Installment Contract Agreement With Irs In Florida

Category:

State:

Multi-State

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

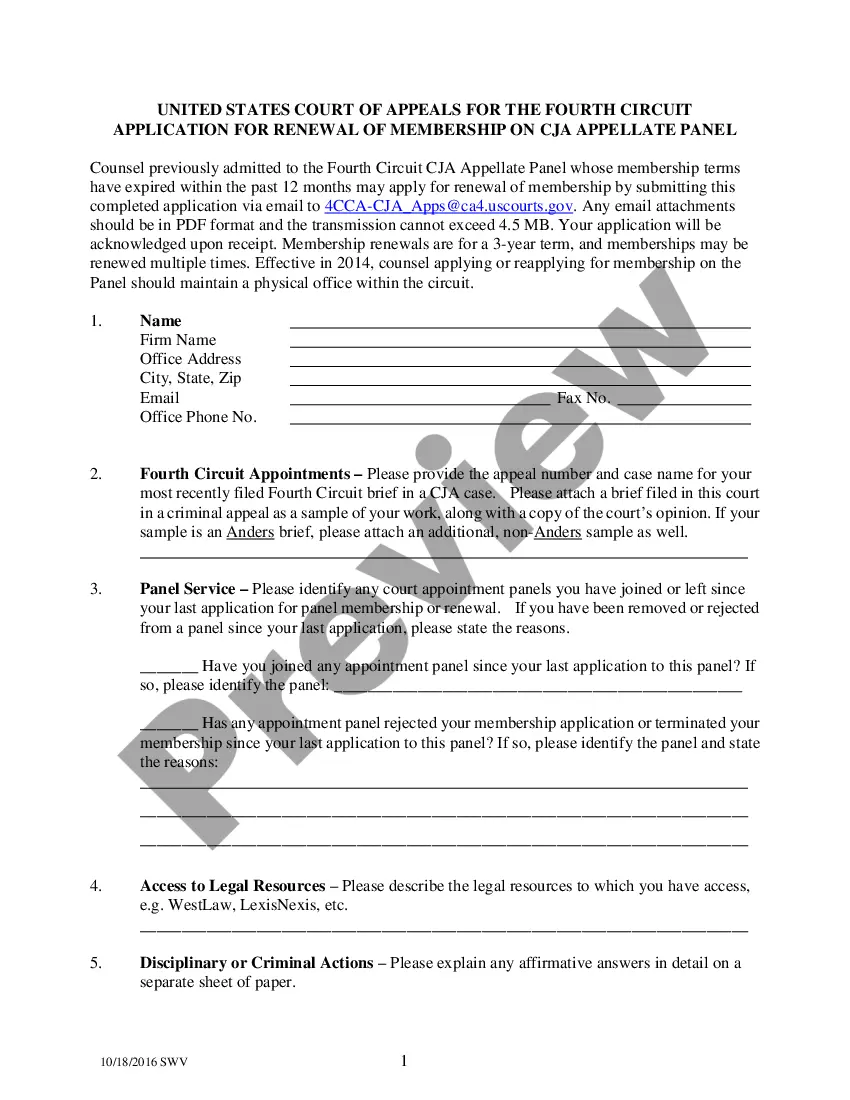

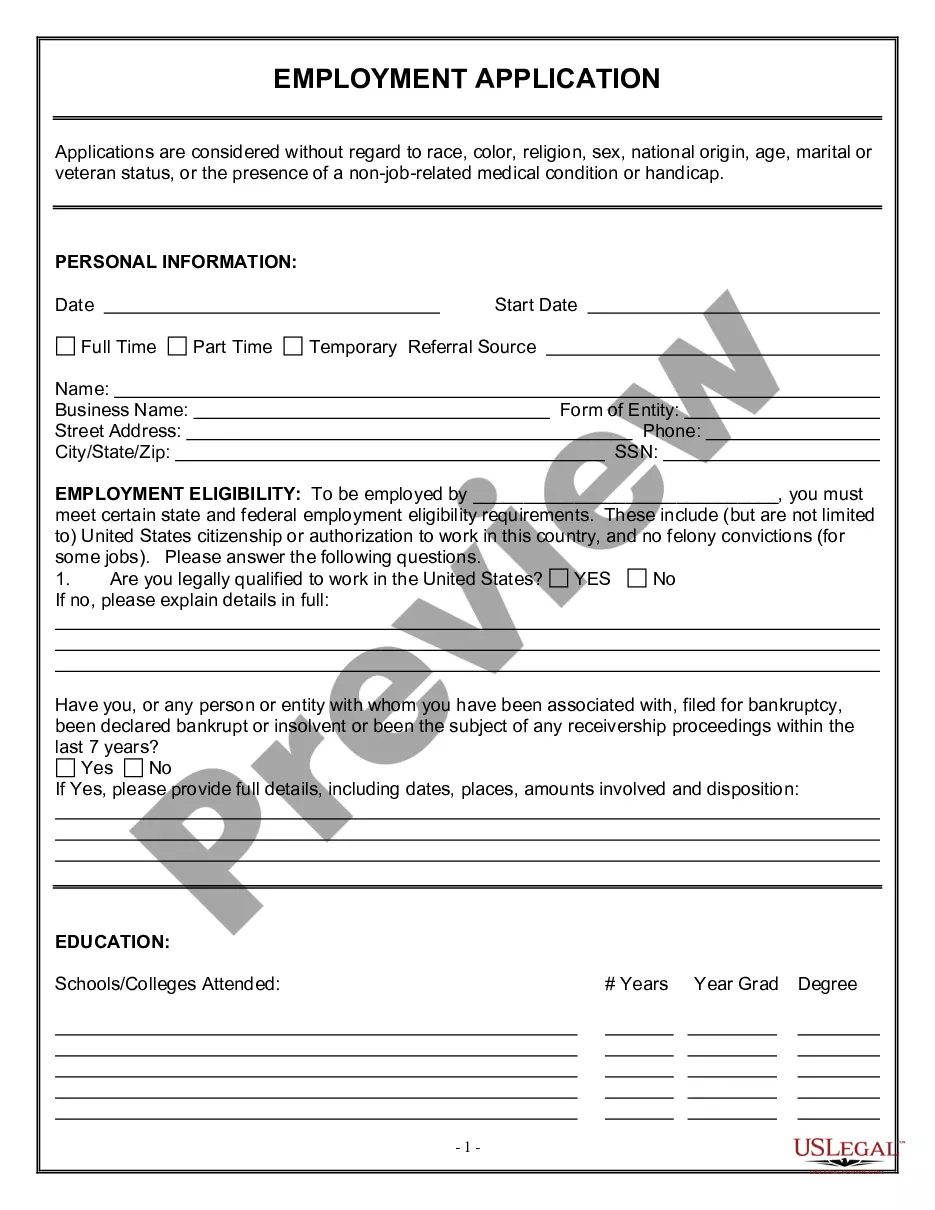

The Installment Contract Agreement with IRS in Florida is a legal document used to outline the terms of payment for a debt owed to the IRS, allowing for payments to be made over time rather than as a lump sum. Key features of this form include the purchase price, interest rate, payment terms, late fees, purchase money security interest, events of default, remedies for default, and provisions for modifications and governing law. Filling out the form requires detailing the total amount owed, interest rate, monthly payment amounts, and consequences for late payments or defaults. It is crucial that all parties sign the agreement to validate terms. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who assist clients dealing with IRS debts, offering a structured way to manage repayments while complying with federal regulations. Specific use cases might include negotiating payment plans for individuals or businesses facing tax debt and ensuring the documentation is thorough to protect both creditor and debtor rights.

Free preview

Form popularity

FAQ

The IRS considers extravagant expenses as those that include charitable contributions, private school funding and hefty credit card payments. In addition, if you fail to provide accurate information on Form 433-A, Collection Information Statement, you can expect your agreement to be rejected.

For more information about TAS and your rights under the Taxpayer Bill of Rights, go to TaxpayerAdvocate.IRS. Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet.