Installment Contract For Deed In North Carolina

Description

Form popularity

FAQ

An installment contract offers a buyer less protection than a traditional mortgage. This is true mainly because of forfeiture provisions, which give the buyer no right of redemption and allow a buyer to lose all interest in the property for even the slightest breach.

Is a contract for deed a good idea? The seller retains the title. This can extend through the completion of your payment plan, which can complicate things like ownership and taxes, as well as personal security and rights. Maintenance gets confusing. There's little regulation. Sellers don't have it easy.

Liquidity risk Structured installment sales can tie up a significant amount of capital, which could limit the seller's ability to invest in other opportunities or meet their financial obligations.

Yes, you can make your own Grant Deed. A lawyer is not required to prepare a valid and enforceable deed. If your deed meets the requirements in the state where the property is located, it is considered legal evidence of the transfer of title.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

Known as the “Homeowner and Homebuyer Protection Act,” N.C. Gen Stat. § 47H-1 et seq. (“Act”), the law imposes stricter requirements for land contracts with the result that such contracts are harder for Owners to enforce in a court of law when the buyer defaults.

Drafting of legal documents, including deeds, mortgages, and other transaction documents must be prepared by a NC attorney. NCGS § 84-2.1. Non-attorneys may provide limited services in a real estate closing including witnessing of closing documents and receipt and disbursement of closing funds.

"A deed seeking to convey an interest in land "is void unless it contains a description of the land sufficient to identify it or refers to something extrinsic by which land may be identified with certainty." Overton v. Boyce, 289 N.C. 291, 293, 221 S.E.2d 347, 348 (1976).

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

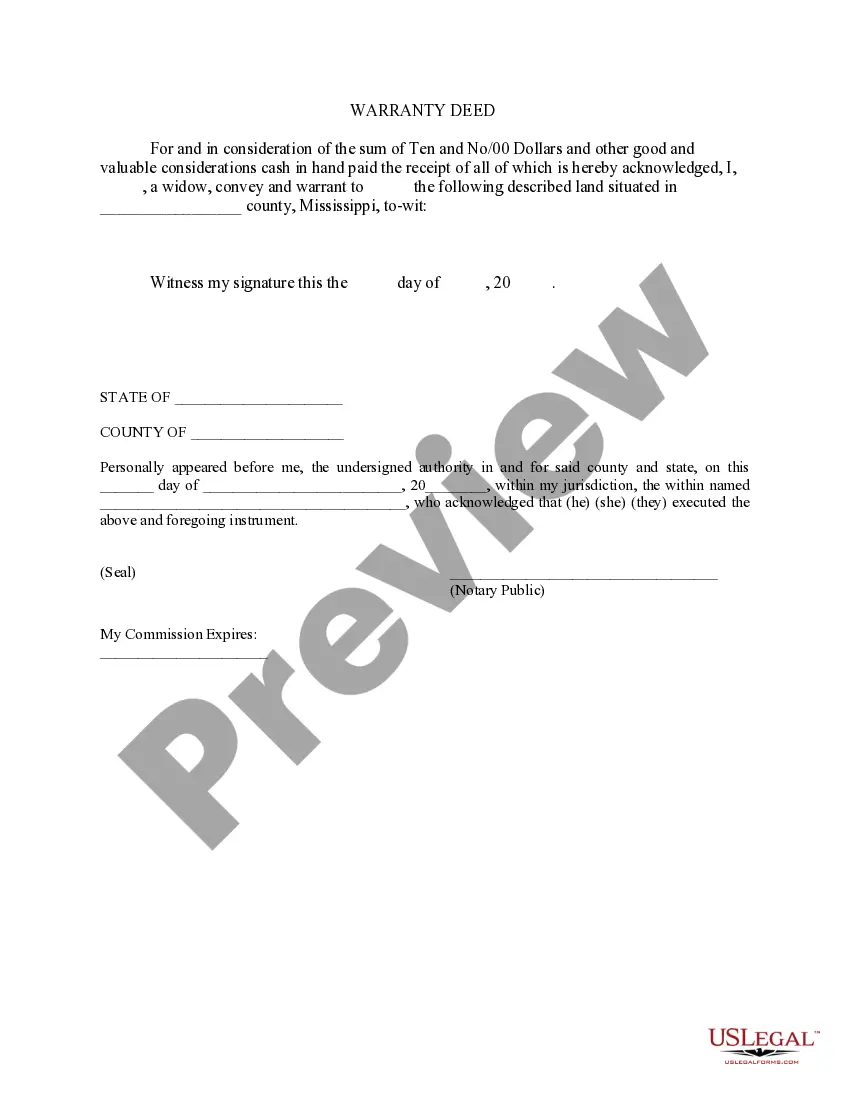

How to fill out the North Carolina Quitclaim Deed Form Instructions? Identify the Grantor and Grantee information accurately. Provide a detailed description of the property being transferred. State the consideration amount clearly. Sign the document in front of a Notary Public.