Installment Contract Receivable Formula In Palm Beach

Description

Form popularity

FAQ

In an installment sale, the seller takes a note receivable for deferred payments from the buyer. The seller then recognizes taxable gain as installment payments of note receivable principal amounts are received, in proportion to the principal payments.

An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. If you realize a gain on an installment sale, you may be able to report part of your gain when you receive each payment. This method of reporting gain is called the installment method.

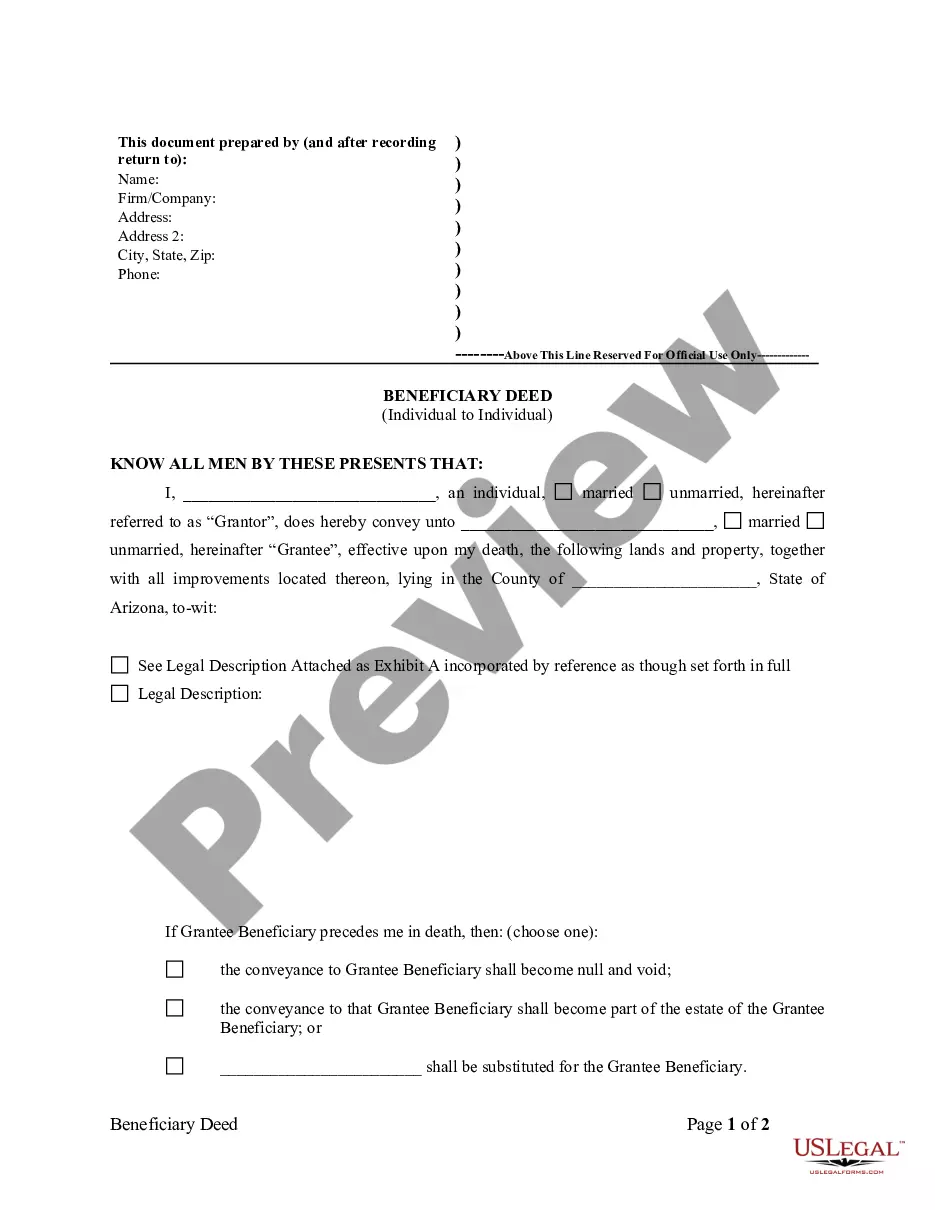

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time.

Amount to report as installment sale income. Multiply the payments you receive each year (less interest) by the gross profit percentage. The result is your installment sale income for the tax year.

The FAR/BAR “AS IS” and Standard contracts are comprehensive and simplified agreements that contain all the pertinent provisions typically agreed upon in residential real estate agreements in Florida.

Real estate installment contracts are a financing option that allows for periodic payments instead of a lump sum payment. Also known as a land contract, contract for deed, or contract for sale in the real estate industry.

Under the installment method, you include in income each year only the part of the gain you receive or are considered to have received. You don't include in income the part of the payment that's a return of your basis in the property.

The installment sales method is only applied in situations where ownership is not fully transferred at the time of sale. In addition, the method is used when there is a degree of uncertainty over the amount that will be collected (therefore, it would be inappropriate to recognize all revenue at the time of sale).