Installment Contract Agreement For Irs In Nassau

Category:

State:

Multi-State

County:

Nassau

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

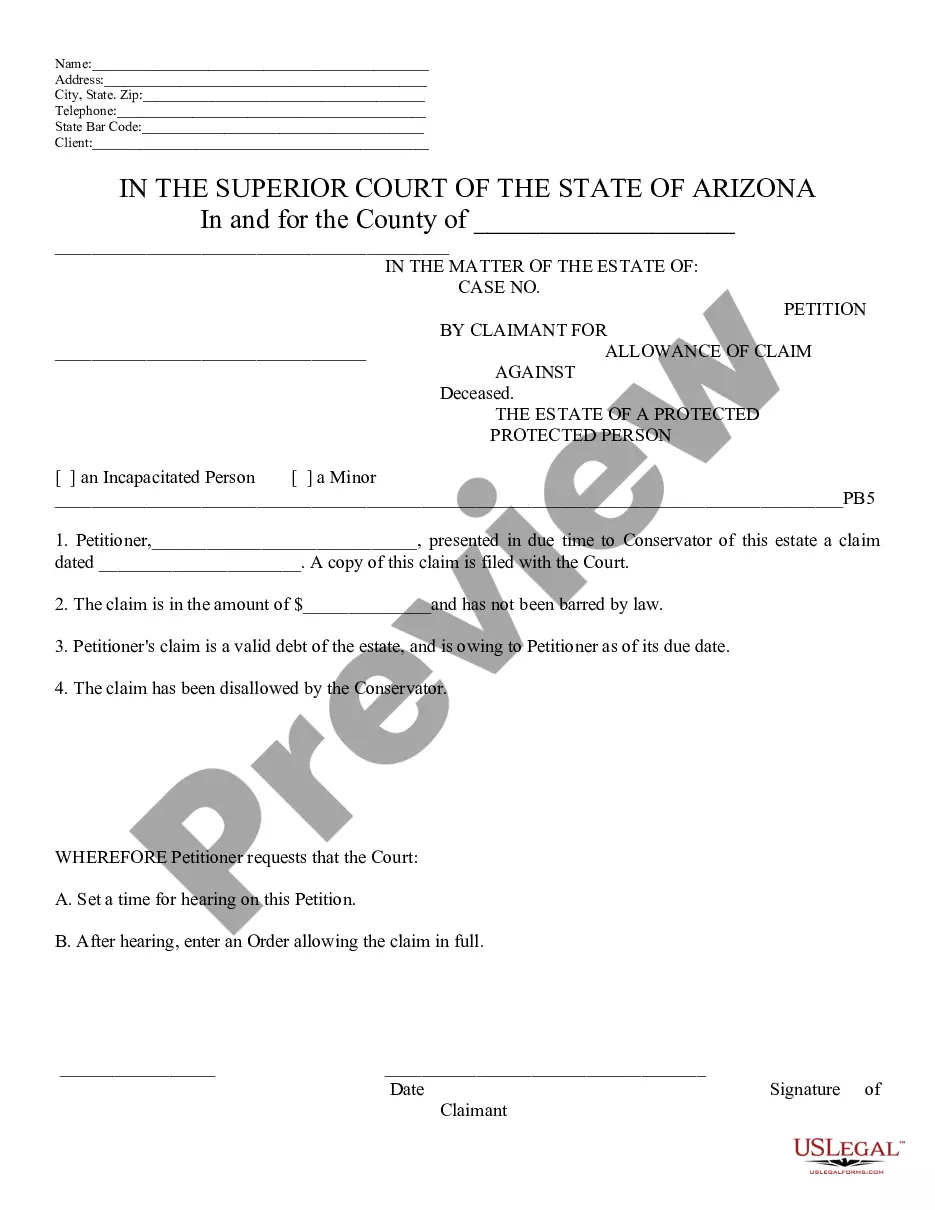

The Installment Contract Agreement for IRS in Nassau details the terms under which a seller may finance a purchase through a series of payments. It outlines key elements such as the total purchase price, applicable interest rate, and payment terms, which specify the frequency and amount of installments. Additional provisions address late fees for missed payments, a purchase money security interest in the collateral, and events of default that could trigger immediate repayment. Remedies for default are clearly delineated, granting the seller rights to reclaim collateral or seek other legal remedies. The form also includes disclaimers regarding warranties, stipulates that it constitutes the entire agreement, and requires modifications to be in writing. Moreover, the governing law applicable to the agreement is identified, ensuring clarity on jurisdiction. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who manage sales agreements and seek to enforce installment payment plans while understanding the legal implications involved.

Free preview

Form popularity

FAQ

Or: For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time. The wait time to speak with a representative may be long. This option works best for less complex questions.

The IRS considers extravagant expenses as those that include charitable contributions, private school funding and hefty credit card payments. In addition, if you fail to provide accurate information on Form 433-A, Collection Information Statement, you can expect your agreement to be rejected.