Residential Property Leases With Zero Down In Clark

Description

Form popularity

FAQ

NNN – Triple Net –This type of lease rate includes the base rental rate plus the three N's. One “N” stands for property taxes, one for property insurance, and the final “N” stands for common area maintenance (CAMs).

While it's possible to have a lease with a $0 rent amount, there are several factors that can affect the validity of a lease.

Zero net leases are often used as a leaseback. In this scenario, the owner of the building sells the property. The new owner then leases it back to the previous owner. That might sound strange but it allows the previous owner to raise capital (from the sale) and reduce debt (i.e., financing the property).

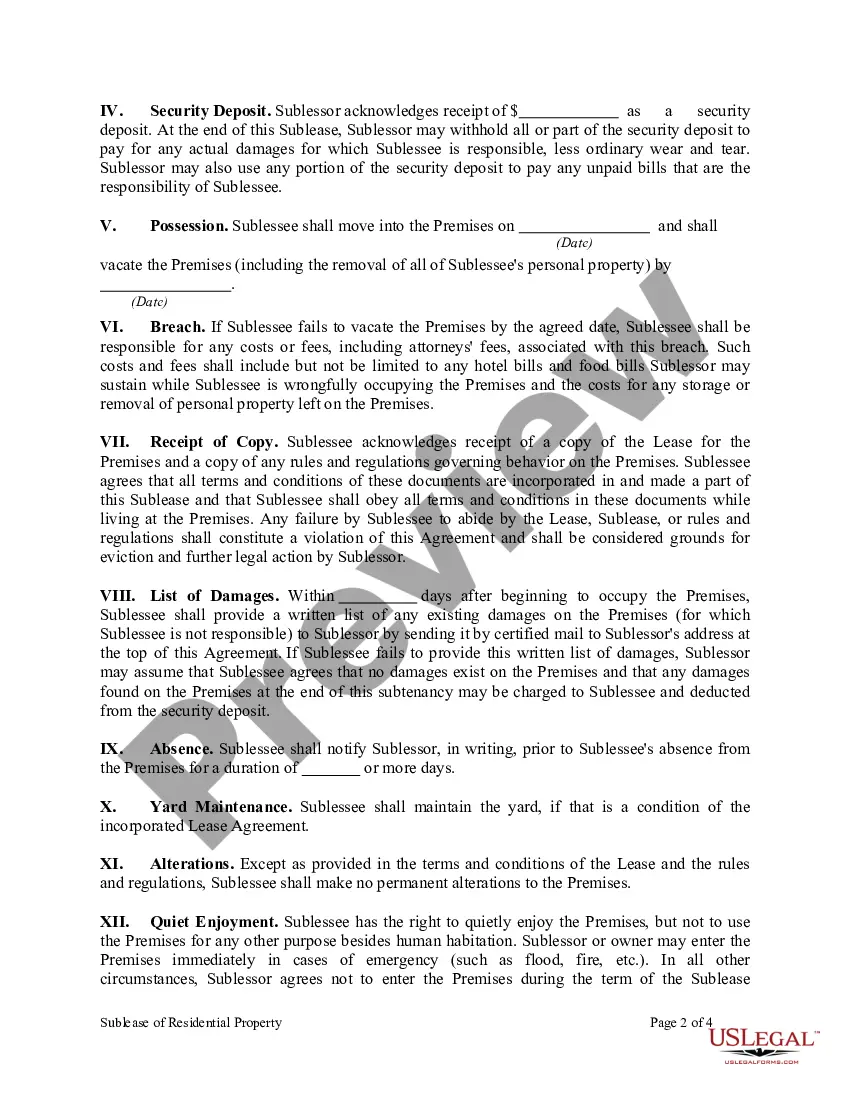

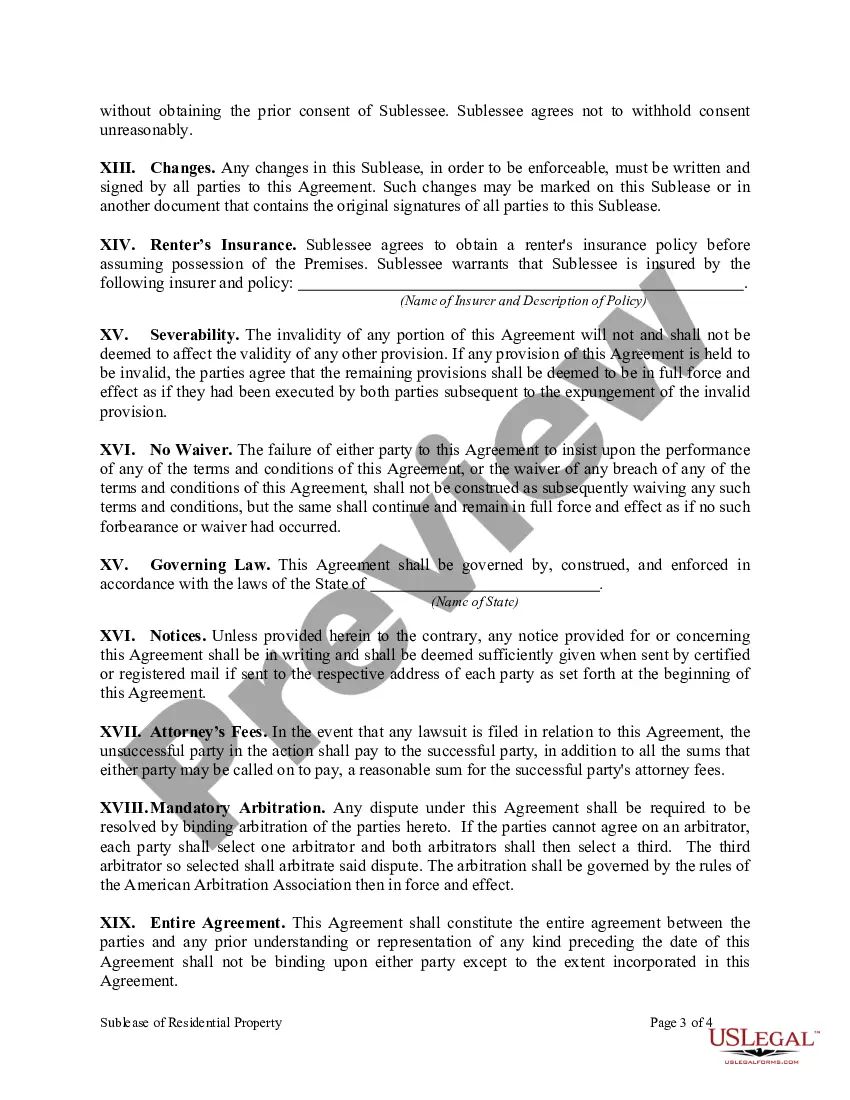

To determine if the lease is null and void, you would need to review the terms and conditions stated in the lease agreement itself, as well as any applicable local tenant laws. In general, leases can be considered void if there are significant inaccuracies or misrepresentations that impact the agreement's validity.

In a net lease, the tenant pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent.

If both parties want out of the agreement, that may be achieved by signing a Mutual Rescission and Release Agreement. The Mutual Rescission and Release Agreement serves to render the original contract null and void and places the parties back to their original positions before they entered into that first agreement.

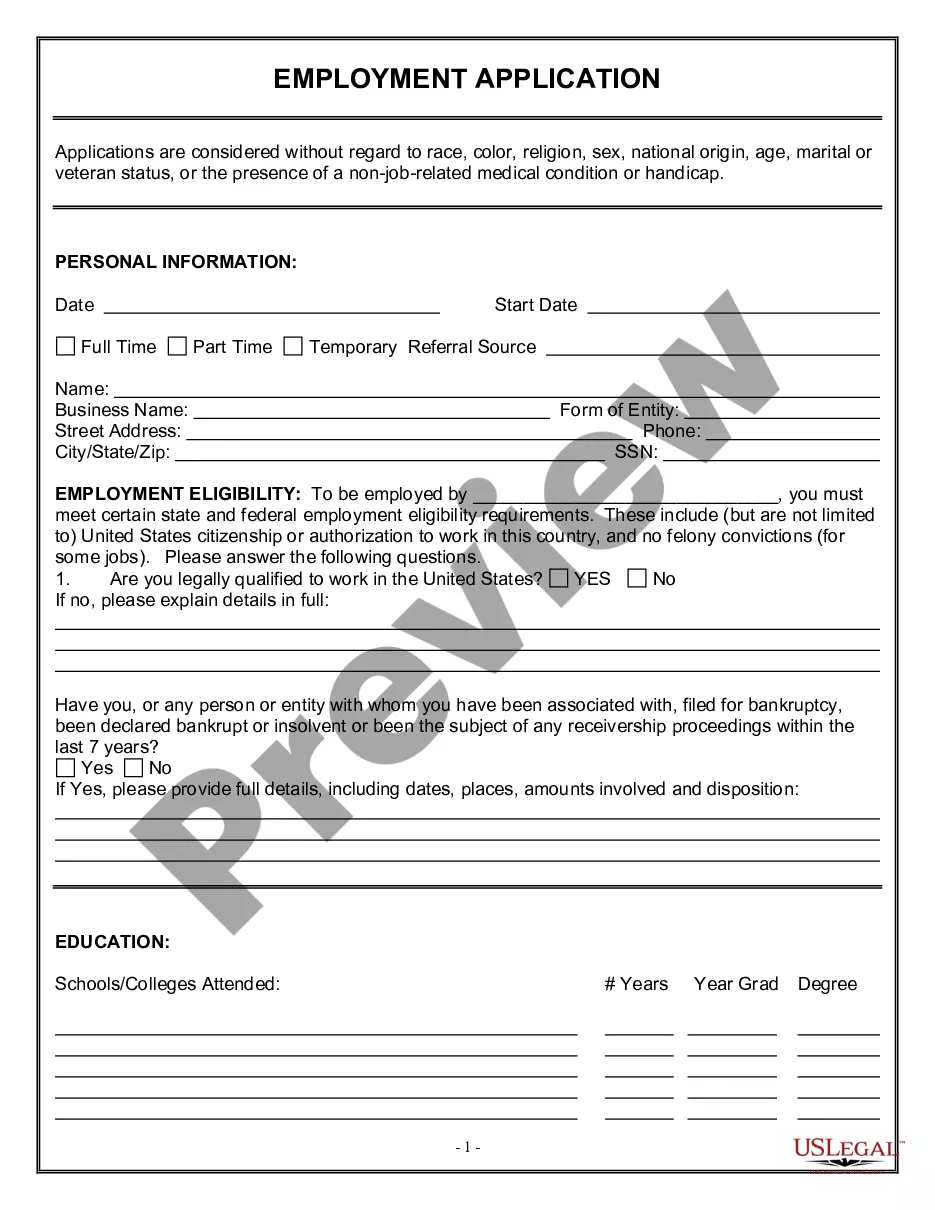

9 Ways to Get Approved With No Rental History Increasing The Security Deposit. Show Proof of Income. Provide Proof of Employment. Consider Renting with a Roommate. Collect References. Get a Cosigner. Get a Guarantor. Show Proof of Regular Payments.

Get a co-signer. Check it a family member or friend is willing to co-sign on your lease. The combined income will likely be enough for the landlord to feel comfortable leasing to you.