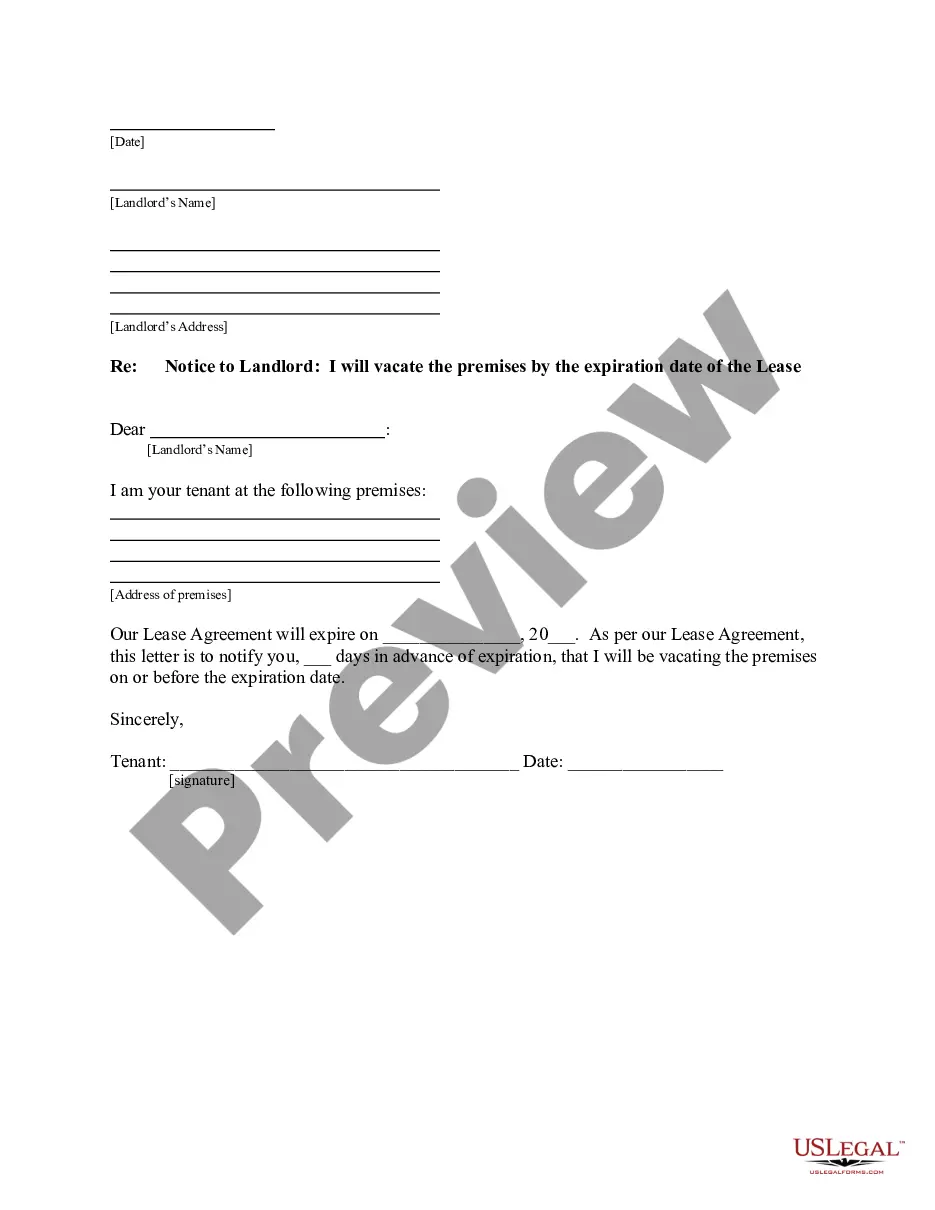

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter For Recovery Debt In San Diego

Description

Form popularity

FAQ

Revenue and Recovery participates in the State and Federal Tax Refund Intercept Programs. Welfare overpayments, court ordered fines, restitution, and dependency attorney fees are just a few of the types of delinquent accounts that are subject to tax intercept.

Summary: The Office of Revenue and Recovery (ORR) is the designated collection agency for the County of San Diego.

Thank you for your attention to this matter. Sincerely, (Your Name) Responding to a debt collector letter should be done thoughtfully and strategically. Always protect your rights, keep detailed records, and don't hesitate to seek professional advice if needed.

Private creditors usually cannot intercept a tax refund before it reaches someone. However, creditors could access the funds deposited if they have a judgment and a writ of levy.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

If you do not respond, you will lose certain rights, but it is not a legal admission, usable in court, that you owe the debt. If there is no response, or if the letter goes back to the collection agency undelivered or marked moved, deceased, in jail, etc., the collection agency can still due you.

If you get an unexpected call from a debt collector, here are several things you should never tell them: Don't Admit the Debt. Even if you think you recognize the debt, don't say anything. Don't provide bank account information or other personal information. Document any agreements you reach with the debt collector.

In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.