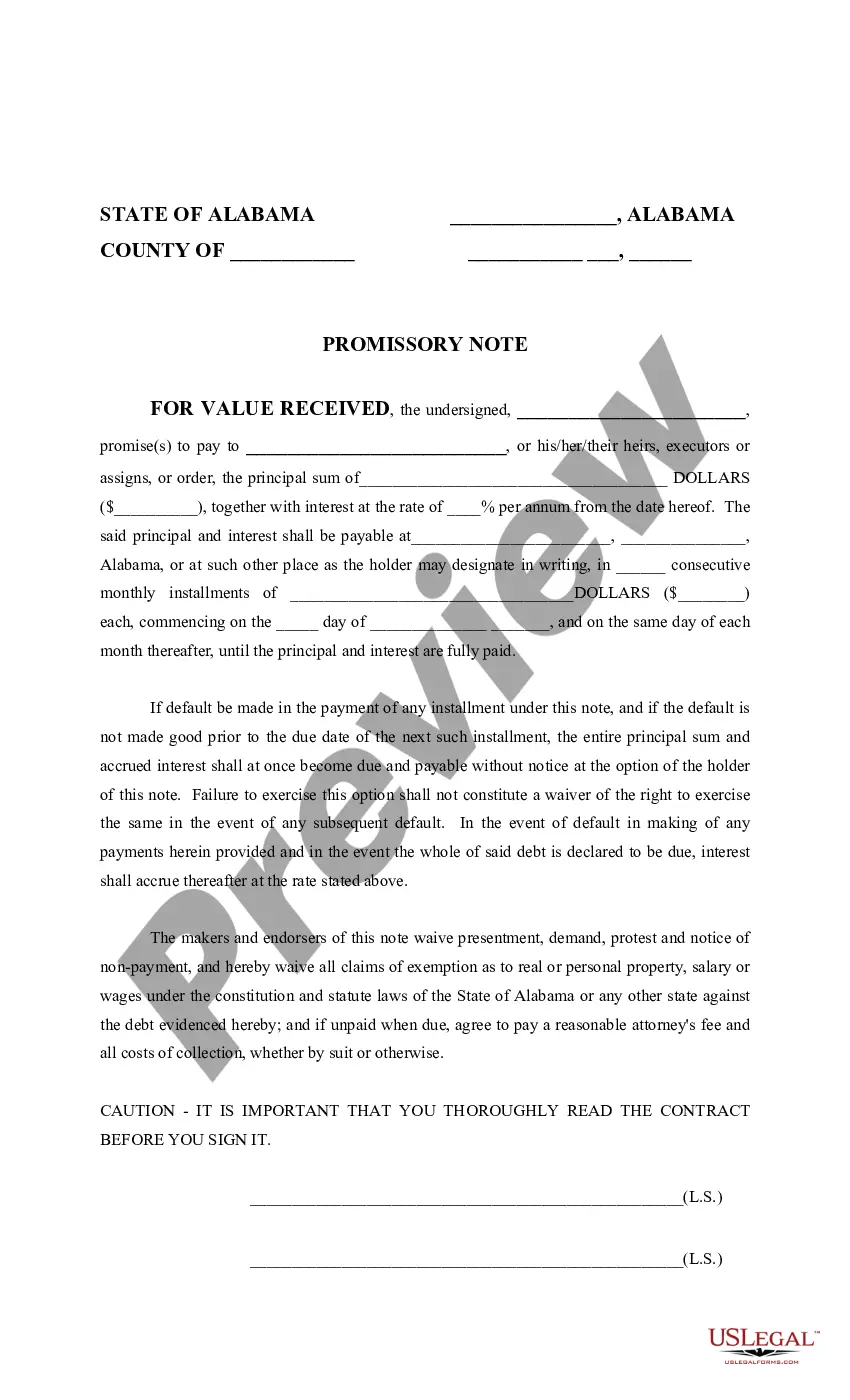

A payment agreement is a legally binding contract between two parties, which outlines specific payment terms for goods or services.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

An installment payment contract is a specific type of contract in which the payment structure of the contract is made in a series, or installments, rather than in one large lump payment.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.