Installment Contract Agreement With Vehicle Owner In Harris

Description

Form popularity

FAQ

Overview of Harris County, TX Taxes The state of Texas has some of the highest property tax rates in the country. In Harris County, the most populous county in the state, the average effective property tax rate is 1.77%. That's nearly double the national average of 0.90%.

If you are a property owner who qualifies for the Age 65 or Older or the Disability exemptions, you may defer or postpone paying any property taxes on your home for as long as you own and live in it.

Harris County passes 2025 budget, including increasing property tax rate by 8% HARRIS COUNTY, Texas (KTRK) -- Harris County Commissioners voted Thursday to pass the Fiscal Year 2025's $2.67 billion budget proposal from the Office of Management and Budget (OMB).

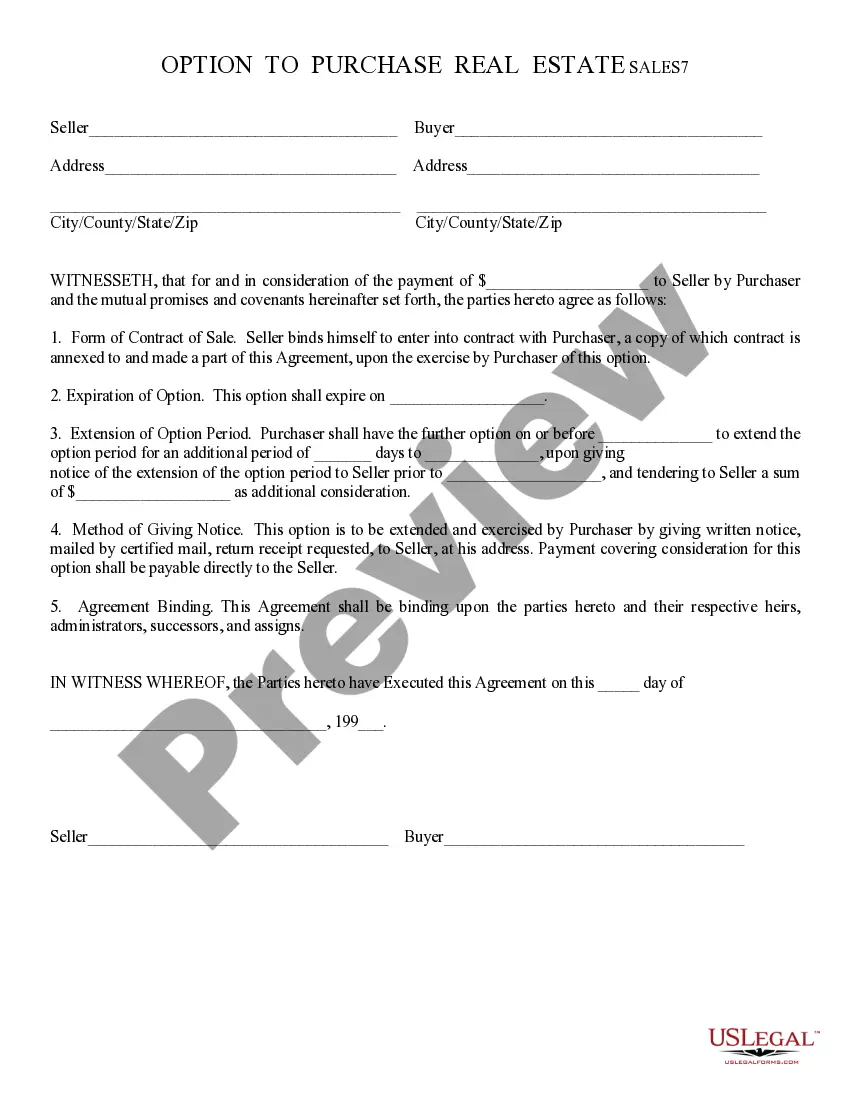

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time.

Real estate installment contracts are a financing option that allows for periodic payments instead of a lump sum payment. Also known as a land contract, contract for deed, or contract for sale in the real estate industry.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .