International Contractor Agreement Template For India In Dallas

Description

Form popularity

FAQ

It is important to note that foreign independent contractors must comply with the immigration laws and regulations of the country where they are providing their services. They may need to obtain work permits or visas to legally work in the United States or any other country where they are contracted.

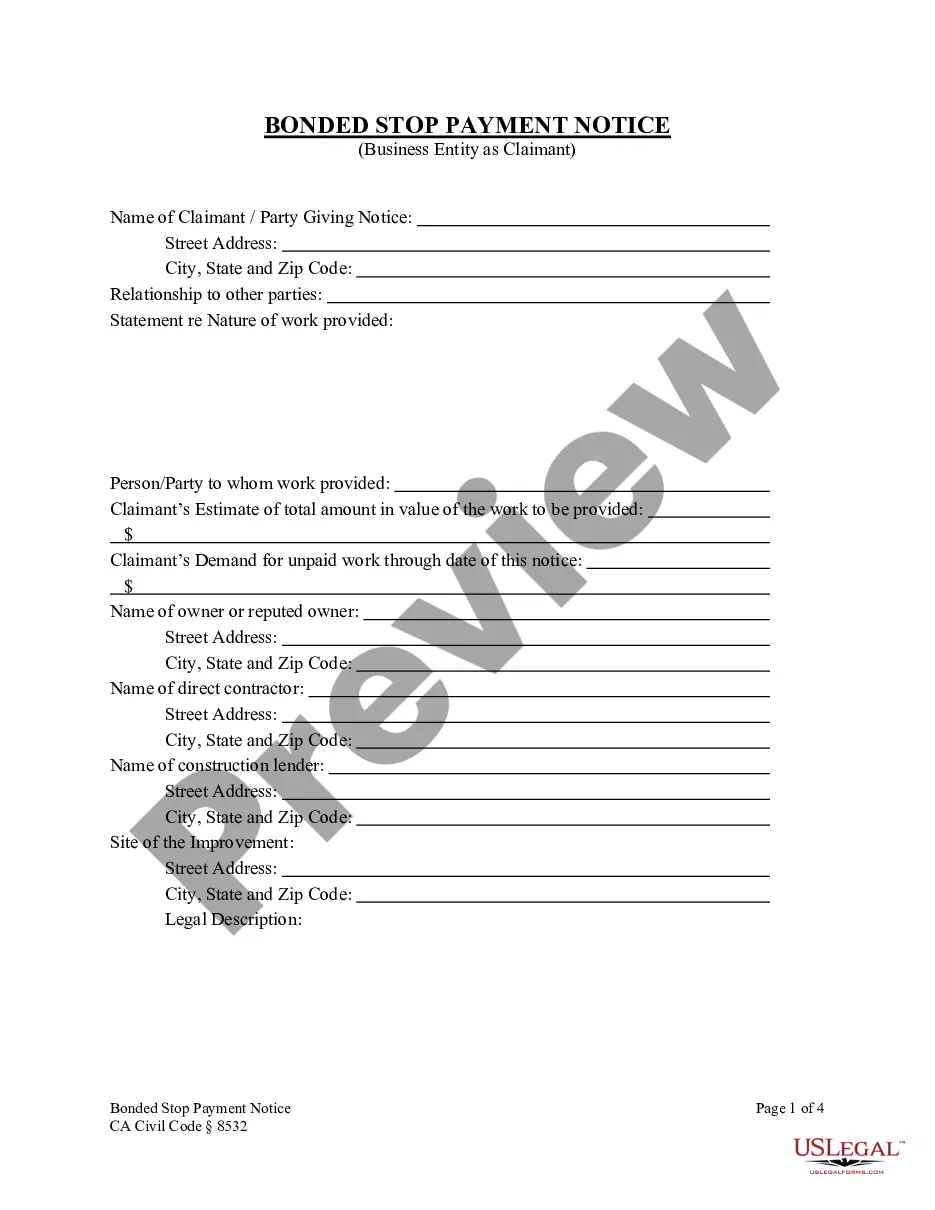

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.

If you're looking to hire contractors in another country, India is an excellent option. Shared language, political alliances, and cultural affinities between India and the US have inspired many American companies to employ talent in India, and India remains a top destination.

The short answer is yes, you can work from India for a US company even if you're not a US citizen. The globalization of the workforce and advancements in communication technology have made remote work a viable and increasingly popular option.

Foreign independent contractors must submit IRS Form W-8BEN (for individuals) or IRS Form W-8BEN-E (for entities) to the US company they work for. This form certifies the contractor's foreign status and can help reduce or eliminate withholding tax on payments. Purpose: Certifies foreign status.