Installment Contract For Payment In Arizona

Description

Form popularity

FAQ

The 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an estimate of the monthly payment you can afford, the day of each month you prefer your payment to be due and the amount of any payment you choose to send with the ...

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

Create an online payment system: step-by-step Set up a hosting platform and apply for a Secure Socket Layer (SSL) certificate. Build the payment form/payment page. Find a payment processor that gives you the ability to process different types of payments, from credit and debit cards to account-to-account bank payments.

Populate the template with key details: Clearly define the amount owed, the payment schedule, the payment method (e.g., bank transfer, check), and any additional terms such as interest rates or late fees. Include any relevant dates, such as when payments are due and the total duration of the payment plan.

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

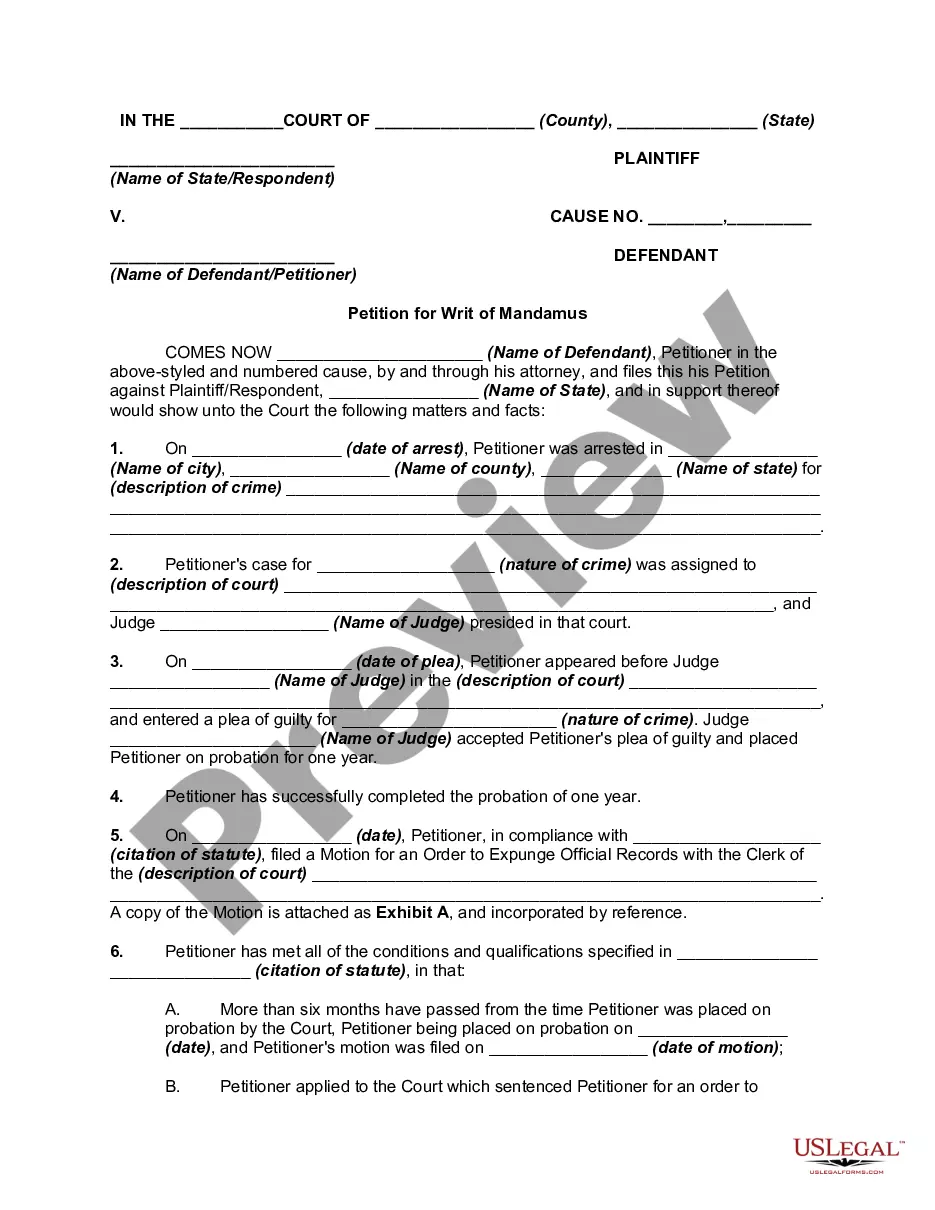

Please note: An Arizona full-year resident is subject to tax on all income, including earnings from another state. Arizona will also tax retirement from another state. Residents are taxed on the same income they report for federal income tax purposes, subject only to the specific modifications allowed under state law.

Arizona charges a flat income tax of 2.50% on all income brackets and filing statuses. This flay income tax rate applies to Arizona taxable income. The starting point for computing Arizona taxable income is federal adjusted gross income (AGI).

Your liability can be found on Line 48 of your Arizona Form 140 and Line 58 for both your Arizona 140PY (Part Year Resident) and Arizona 140NR (Non-Resident) forms. If your income is the same or similar as the previous year, this will give you a good indication of what your liability will be for this year.

Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state, but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file.

Arizona has a flat 2.50 percent individual income tax rate. Arizona has a 4.9 percent corporate income tax rate. Arizona also has a 5.6 percent state sales tax rate and an average combined state and local sales tax rate of 8.38 percent.