Installment Contract For Payment In Michigan

Description

Form popularity

FAQ

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

While the IRS typically doesn't allow taxpayers to have two separate installment agreements, adding a new tax debt to an existing installment plan is possible. However, taxpayers must act swiftly before the IRS assesses the new tax balance and potential default occurs, triggering enforcement actions.

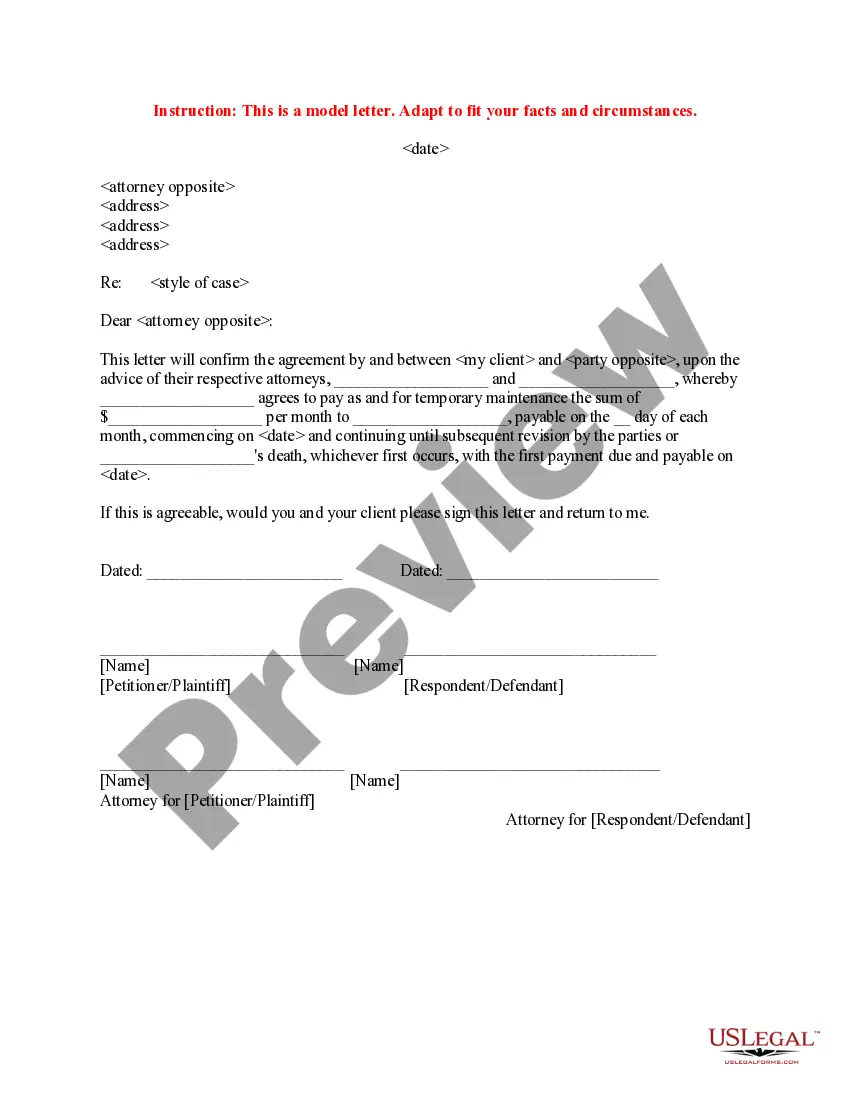

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

At this time the Michigan Department of Treasury may consider an Installment Agreement if your situation meets certain criteria. There are fast and convenient ways to make your payment on our e-Service site.

The easiest way to set up a payment plan with the state is to call Interface at 517-241-5060 or call Michigan Accounts Receivable Collection System (MARCS) at 800-950-6227.

Under Michigan's prompt payment law, if a payment is delayed beyond the statutory deadline, the unpaid party “may include reasonable interest on amounts past due in the next request for payment.” Michigan's statutes do not define the limits of “reasonable interest,” though Michigan's interest rate law (MCL 438.31) caps ...

Applying for an Installment Agreement For installment agreements for 48 months or less, the taxpayer must sign and return the installment agreement (Form 990). The agreement requires a proposed payment amount that will be reviewed for approval by the Michigan Department of Treasury.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .