Installment Contract For Payment In Oakland

Description

Form popularity

FAQ

If you miss payments, your creditor can file a Motion to Set Aside the Order for Installment Payments. If that motion is granted, your creditor can garnish your wages. If this happens, you will get notice that the Motion to Set Aside Order for Installment Payments was filed.

If the IRS approves an installment agreement, it will generally keep any tax refunds and apply them to your debt. If the IRS agrees to an installment agreement, it may still file a Notice of Federal Tax Lien. For more information, see Publication 594, The IRS Collection Process.

Installment loans are often distributed in a lump sum and then repaid in equal amounts over time. Personal loans, auto loans, mortgages and student loans are all examples of installment loans.

Go to ftb.ca and search for installment agreement, select online and follow the instructions on the Installment Agreement – Apply Online page. Only newly assessed liabilities may qualify for an online installment agreement.

Oakland University offers a range of scholarships for international students, which is a great way to help finance your studies. One notable scholarship is the International Students Scholarship. This award is based on GPA and SAT/ACT scores (if submitted).

At Oakland University, we welcome students from all over the world.

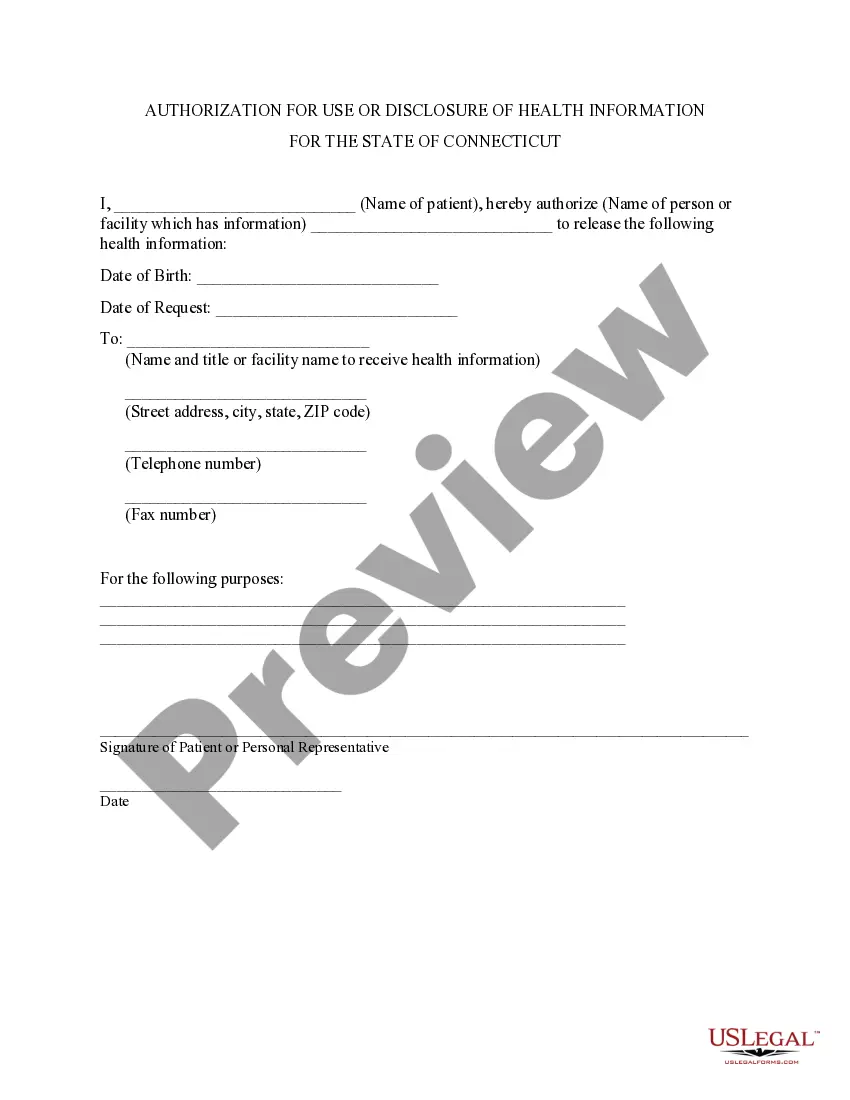

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

Go to ftb.ca and search for installment agreement, select online and follow the instructions on the Installment Agreement – Apply Online page. Only newly assessed liabilities may qualify for an online installment agreement.